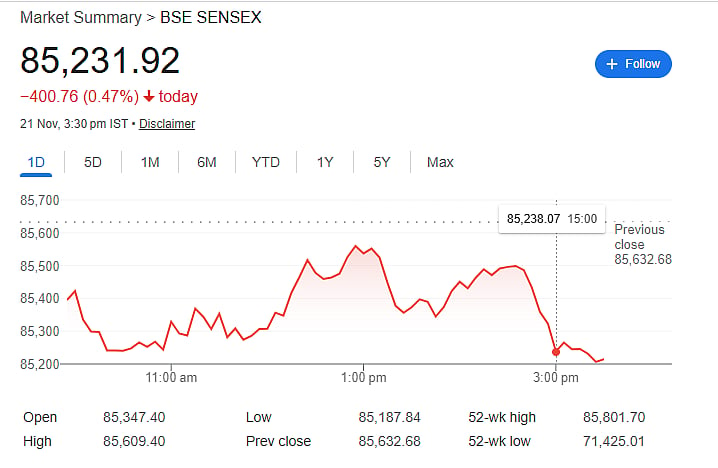

Mumbai: Indian benchmark indices retreated on Friday, snapping a brief two-session recovery. The Sensex fell 400.76 points, or 0.47 percent, to close at 85,231.92 after touching an intraday low of 85,187.84. The Nifty also slipped 124 points, or 0.47 percent, to 26,068.15, pulling back after rallying more than 1 percent in the previous sessions.

The downturn follows a strong Thursday session, when the Sensex had surged 446 points and Nifty hit a 52-week high of 26,246 before ending higher.

Global Weakness and Rate Cut Concerns Drag Markets

Market sentiment weakened sharply after stronger-than-expected US non-farm payroll data reduced the likelihood of a December rate cut by the US Federal Reserve. The fresh data triggered concerns that interest rates may stay higher for longer, hurting risk assets globally.

Additionally, renewed worries about a potential bubble in AI-related stocks further dampened global appetite for equities. Asian markets reacted sharply, with South Korea’s Kospi dropping 3.79 percent, Shanghai’s SSE down 2.45 percent, Japan’s Nikkei falling 2.40 percent, and Hong Kong’s Hang Seng sliding 2.38 percent. European markets also opened lower, while US markets had ended Thursday in the red, led by a 2.15 percent fall in the Nasdaq.

Losers, Gainers, and Domestic Flows

Among Sensex constituents, Tata Steel, HCL Tech, Bajaj Finance, Bajaj Finserv, Bharat Electronics and Eternal were the major laggards. On the positive side, Maruti Suzuki, Mahindra & Mahindra, Tata Motors Passenger Vehicles and ITC provided some support to the indices.

Despite the market fall, both FIIs and DIIs were net buyers on Thursday, purchasing Rs 283.65 crore and Rs 824.46 crore worth of equities respectively. Brent crude remained under pressure, declining 1.51 percent to USD 62.42 per barrel.

Analyst View: Volatility Likely to Persist

According to Vinod Nair of Geojit Financial Services, Indian markets mirrored the broader decline across Asia, with profit-booking adding to weakness after recent gains. Mid- and small-cap stocks saw sharper corrections, signaling cautious sentiment heading into the next week.