Mumbai: Indian stock markets gave up their early gains on Friday and slipped into mild losses as selling pressure returned. The Sensex and Nifty both opened higher but failed to hold on to the momentum due to weak global cues and continuous foreign selling.

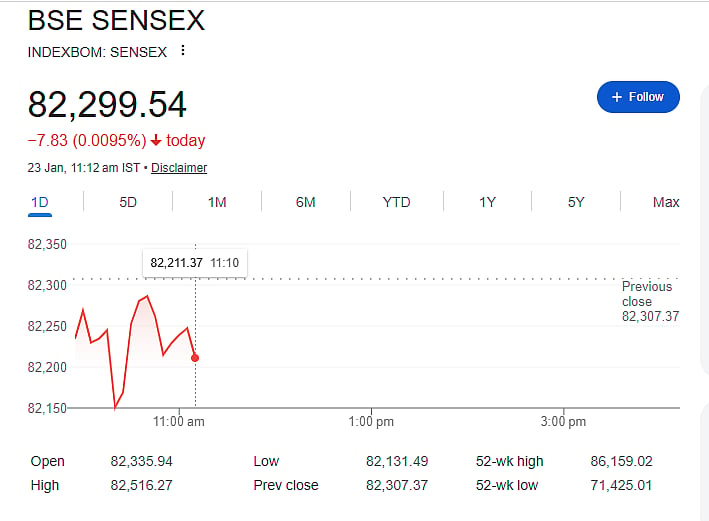

The Sensex opened at 82,335.94 and moved up to an intraday high of 82,516.27. However, profit booking at higher levels dragged the index lower. By 11.12 am, the Sensex was trading 7.83 points, or 0.0095 percent, down at 82,299.54.

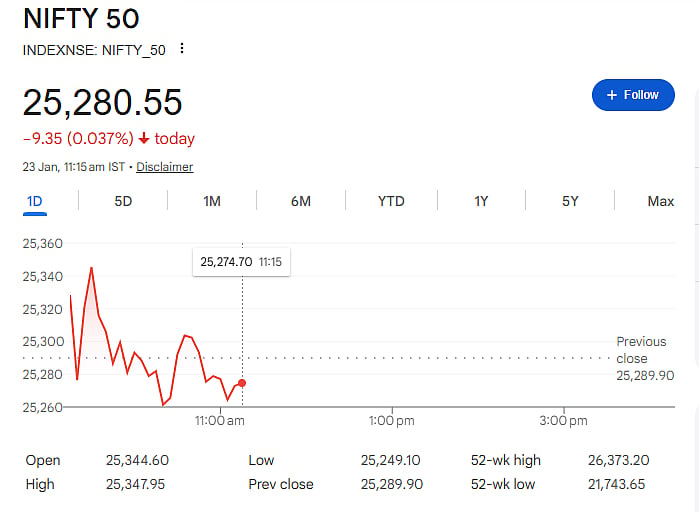

The Nifty also slipped below the key 25,300 mark. It was down 9.35 points, or 0.37 percent, at 25,280.55. During the session, the index moved between a high of 25,347.95 and a low of 25,249.10.

Recent recovery fails to hold

On Thursday, both benchmark indices had closed nearly 0.5 percent higher, ending a three-session losing streak. That recovery was supported by positive global cues after US President Donald Trump softened his stance on proposed tariffs against European countries and ruled out the use of force over Greenland.

Despite Thursday’s rise, the broader trend remains weak. So far this week, both the Sensex and Nifty are down around 1.5 percent, showing continued pressure on the market.

Continued FII selling

One of the main reasons for market weakness is the steady selling by foreign institutional investors (FIIs). On Thursday alone, FIIs sold shares worth Rs 2,549.80 crore.

January has been especially tough, with FIIs remaining net sellers for 13 sessions so far. The only day they were net buyers this month was January 2. This continuous outflow has kept investor sentiment cautious.

Weak quarterly results

Some heavyweight stocks also weighed on the market. Companies like ICICI Bank and HCL Technologies reported weaker-than-expected quarterly results. Disappointing earnings from large companies usually impact overall market confidence and limit upside.

Rising crude oil prices

Rising crude oil prices added further pressure. Brent crude rose 0.8 percent to USD 64.57 per barrel. Higher oil prices can increase India’s import bill, widen the trade deficit, and raise inflation concerns. These factors often hurt equity markets.

Market outlook

With foreign selling, mixed earnings, and rising oil prices, markets may remain volatile in the near term. Investors are likely to stay cautious until clearer signals emerge.