Fintech platform Recur Club on Sunday said it has allocated $15 million in financing within 48 hours to all Indian startup founders affected by the Silicon Valley Bank collapse, to fund immediate short-term expenses and payroll without diluting equity to all Indian startup founders affected.

Recur Club also added that it will not charge any platform fees in order to bolster and support the ecosystem.

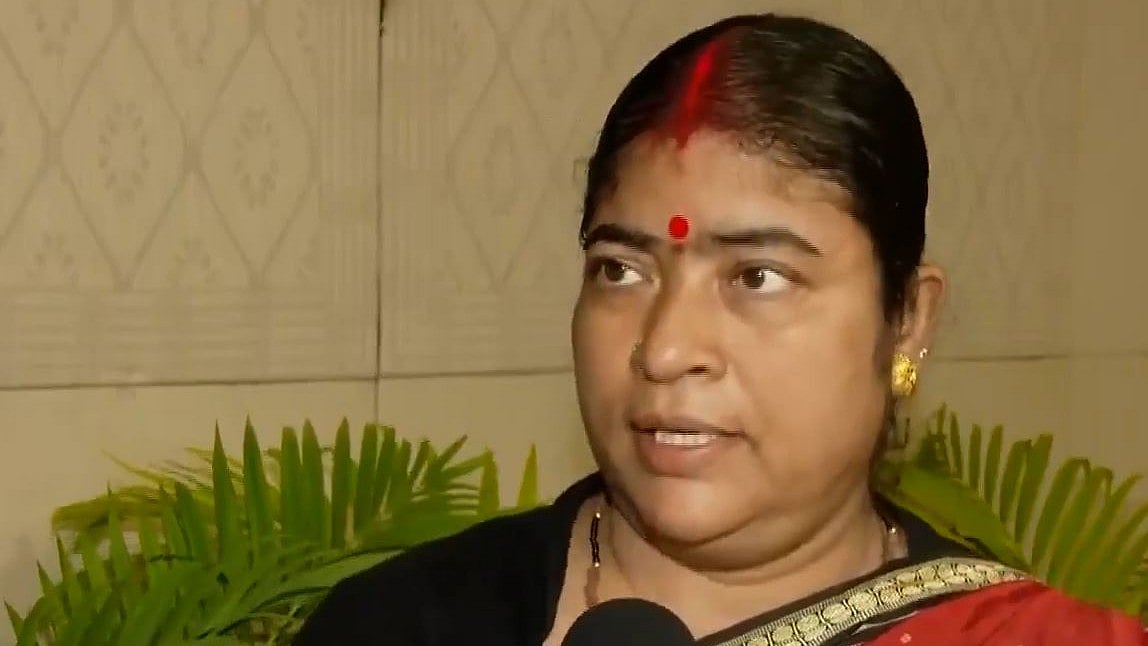

Eklavya Gupta co-founder of Recur Club said, "This incident tells us about the criticality of diversification, be it customers, banking, or investors in a business. Recur Club has received interest from more than 100 startups regarding immediate Payroll financing and managing short-term expenses."

Close to 50 per cent of Indian software-as-a-service companies are estimated to have a US presence and from these companies a majority were banking with SVB. Though the exact number of Indian startups with SVB accounts is not known. As of the 1,000 Indian start ups are expected to be directly impacted but the number will more likely be increased once you take into consideration the companies that have been hit indirectly.

The affected companies range from early-stage to late-stage growth stage.

The company that has funded over 300 companies is also working to provide instant non-dilutive financing solutions for startups to fund their payroll and short-term working capital requirements within 48 hours of receiving the companies' data and without diluting equity.

In addition, Recur Club will also help Indian start ups open bank accounts in GIFT city within 24-48 hours by taking special exemptions for enabling the startup community to flourish.

The club founded in 2021 by IIM Calcutta alumni, Abhinav Sherwal and Eklavya Gupta, currently works with companies that have predictable annual revenue of at least $100,000 from existing customers, greater than one year of vintage, and more than three months of runway.

With inputs from IANS