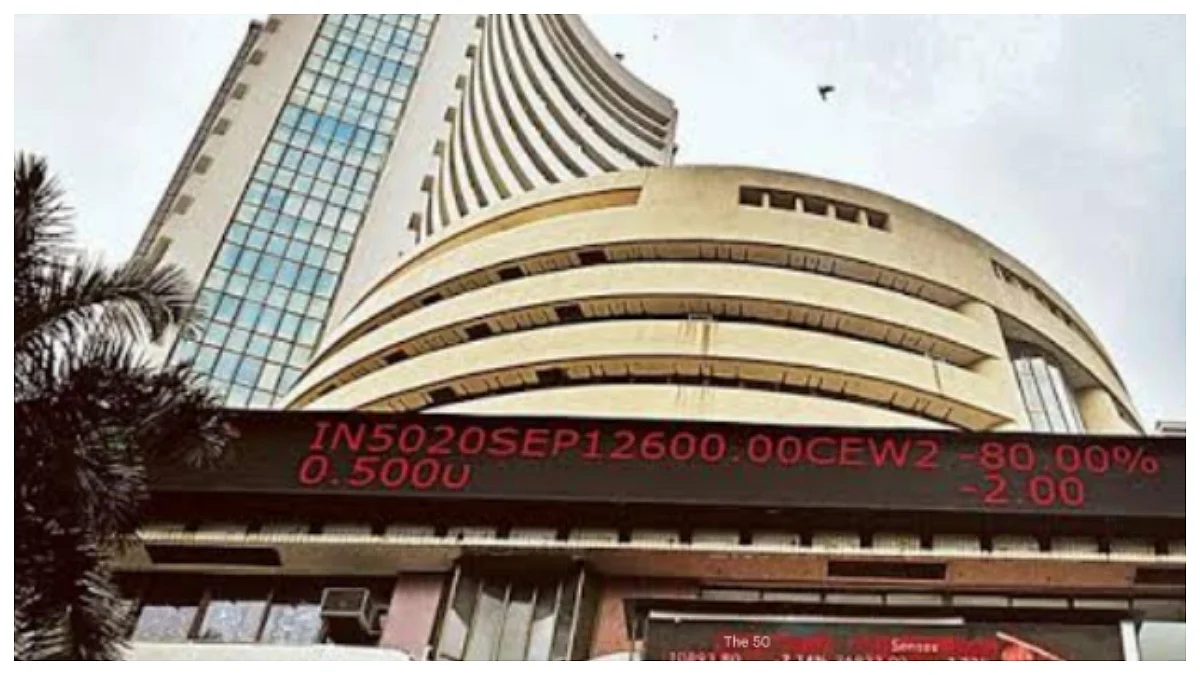

New Delhi: The much-awaited Reserve Bank of India's Monetary Policy Committee (MPC) meeting from August 4-6 comes at a time when the global economy is facing fresh challenges amid US tariffs — with India set to face 25 per cent tariffs from August 7.

According to economists, the Central Bank has reasons to consider another rate cut of at least 25 bps, as upcoming US tariffs may affect exports and slow down the overall economic activity.

According to a latest SBI Research report, the RBI is expected to cut 25 bps in repo rates in light of soft inflation and global uncertainties — aiming to reinforce growth momentum while it has a policy window.

“We expect the RBI to continue frontloading with a 25 basis point cut at its August MPC meeting. Tariff uncertainty, better GDP growth and CPI numbers in FY27 are all frontloaded. A frontloaded rate cut in August could bring an ‘early Diwali’ by boosting credit growth, especially as the festive season in FY26 is also frontloaded,” the report mentioned.

Empirical evidence suggests a strong pick up in credit growth whenever the festive season has been early and has been preceded with a rate cut. The report suggested that policymakers at central banks should avoid missing the window for effective intervention by acting too late.

The RBI is also likely to revise its inflation forecast downward for the full year FY26 due to expected low inflation in H1 FY26.

According to a CareEdge Ratings report, it expects headline inflation to breach the 4 per cent mark by Q4 FY26.

“With a forward-looking view, the RBI would be focusing on inflation in the quarters ahead. We are maintaining our GDP growth projection at 6.4 per cent in FY26. However, external headwinds warrants close monitoring,” the report mentioned.

Additionally, transmission of the previous rate cuts is still underway and could take some more time to show its effect on the economy.

(Except for the headline, this article has not been edited by FPJ's editorial team and is auto-generated from an agency feed.)