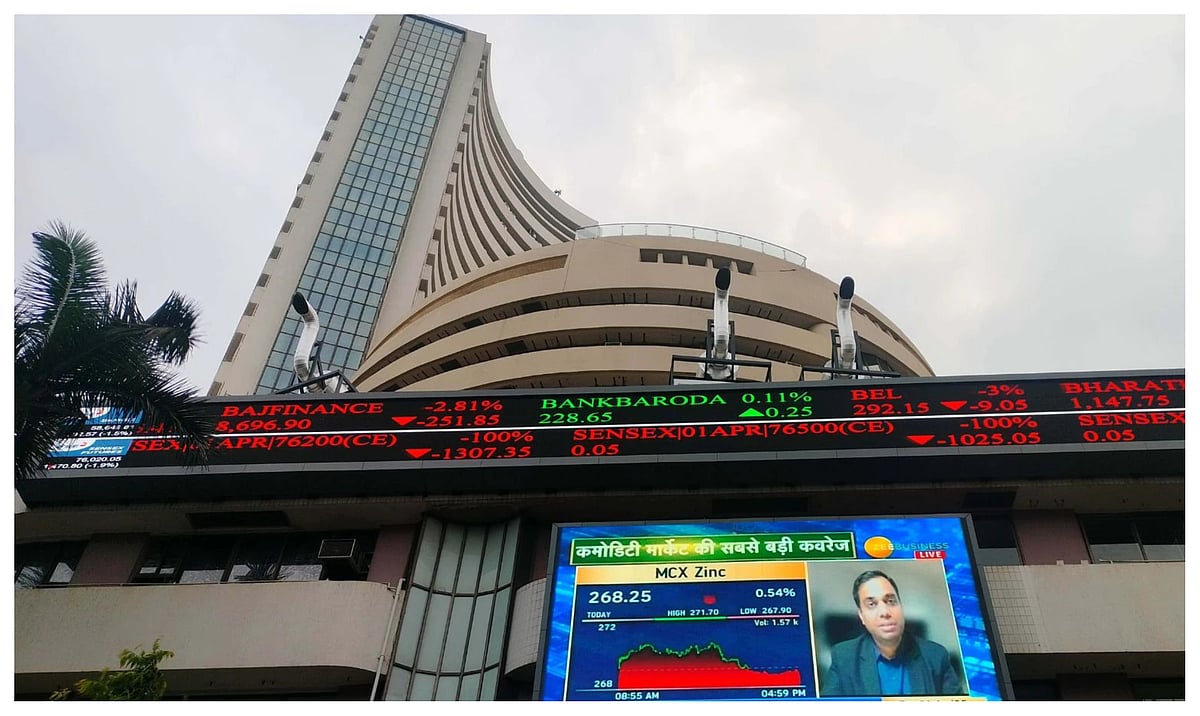

Mumbai: Mumbai: Indian benchmark indices began Thursday’s session on a positive note amid strong buying in heavyweight stocks like Reliance Industries and ICICI Bank.

The BSE Sensex jumped 373.33 points to reach 82,231.17 in early trade. Meanwhile, the NSE Nifty also rose 94.3 points to 25,144.85, continuing its upward momentum from the previous sessions.

Reliance, ICICI Bank Among Top Gainers

Among the Sensex stocks, Bajaj Finserv, Reliance Industries, Trent, ICICI Bank, Tata Motors, and Bharat Electronics were the biggest gainers, pushing the market higher.

However, some tech and FMCG giants like Infosys, Tech Mahindra, Hindustan Unilever, and Eternal lagged behind in early trade.

Reforms and Ratings Drive Market Mood

Experts believe the positive market opening is supported by the government’s proposed GST reforms and a recent upgrade in India’s credit rating, which have boosted investor confidence.

VK Vijayakumar, Chief Investment Strategist at Geojit Investments, noted that India’s market is showing resilience despite global headwinds.

He said, “The steady up move in India contrasts with the downtrend in the US, driven by domestic reforms and strong fund flows.”