Investing in real estate, that too in a city such as Mumbai, requries a lot of money and planning. But several investors, unrelated to each other, can own parts of the same property for a smaller price than the value of the whole via fractional ownership.

Online platform hBits, which facilitates fractional ownership of real estate, is offering a commercial property worth Rs 42 crore to investors looking to earn rental income apart from capital value application.

What's on the table?

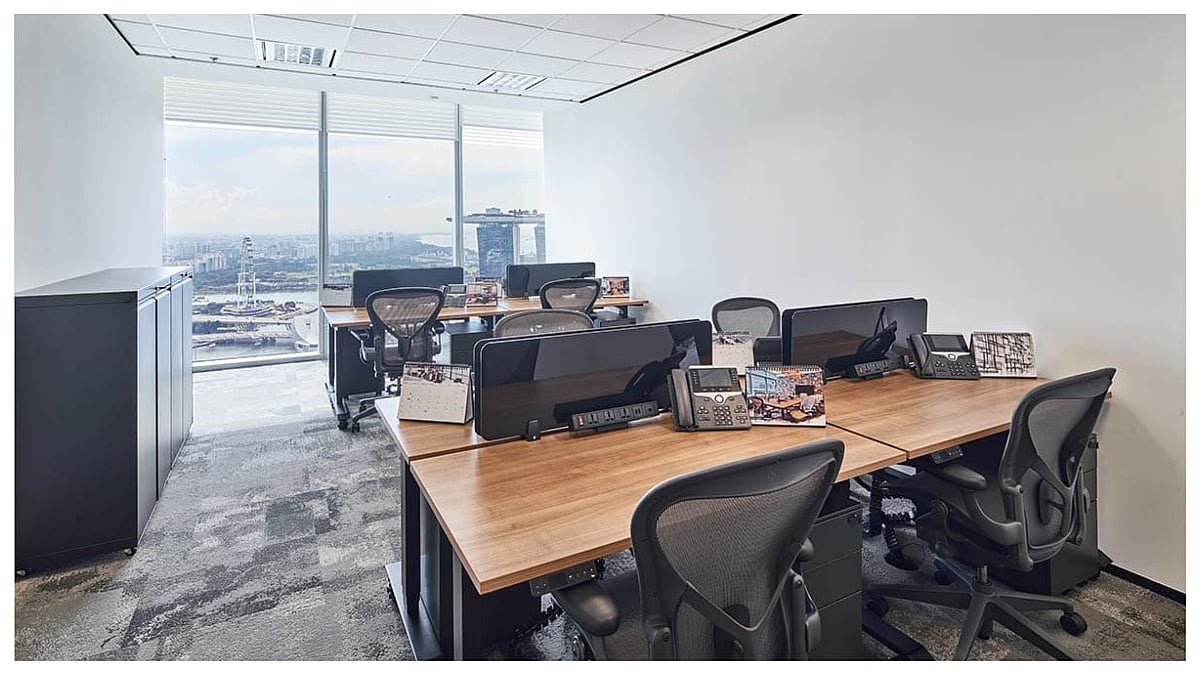

The firm has identified 27,492 square feet in the Boomerang Building located in Powai, Mumbai.

The Grade A+ asset boasts of a high entry yield of 10 per cent gross per annum and an expected IRR of 16.40 per cent, it added.

Investments in the asset fractional ownership start from Rs 25 lakh, and hBits already has assets under management (AUM) of Rs 150 crore.

The building's anchor tenant is US multinational corporation, Sitel.

Demand for smaller investments getting bigger

"The fractional ownership market is seeing a steady rise in demand from investors, particularly due to the volatility in equity markets," Shiv Parekh, Founder of hBits, said.

"We are seeing continued interest from senior corporate executives and seasoned investors alike," he said.

HBits, which started business in 2019, said it invests only in Grade A assets with large corporates and MNCs as marquee tenants to ensure better returns for our investors.

"Fractional ownership is a unique financial instrument that offers investors higher returns than traditional investment options. While the concept is popular across the globe, it is relatively new in India," Samir Bhandari, Chief Financial Officer of hBits, said.