Over the years, BharatPe founder Ashneer Grover has become an unabashedly vocal opinion source in the Indian industrial circle. The entrepreneur, who is known for making brash statements online and offline, has carved a niche for himself amongst the younger generation of businesspeople/entrepreneurs.

After his comments on the budget, an old video of Grover criticising the taxation system has surfaced. While speaking at an event in 2023, he went on a tirade against the Indian taxation system, which, according to him, was punitive and was against the largest populace of the country.

According to Grover, the country's taxpayers are working for the government for 5 months out of the 12 months in a year. This video and the statement surfaced just days after the Union Budget was presented in Parliament by the finance minister, Nirmala Sitharaman.

Grover even called the relationship between taxpayers and its government as servitude or 'Sarkar Gulami'. He emphasised the larger, defeated attitude of Indian taxpayers, who, according to him, have accepted the flawed system for what it is without protesting against it.

Underscoring the system's alleged inefficiency, Grover said that whatever one (the tax payer) has to derive from their earnings has to happen in the 7 months of the year, as their earnings for the remainder of the 5 months goes in thin air, or, in Grover's own words, 'Swaha ho jati hai'

Tweak in Taxing

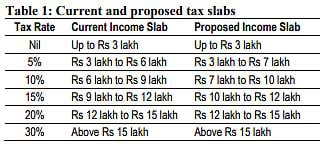

Coming to the budget, the speech from the FM that largely focused on Youth, Skilling and Employment also had some tweaks in store for the existing New Tax Regime. It is to be noted that the old tax regime has not undergone any change, and no new incentive has been added to those opting for the old tax regime.

The tweaks introduced into the new tax regime are said to bring down the cumulative tax paid by citizens. With tax rebate, individuals who earn up to Rs 7 lakh would not be liable to pay taxes.

In the past, Grover has also made a controversial statement about young Indians living in bubbles. He said, "Indian schools have become clubs in themselves, so that admission takers in those schools will belong to the same strata." And the entire school becomes an elite bubble, which doesn't expose Indian youth to the outside world."