After posting sharp gains in last week, investors turned cautious during the week gone by as the market awaits fresh triggers.

The impact of the dovish tone of the US Fed faded as benchmark indices reached record high. Sensex posted marginal gains of 0.3 percent as some support was provided to market sentiments by the US nonfarm payrolls which missed street estimates raising hopes of delay in the US Fed taper plan. However, gains remained capped, as sentiments remained cautious over the prevailing expensive benchmark valuation and concerns about the delta variant hitting economic recovery.

Sentiments were further dented as Goldman Sachs cut its US GDP forecast amid concern over delta variant and consumer spending.

The capital market regulator – SEBI, in a major development for the domestic equity market during the week, introduced an optional T+1 settlement cycle for the Indian markets.

On stock-specific movement, sharp gains in stocks like HDFC, Bharti Airtel and Kotak Bank provided support to benchmark, though the effect was partially offset by profit booking in IT major stocks like Infosys and TCS.

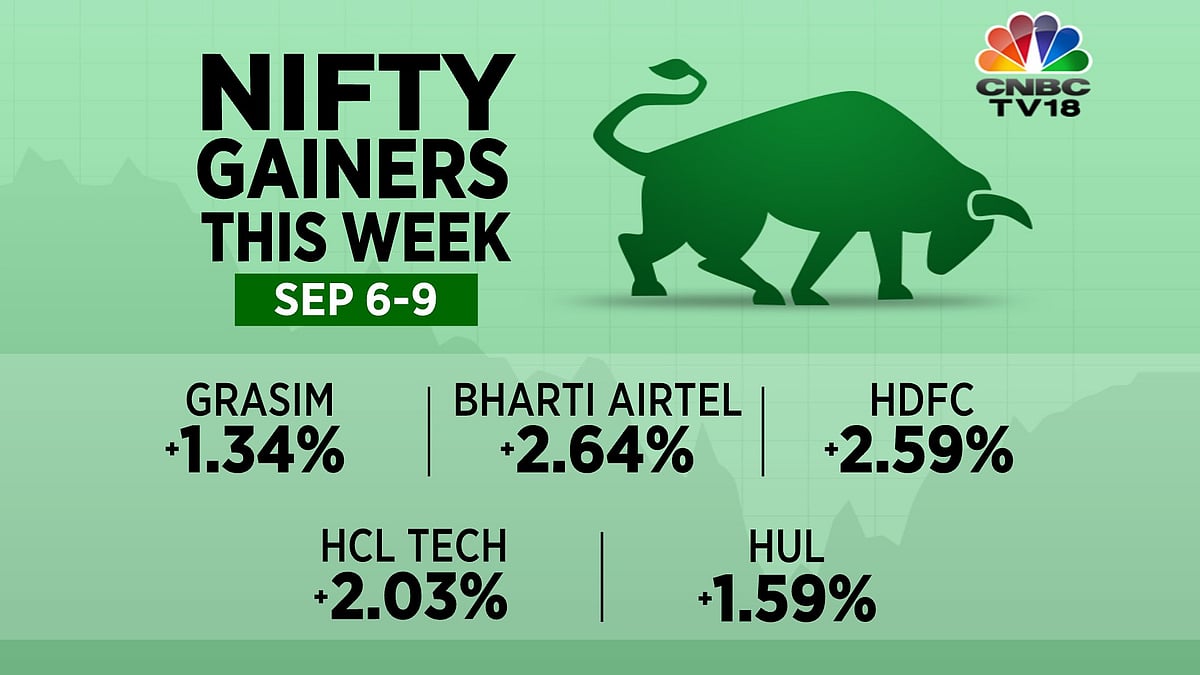

Nifty gainers |

Major economic data for next week that investors would track include inflation, trade data, US Inflation, OPEC Monthly report among others.

During the week, the Nifty index gained more than 0.69 percent and set a new milestone at 17,435.50 levels. All the sectoral indices performed well, wherein Nifty Energy and Realty were the star of the week while the rest of the indices closed with an average gain.

On the stock front, the top gainers were IRCTC, Reliance, and Coal India which supported the index gains while NTPC and HDFC Life were the top laggards.

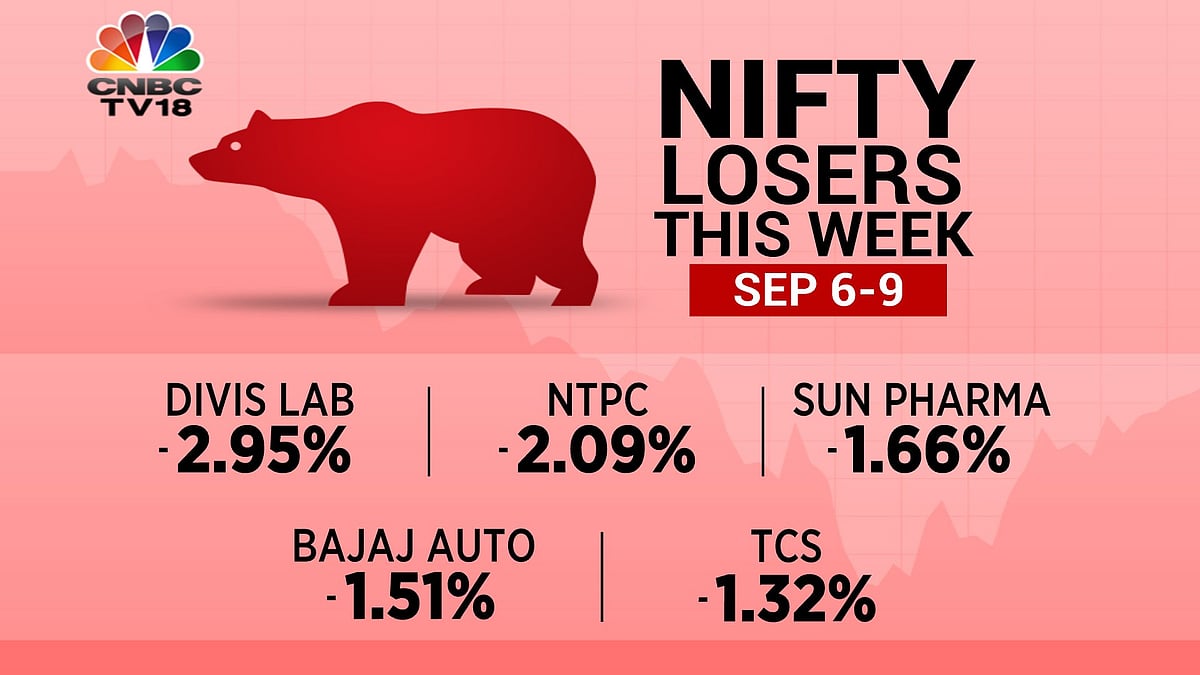

Nifty Losers |

Technically, the Nifty index has been trading in a bullish trend continuously and also holding the gain above 17,200 levels. On a weekly chart, the index has formed a Doji candlestick pattern which suggests bias between a buyer & seller.

All the key indicators like RSI, MACD, and Parabolic Sar are also supporting the upward rally. At present, the Nifty may find the resistance around 17500 levels while on the downside, 17200 may act as support for the index.

Nifty Gainers & Losers

Grasim surged over 5 percent this week on improved business outlook, capex plan and growing value of subsidiaries. PLI buzz on textile industries also boosted sentiments.

Bharti Airtel was on the buying radar of investors this week in hope of some relief by DoT on AGR dues. Though, the cabinet skipped DoT proposal on relief package for telecom companies.

As benchmark reaches peak, Investors keep defensive stocks on buying radar, HUL gained 1.4 percent in one week.

HDFC jumped nearly 2.5 percent on the optimism of pick up in business performance. Market participants expect strong real estate demand in the upcoming festive season.

HCL Tech gained on improved business performance outlook.

Profit booking emerged in the pharma sector, Sun Pharma and Divis Lab shed 1.8 percent and 2 percent in one week.

Selective IT stocks too witnessed profit booking.

(Ankit Pareek is Research Analyst, Choice Broking)