Mumbai:The State Bank of India on Monday announce the successful completion of the qualified institutional placement (QIP) of its equity shares, raising Rs 25,000 crore. The equity shares were priced at premium to floor price of Rs 811.05 per share.

The capital will augment SBI’s CET-1 buffer that will improve to 11.50 per cent from 10.81 per cent as on March 31, 2025, support calibrated credit growth across retail, MSME and corporate segments, the bank said in a statement. The book received robust demand and was oversubscribed 4.5 times, reflecting strong investor confidence in SBI’s strategy and the outlook for India’s banking sector. Foreign investors accounted for 64.3 per cent of total demand.

Marquee long term investors received 88 per cent of the final allocation, including 24 per cent of the issue size placed with foreign long-term investors. “This landmark equity raise is a vote of confidence in SBI’s solid fundamentals, prudent risk management and digital-first growth agenda.

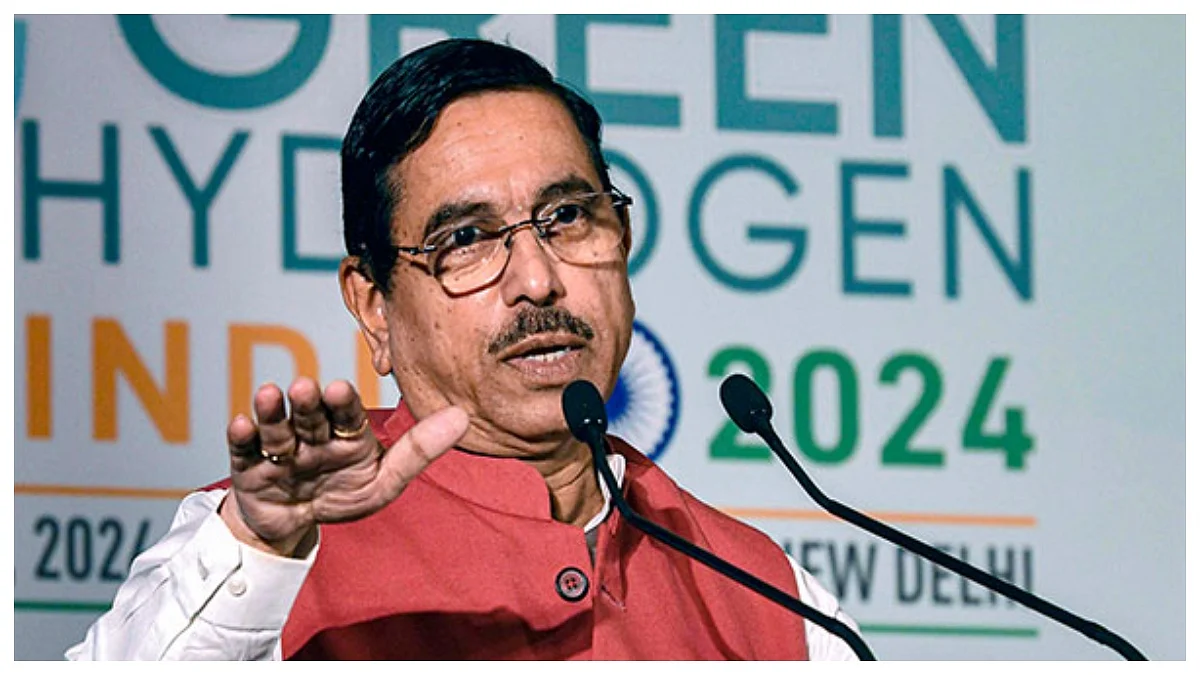

We are grateful to both domestic and international investors for their overwhelming support, which also speaks volumes about the current strength and future potential of the Indian economy,” said C.S. Setty, Chairman, SBI.

Earlier in May this year, SBI’s board gave the go-ahead for raising equity capital of up to Rs 25,000 crore during FY26. The objective was to boost SBI’s Common Equity Tier 1 (CET1) capital ratio — which will bolster the bank’s financial health.

SBI gave a dividend cheque of Rs 8,076.84 crore to the government for the financial year 2024-25. The public sector bank’s net profit for the financial year 2024-25 shot up to Rs 70,901 crore. The bank is celebrating its 70th year of operations with a balance sheet that has soared to Rs 66 lakh crore and the number of its customers surging past a staggering 52 crore.

Disclaimer: This story is from the syndicated feed. Nothing has been changed except the headline.