Zerodha Co-founder, Nithin Kamath, recently took on to the social media platform X, formerly Twitter to highlight the inconsistency in the way cryptocurrency transaction are being taxed.

In a post on X, Kamath, noted out an advertisement for a cryptocurrency Futures and Options (F&O) exchange that caught his attention.

Kamath in his post, wrote, "On one side, SEBI is working on restricting F&O, but on the other side, this crypto F&O ad is on the front page of ET. By the way, all these platforms have taken the stance that the 1% TDS rule doesn't apply to crypto F&O. For regular crypto transactions, 1% of the transaction is deducted as TDS. Something for @nsitharaman and @FinMinIndia to check out.

In his post, he pointed out that the 1 per cent Tax Deducted at Source (TDS) rule which is applied to the regular cryptocurrency transactions doesn't seems to have enforced for crypto F&O transactions.

Moreover, Kamath, in his post also urged tagging the Finance Ministry and Nirmala Sitharaman to look into the matter and investigate this discrepancy.

Impact on SEBI's New circular

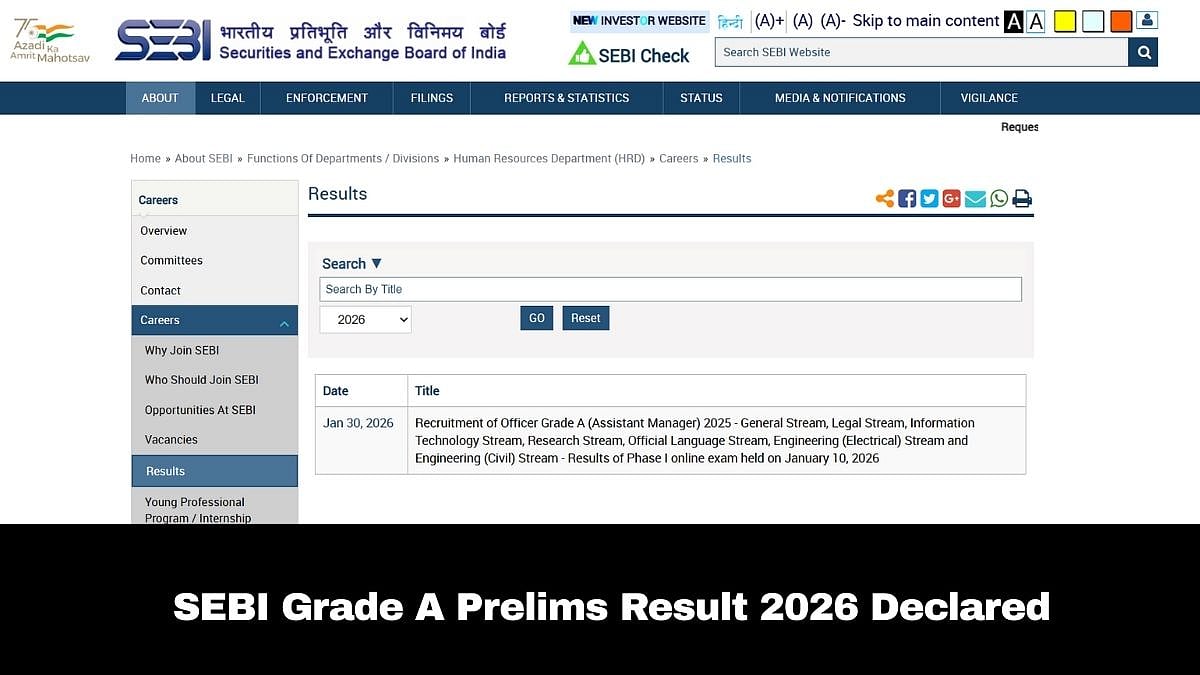

Prior to this post, Kamath has earlier commented on a new circular issued by the Securities and Exchange Board of India (SEBI).

According to Kamath, the new SEBI circular will eliminate the rebates brokers receive from stock exchanges based on overall turnover.

His post reads, "SEBI issued a new circular mandating all market infrastructure institutions, like stock exchanges, to be "true to the label" in how they levy charges. This circular has a significant impact on brokers, traders, and investors. Stock exchanges charge transaction fees based on the overall turnover contributed by brokers."

"The difference between what the brokers charge the customer and what the exchange charges the broker at the end of the month is a rebate, which goes to brokers. Such rebates are common across the major markets in the world. These rebates account for about 10% of our revenues and anywhere between 10-50% of other brokers across the industry. With the new circular, this revenue stream goes away," he added.

"We were one of the last remaining brokers that offered free equity delivery trades. We could do this because F&O trading revenues were subsiding equity delivery investors. With the new circular, we will, in all likelihood, have to let go of the zero brokerage structure and/or increase brokerage for F&O trades. Brokers across the industry will also have to tweak their pricing," Kamath further added in his post.