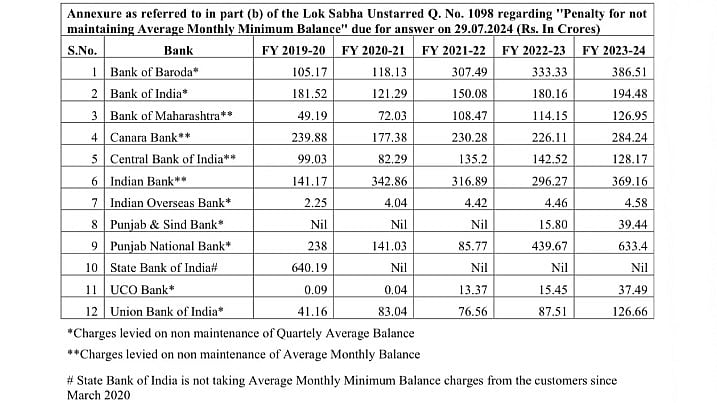

Even in cases where consumers have no money in their savings accounts, banks are still making money by charging for failure to maintain a minimum balance in their bank accounts.

Banks earned Rs 2,331 crore from penalty

For failing to maintain a minimum balance in savings banks, 11 public sector banks charged account holders Rs 2,331 crore in FY 2024. A 25.63 per cent increase from Rs 1,855.43 crore in FY 2023.

According to Ministry of Finance data, these banks collected Rs 5,614 crore from account holders who failed to maintain the minimum balance over the previous three years.

Since FY 2020, SBI has not imposed penalties for failing to maintain a minimum balance.

Which banks charged how much?

In response to a question in Parliament, the Ministry of Finance stated that, with a total of Rs 633.4 crore, Punjab National Bank (PNB) had collected the most money from its customers. Bank of Baroda came in second with Rs 386.51 crore, Indian Bank with Rs 369.16 crore, and Canara Bank with Rs 284.24 crore.

Notably, Indian Overseas Bank earned the least by charging customers for not maintaining the minimum balance in their accounts, which stood at Rs 4.58 crore in FY 2024.

If fees from private sector banks are included, the minimum balance penalty will increase. If account holders do not maintain the minimum balance in their accounts, all private banks impose heavy fees.

RBI's rules for maintaining minimum balance

The Reserve Bank of India (RBI) established guidelines in its circulars from 2014 and 2015 that addressed customer service in banks as well as the imposition of penalties for savings bank account holders who fail to maintain minimum balances.

According to their board-approved policy, banks were allowed to impose penalties for failing to maintain the minimum balance in a savings account.

However, they had to make sure that the penalties would always be based on the difference between the actual amount maintained and the minimum amount that was agreed upon when the account was opened.