Mumbai: Indian stock markets opened strong on Thursday as global tensions eased after US President Donald Trump stepped back from tariff threats against European countries linked to the Greenland issue. The positive global mood lifted investor confidence across Asian and Indian markets.

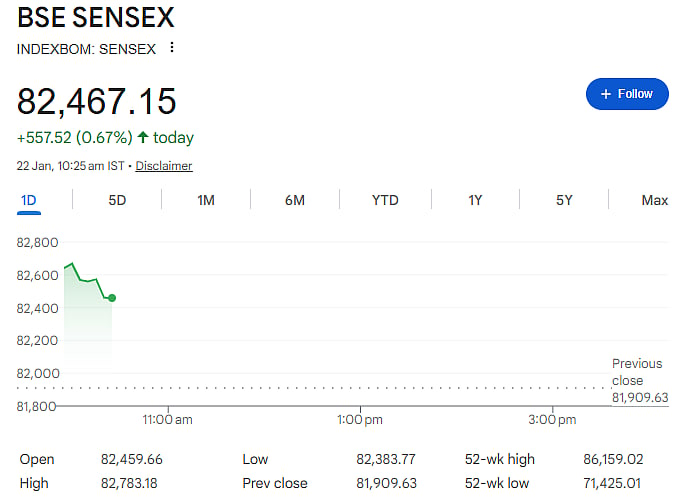

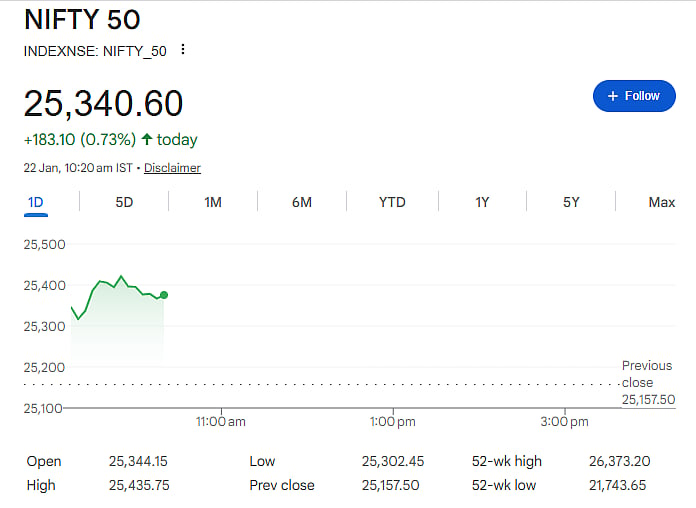

By 10:25 am, the Sensex rose 557 points, or 0.67 percent, to 82,467. The Nifty climbed 160 points, or 0.64 percent, to 25,317. Buying interest was broad-based, with midcap and smallcap stocks rising faster than the main indices.

The Nifty Midcap 100 gained 0.94 percent, while the Nifty Smallcap 100 rose 1.01 percent, showing strong risk appetite among investors.

All sectors trade in the green

All sectoral indices were trading higher in early trade. Auto, PSU banks, media and IT stocks led the gains. The Nifty Auto index rose 1.05 percent, PSU Bank added 0.89 percent, Media gained 1 percent, and IT stocks climbed 0.80 percent.

Market experts said the overall mood improved sharply after global trade worries eased, encouraging investors to buy across sectors.

Key levels to watch

Analysts said immediate support for the Nifty is placed near the 25,000 level. On the upside, resistance is now seen in the 25,250–25,300 zone. A clear move above this range could further strengthen the market trend.

Global markets support the rally

Asian markets also reacted positively. Japan’s Nikkei surged 1.87 percent, while South Korea’s Kospi jumped 1.97 percent. China’s Shanghai and Shenzhen indices slipped slightly, while Hong Kong’s Hang Seng was marginally lower.

US markets ended firmly higher in the previous session. The Nasdaq gained 1.18 percent, the S&P 500 rose 1.16 percent, and the Dow Jones advanced 1.21 percent.

Short covering may boost momentum

Analysts said Trump’s statement at the World Economic Forum in Davos, where he ruled out force and tariffs over Greenland, reduced fears of a US-Europe trade war. This has set the stage for a relief rally.

With nearly two lakh short positions in the market, experts believe short covering could further push indices higher. They also noted that weak Q3 profits due to one-time labour code provisions are likely to be ignored by the market.

FII selling, DII buying continues

On January 20, foreign institutional investors sold shares worth Rs 1,788 crore. In contrast, domestic institutional investors bought equities worth Rs 4,520 crore, helping support the market.