Mumbai: The positive momentum from global markets continued for the third day, and its impact was visible in the domestic market opening. Investor sentiment is getting a boost from expectations that the US Federal Reserve may cut interest rates in December 2025.

This optimism has helped markets in Asia and the US trend higher, and Indian markets followed the same path.

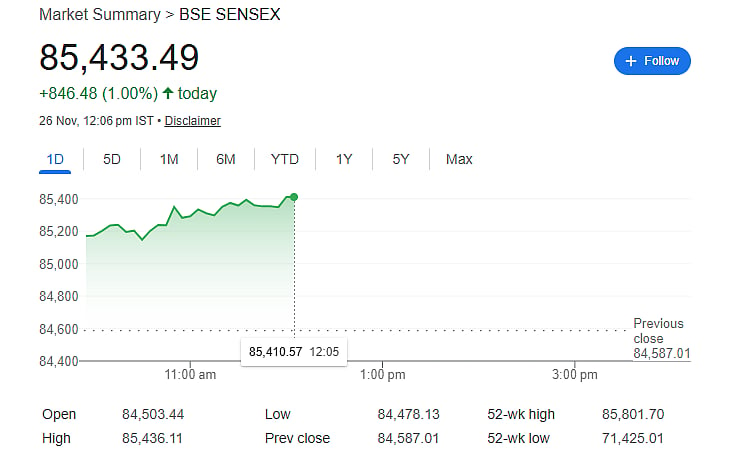

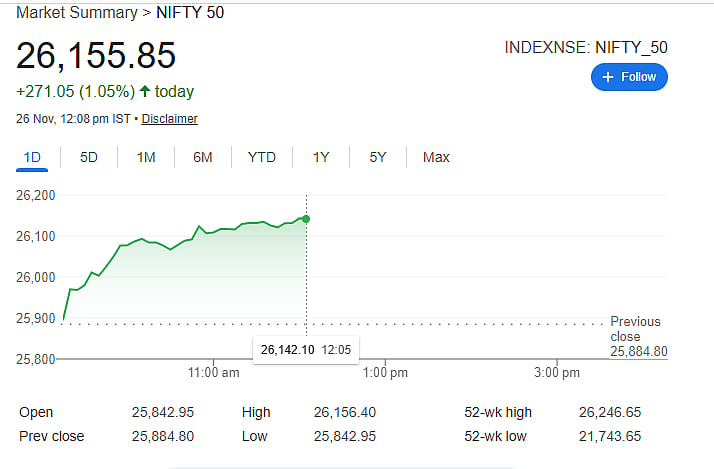

By 12.06 p.m., the Sensex rose 846 points to cross 85,400, while Nifty gained 271 points to cross 26,100. Market breadth was strong, with 1,534 stocks rising and 724 falling. All sectoral indices opened in the green, indicating widespread buying interest.

Rate Cut Hopes Fuel the Rally

The Sensex and Nifty rose nearly 1 percent, driven mainly by expectations of a US rate cut in December. When the US cuts rates, foreign investments flow into emerging markets like India, pushing local indices higher.

Sectoral Gains Lead the Charge

All 16 sectoral indices opened in the green:

- IT stocks rose 0.8 percent as they earn heavily from the US, which benefits from rate cuts.

- Metal stocks jumped 1.7 percent.

- Smallcap and midcap stocks rose around 1 percent, reflecting broad-based market strength.

Strong FII and DII Activity

Foreign Institutional Investors (FIIs) bought Rs 785 crore, while Domestic Institutional Investors (DIIs) invested Rs 3,912 crore. Heavy domestic buying indicates strong market undercurrents and investor confidence.

Heavyweights Lead the Rally

Top-weighted Nifty stocks—HDFC Bank, ICICI Bank, and Reliance Industries—each rose nearly 1 percent, lifting the broader index.

Crude Oil Decline Boosts Markets

Brent crude fell below USD 63 per barrel, easing India’s import bill and inflation concerns, while also reducing corporate costs.

Easing Geopolitical Tensions

Hopes of a Ukraine-Russia peace improved global sentiment, suggesting a stable supply of commodities and easing pressure on oil prices.

Calm Market Conditions

The VIX index is just 12, indicating low market fear and minimal expectation of sudden shocks.