The minutes of the minutes of the Federal Open Market Commitee (FOMC) Meeting have been released, and the Asian markets appear to have reacted to the development in a mixed big.

Asian Markets React To Rate Cut Promise

The US Federal reserve chair, Jerome Powell has hinted at the much awaited rate cut. The central banking system of the world's largest economy could cut use its scissors in September. This 'promise' has perhaps reinvigorated some if not many in the business paradigm.

And given the US's significance as one of the most consequential economy in the world, the ripple effects of decisions made in Washington are often felt across the Atlantic, Pacific and beyond.

The Asian markets, which are usally the first to respond to such happenings, appear to expressed the larger sentiment. After a period of minor decline, major Asian indices are now trading in green.

Japan's marquee index, the Nikkei gained 0.68 per cent or 259.21 points, climbing to 38,211.01.

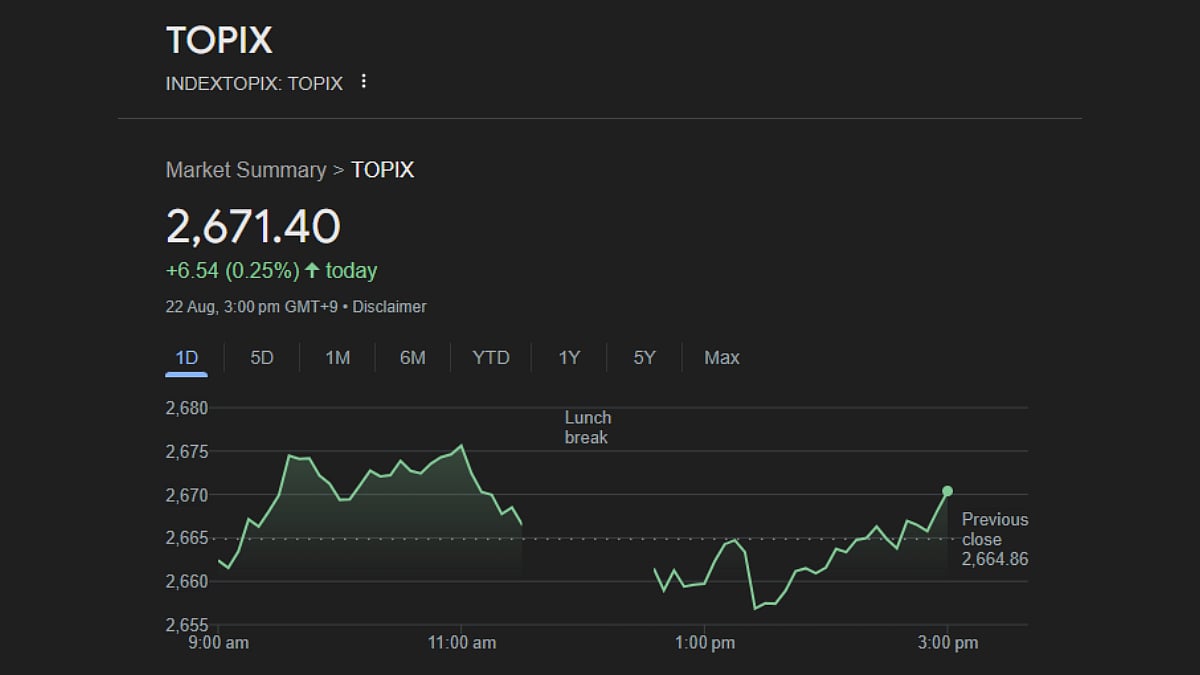

Another Tokyo-based index, TOPIX also saw made gains. The index increased by 0.25 per cent or 6.54 points, taking the overall gain to 2,671.40.

When we more across to the largets economy on the Asian continent, the Shanghai-based SSE Composite Index, the index largely continues to be in red. The index lost 0.27 per cent or 7.69 points, taking the overall value to 2,848.90.

While moving away from the 'mainland', gains of green continue. The Hong Kong-based Hang Seng also made significant gains on Thursday. The index surged by 1.17 per cent or 203.73 points. The index climbed to 17,594.74 with that rise.

When we come to South Korea, the story is no different, as the KOSPI index gained by 0.24 per cent or 6.54 points, taking the overall value to 2,707.67.

The current interest rate in the United States is in the range of 5.25 - 5.50 per cent. This rate has remained unchanged since July 2023.