Mumbai: RRP Semiconductor Ltd. has become one of the most shocking stories in Indian stock market history. In just 18 months, the stock has surged by an unbelievable 73,000%. This massive rise has pushed the company into the spotlight and turned Rajendra Kamalakant Chodankar, once largely unknown, into a billionaire overnight.

A Stock That Defied All Logic

On October 31, RRP Semiconductor shares touched a lifetime high of Rs 10,887 on the NSE. The company’s market value crossed Rs 14,000 crore. Chodankar owns 74.5 percent of the company, equal to around 1.01 crore shares. At peak prices, his personal wealth crossed Rs 11,000 crore. Surprisingly, despite holding such a large stake, he is not listed as a promoter but appears as a retail shareholder.

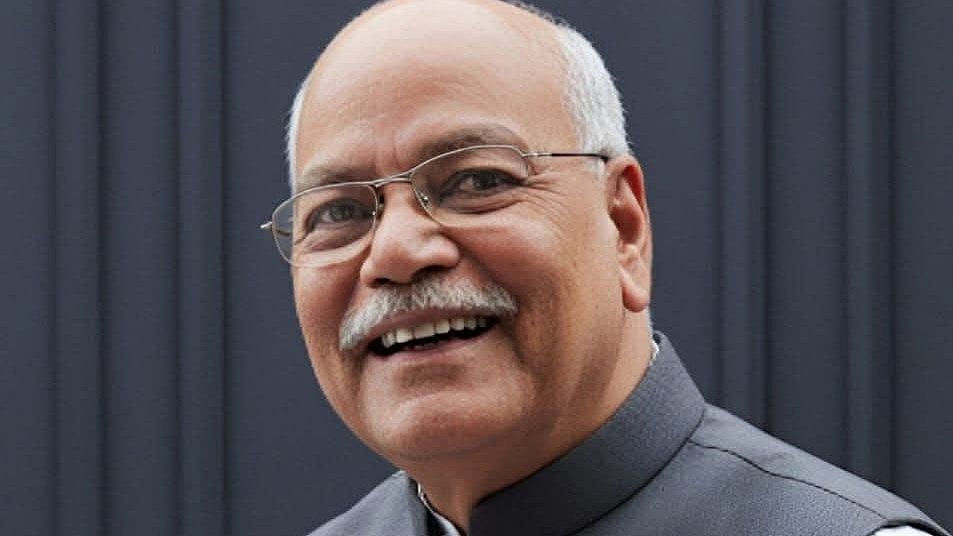

Who Is Rajendra Chodankar?

Very little is known about Chodankar. His LinkedIn profile shows he is a postgraduate from Mumbai University and was earlier chairman of Mechvac Fabricators. Apart from this, there is hardly any public information about him, adding to the mystery around RRP’s rise.

Rumours, Not Results, Drove the Rally

The stunning rally was not backed by strong business growth or major technology success. Instead, it was largely fuelled by social media rumours. Claims ranged from Sachin Tendulkar investing in the company to the Maharashtra government allotting 100 acres of land. RRP Semiconductor clearly denied all these claims.

The company also rejected reports of large semiconductor orders and export deals. In an exchange filing, RRP admitted that its financials did not justify the sharp rise in its share price and warned about unethical trading harming its reputation.

Financials Tell a Different Story

RRP’s revenue rose to Rs 31.6 crore in FY25 from just Rs 38 lakh a year earlier, while profit stood at Rs 8.47 crore. However, in the June 2025 quarter, the company reported zero revenue. Nearly 99 percent of its shares are locked in till March 2026, leaving barely 4,000 shares for trading.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to risks. Please consult a qualified financial advisor before investing.