After witnessing a midweek sell-off, the volatile equity markets during the week, bounced back on Friday to end back above the 18,000 mark and around 1% higher on weekly basis. Continued sell off by FIIs, sustained high inflation in the US and weak global cues weighed on investor sentiments.

UK GDP growth for Q3CY21 was 1.3 percent v/s 5.5 percent in Q2 CY21 and the slowdown in growth was attributed to staff shortages and supply chain constraints. The ongoing real estate crisis in China continues to remain a concern for global investors. However, sentiments were buoyed by softening in crude oil prices and strong DII buying in the Indian equity markets.

FSN e-commerce ventures, the parent company of Nykaa listed on the bourses this week with massive gains of 79 percent over its IPO price, Latent view IPO became the most subscribed IPO of 2021 at 305 times as retail participation remains robust.

Broader markets outperformed the benchmark indices. The Midcap 100 and Smallcap 100 indices ended the week with gains of 1.5 percent and 1.3 percent respectively. IT, energy and Auto sectors were the top performers, ending the week with 2.8 percent, 2.6 percent and 1.2 percent in gains, respectively. While Bank and Pharma sectors struggled, ending the week 2.1 percent and 1.2 percent in the red. Mahindra and Mahindra, Bharti Airtel and Tech Mahindra were the top gainers of the week, while Indusind Bank, Divis Lab and SBI were the top laggards.

Technically, the benchmark index Nifty ended up closing above 20-days DEMA on the daily chart indicating further bullish journey. The stochastic indicator is witnessed with a positive crossover indicating a positive trend and the index is trading above the bullish Ichimoku Clouds. Nifty has a weekly support of 17,700 levels and resistance of 18,350/18,400 levels. Overall, we can expect bullishness in the upcoming week.

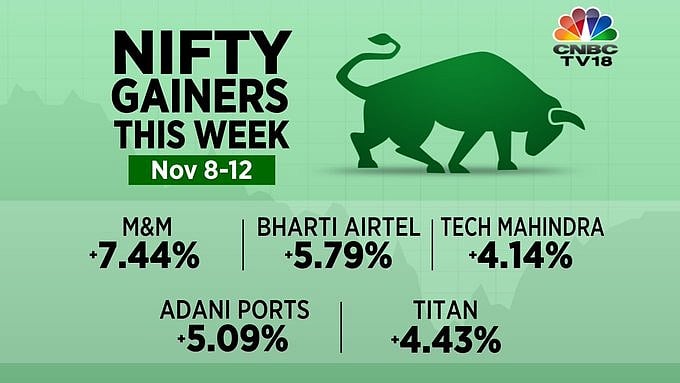

Gainers

Nifty Gainers | CNBC TV18

Mahindra and Mahindra surged 7.4 percent during the week led by positive quarterly results (Q2 Net income was higher by 15 percent), strong performance of new car launches (XUV700) and enhanced focus towards Electric Vehicles.

Bharti Airtel stock saw gains as the company posted healthy numbers in Q2 results, and ARPU reaches Rs 153.4 on the back of improving customer mix and segmented tariff hikes. Airtel is also a beneficiary of the 4-year moratorium on AGR dues.

Tech Mahindra was up 4.1 percent during the week, healthy deal wins, good performance in key verticals like communication and media and positive growth outlook on the back of 5G integration are the key factors.

Titan stock was up 4.4 percent propelled by strong Q2 results, improved margins on the back of cost control measures, aggressive store addition plans and robust festive demand for gold were drivers for the stock.

Losers

Nifty Losers |

IndusInd Bank shares tumbled by more than 12% after whistle-blowers alleged that its subsidiary Bharat Financial Inclusion Ltd has carried out “Evergreening” of loans

Rising near-term pressures like higher raw material prices, supply chain issues, and declining generics revenue led to Divi's Labs' shares falling by around 7 percent during the week.

Bajaj Auto stock closed more than 3 percent lower as Egypt announced that it is looking to replace three-wheelers with mini-vans. 30-40 percent of three-wheeler exports of Bajaj Auto are to the Egyptian market.

(Yug Tibrewal is Research Associate, Choice Broking)