The share of Persistent Systems zoomed more than 11 per cent on the NSE (National Stock Exchange) after net profit and revenue saw jumps of 23 per cent and 20 per cent respectively, in the Q2 FY25.

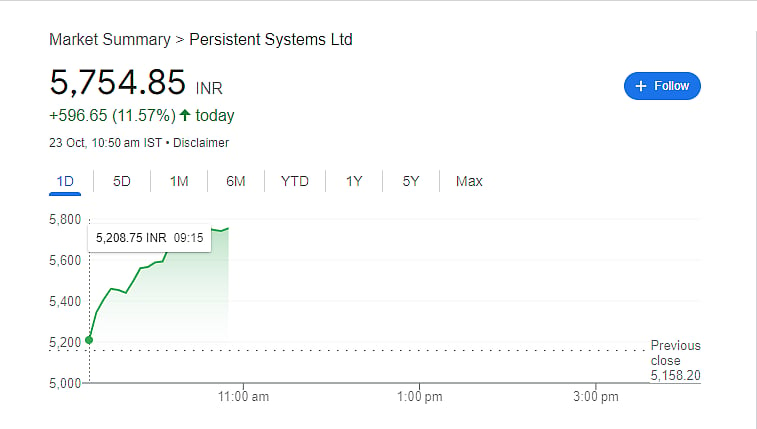

The persistent systems's shares hit the opening bell at Rs 5,209.30 per share on the NSE (National Stock Exchange) before the stock went on to touch the day high and record a new life high level of Rs 5,798.70 per share on the Indian Bourses.

The shares of persistent system were trading around Rs 5,754.85 per share on the National Stock Exchange (NSE), surging more than 11 per cent amounting to Rs 596.65 per share on the Indian stock exchanges.

Persistent Systems Q2 FY25

Q2 FY25 Net Profit

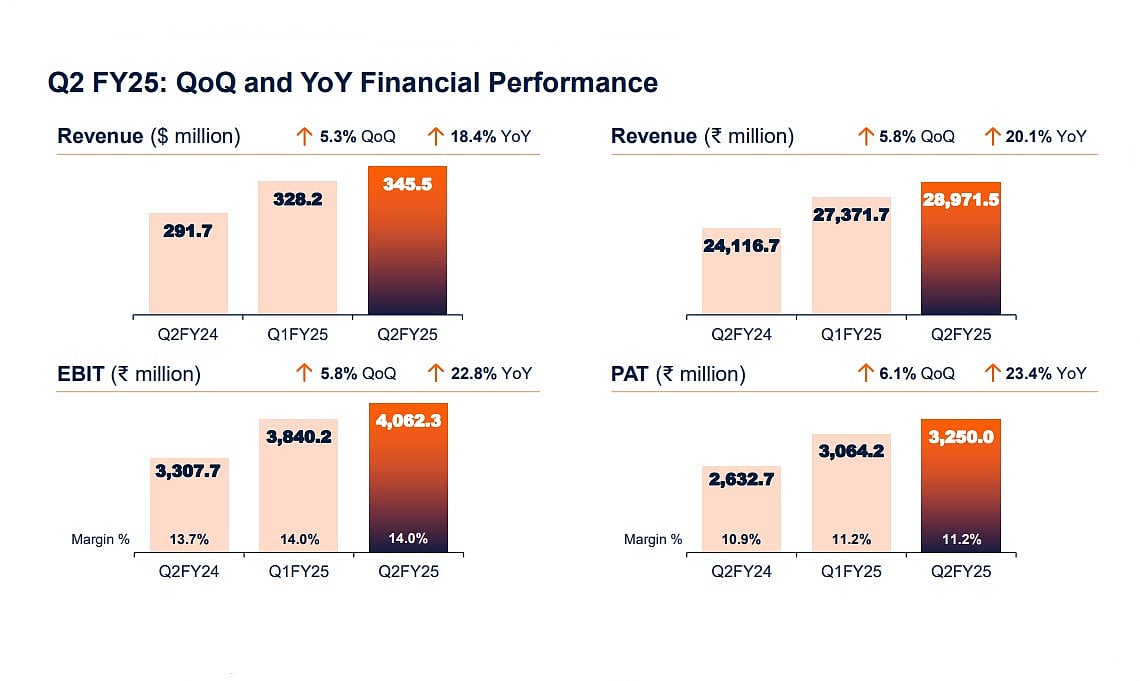

With a profit after tax (PAT) of Rs 325 crore for the quarter, the company saw a notable 23.4 per cent year-over-year growth and a 6.1 per cent QoQ increase.

Operational efficiencies and better financial management drove strong bottom-line performance, as evidenced by the PAT margin, which was recorded at 11.2 per cent.

Revenue Q2 FY25

In the second quarter of FY25, Persistent Systems' revenue was Rs 2,897.15 crore, which was 20.1 per cent more than the same period the previous year. Compared to the previous quarter, revenue grew by 5.8 per cent.

EBITDA Q2 FY25

During the second quarter of FY25, the company's earnings before interest, taxes, depreciation, and amortisation (EBITDA) came to Rs 480.73 crore, with an EBITDA margin of 16.6 per cent. Strong operational efficiency and cost control are demonstrated by this 18.7 per cent year-over-year growth and 5.6 per cent quarter-over-quarter increase.

Total contract value

The total contract value (TCV) and annual contract value (ACV) of the order booking for the quarter that concluded on September 30, 2024, were USD 529 million and USD 348.3 million, respectively.