Asia's second-largest economy, Japan, started the new trading week with some relatively bad news. As per reports, revised data for the GDP growth of the Land of the Rising Sun pegged its growth slightly lower than the preliminary estimates for the second quarter of 2024.

The Japanese economy grew at a rate of 2.9 per cent in the second quarter. This was below the 3.1 per cent mark that was initially estimated.

Japanese Markets Suffer Marginal Decline

The Japanese equity markets appear to have reacted to this development. Major indices based out of Tokyo started the day's trade on a negative note. The losses only widened as the trade went further.

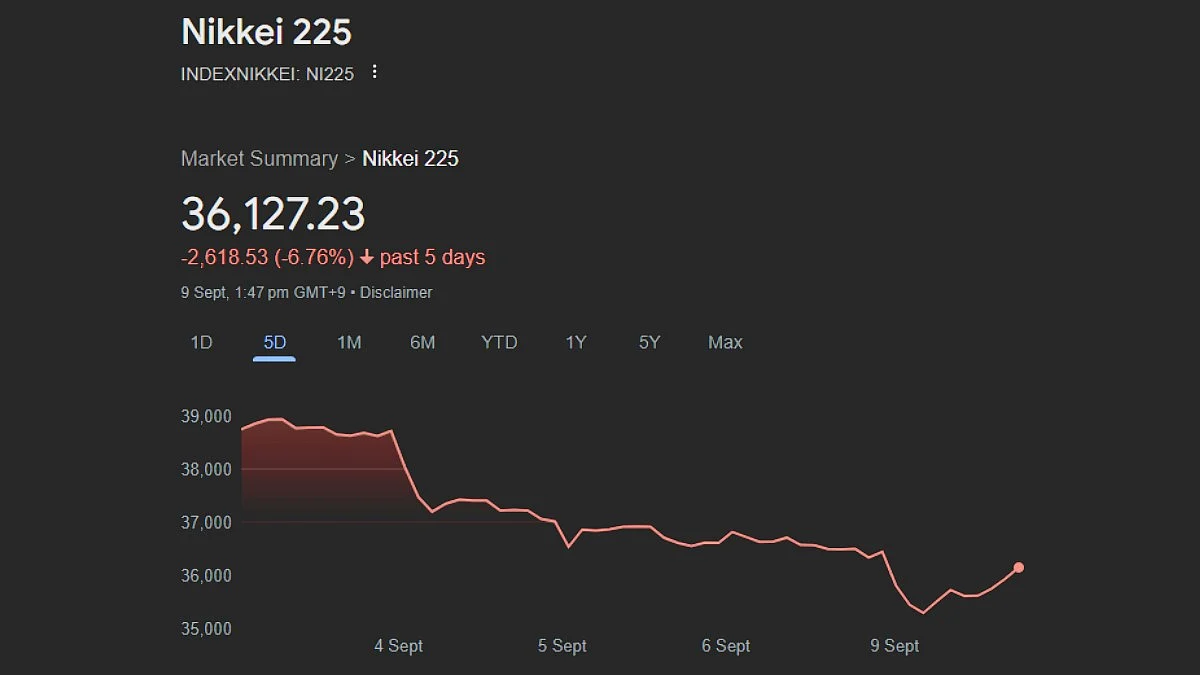

The marquee index of Nikkei 225 dropped by over 1 per cent in the intraday trade. However, it must be noted that after the lunch break, the losses were minimised.

At 10:38 IST, the Nikkei lost 0.73 per cent or 264.24 points, taking the overall value to 36,127.23 points. This took the decline over the past 5 trading session to 6.76 per cent.

The TOPIX index also observed a similar trend. Until the lunch break, the index lost over 1 per cent of its value. However, post the lunch break, TOPIX saw its slump diminish in intensity. At the time of writing, the TOPIX index lost 0.59 per cent or 15.20 points. This resulted in the overall value sliding to 2,582.22.

Private Consumption Slows

This decline in the country's growth is largely attributed to a drop in private consumption, along with a decrease in capital investment.

Even the slightest decline in private consumption is crucial. Although, a pioneer in manufacturing cutting-edge technology, the Japanese economy is largely driven by private consumption. Contrary to the first estimate of 1.0 per cent growth, private consumption—which makes up over half of the Japanese economy—rose by 0.9 per cent.

The Bank of Japan, Japan's central bank, last met in July, when they raised key interest rates from 0-0.1 per cent to 0.25 per cent.