On Monday, October 14, a number of companies, including the Mukesh Ambani-led Reliance Industries Limited (RIL), the IT services giant HCL Technologies, the maker of popular Indian snacks, Gopal Snacks Ltd, and the textile company Alok Industries, will make an announcement regarding their financial results for the second quarter of the fiscal year 2024–25 (Q2 FY25).

On Monday, the companies, including discount broking giant Angel One, Rajoo Engineers Ltd., which makes plastic-extrusion machinery, and solar panel manufacturer Sterling and Wilson Renewable Energy, which offers EPC solutions, will also release their Q2 report cards.

Full List of companies

Alok Industries Ltd.

Angel One Ltd.

Ceenik Exports (India) Ltd.

Dr Lalchandani Labs Ltd

Gopal Snacks Ltd.

HCL Technologies Ltd.

International Travel House Ltd.

J. Taparia Projects Ltd.

Nutraplus India Ltd.

Oriental Hotels Ltd.

Premier Polyfilm Ltd.

Rajoo Engineers Ltd.

Reliance Industries Ltd.

Rita Finance and Leasing Ltd.

Sterling & Wilson Renewable Energy Ltd.

Reliance previous earnings

The energy, telecom, and retail conglomerate Reliance Industries Ltd. (RIL), headed by billionaire Mukesh Ambani, reported a 5.4 per cent year-over-year decline in net profit to Rs 15,138 crore.

On the other hand, operating revenue rose by more than 11 per cent to Rs 2.36 lakh crore. EBITDA climbed by 2 per cent YoY to Rs 42,748 crore, driven by a robust contribution from the consumer and oil and gas industries offsetting a weak one from O2C.

Reliance share performance

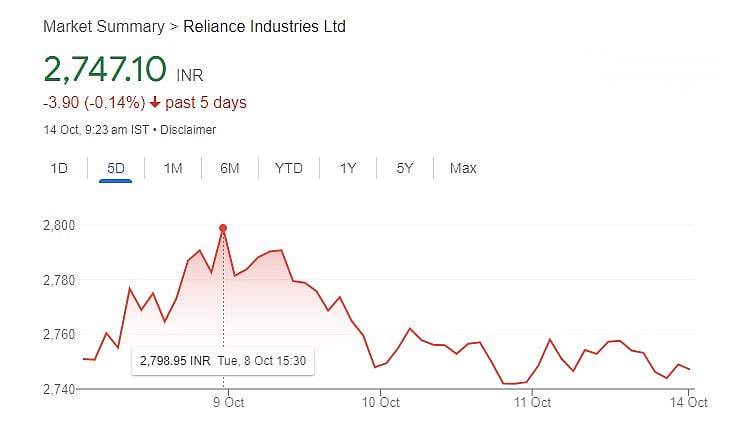

The shares of Reliance Industries Ltd. were trading around Rs 2,748.95 per share on the NSE (National Stock Exchange). The stock has given a negative return of 6.17 per cent return in the last 6 months.

The shares of Reliance industries recorded a life-high level of Rs 3,217.60 on July 8, 2024.

Reliance Retail business

RIL's telecom division, Jio Info comm, reported a higher first-quarter profit because of an increase in customers. The biggest telecom provider in India in terms of users, Jio, announced a 12 per cent increase in earnings year over year to Rs 5,445 crore.

Operating revenue increased by 10 per cent to Rs 26,478 crore over that time.

Jio had a 1.7 per cent monthly churn rate in the first quarter and added 8 million net subscribers.

With revenue increasing by 8 per cent annually to Rs 75,615 crore, Reliance's retail division also demonstrated stable performance. Reliance Retail demonstrated a strong operational performance, achieving an EBITDA of Rs 5,664 crore, a 10 per cent yearly increase.