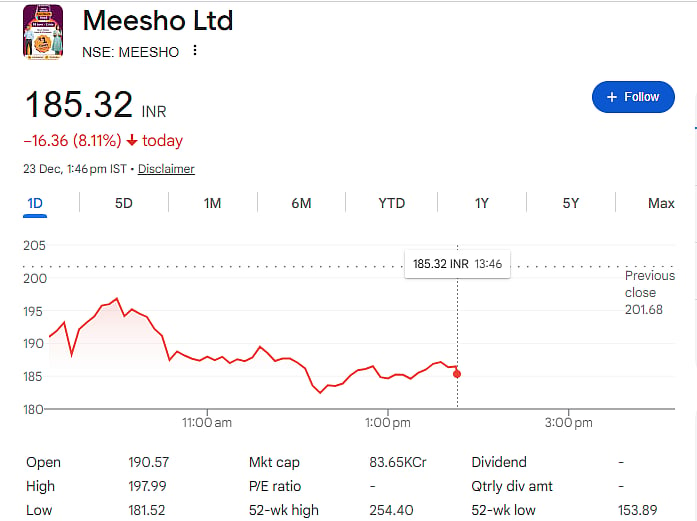

Mumbai: Meesho, a recently listed e-commerce company, has seen a sudden and sharp fall in its share price. On December 23, the stock dropped more than 8 percent, marking its third straight session of losses. In just three trading days, the stock has fallen nearly 21 per cent, surprising many investors.

From Big Rally to Sudden Pressure

This fall comes soon after a very strong listing. Meesho shares debuted on December 10 at Rs 162.50 on the NSE, which was around 46 per cent higher than its IPO price of Rs 111. In just four trading sessions after listing, the stock had surged nearly 65 per cent, driven by strong investor excitement.

Market Cap Slips Below Rs 85,000 Crore

As the selling pressure increased, Meesho’s share price slipped to around Rs 185.34. Due to this decline, the company’s market capitalisation dropped below Rs 85,000 crore. Experts believe the market is now reassessing the stock after the early optimism faded.

Why the Stock Is Falling?

According to Abhinav Tiwari, Research Analyst at Bonanza, Meesho has a strong long-term business story, but at current prices the short-term risk-reward does not look attractive. He said that while the company’s fundamentals are improving, high valuations and execution risks are not fully priced in.

Valuation Is the Key Concern

Experts say Meesho’s rapid rise pushed the stock well above brokerage target prices. Harshal Dasani of INVasset PMS noted that early optimism was already reflected in the share price. Meesho is still in a transition phase and has not yet achieved consistent profitability.

Focus Shifts to Delivery, Not Just Growth

Analysts believe investors are now focusing less on headline growth and more on actual delivery. Meesho must show strong unit economics, better operating leverage and the ability to handle competition. How quickly the company turns its scale into sustainable profits will decide whether its post-IPO valuation can hold.

Still Above IPO Price

Despite the recent fall, Meesho shares are still about 67 per cent above the IPO price and nearly 14 per cent higher than the listing price. However, the sharp correction has made investors more cautious about the road ahead.