The benchmark Sensex and Nifty registered losses at the end of trading session on Tuesday. Sensex fell over 243.62 points or 0.51 percent to close at 47,705.80 while the Nifty was down 63.05 points or 0.44 percent at 14,296.40.The markets failed to hold the gains recorded in the first half as several states made announcements regarding new restrictions. The stock market fell over 1 percent after the Maharashtra government announced stricter restrictions.

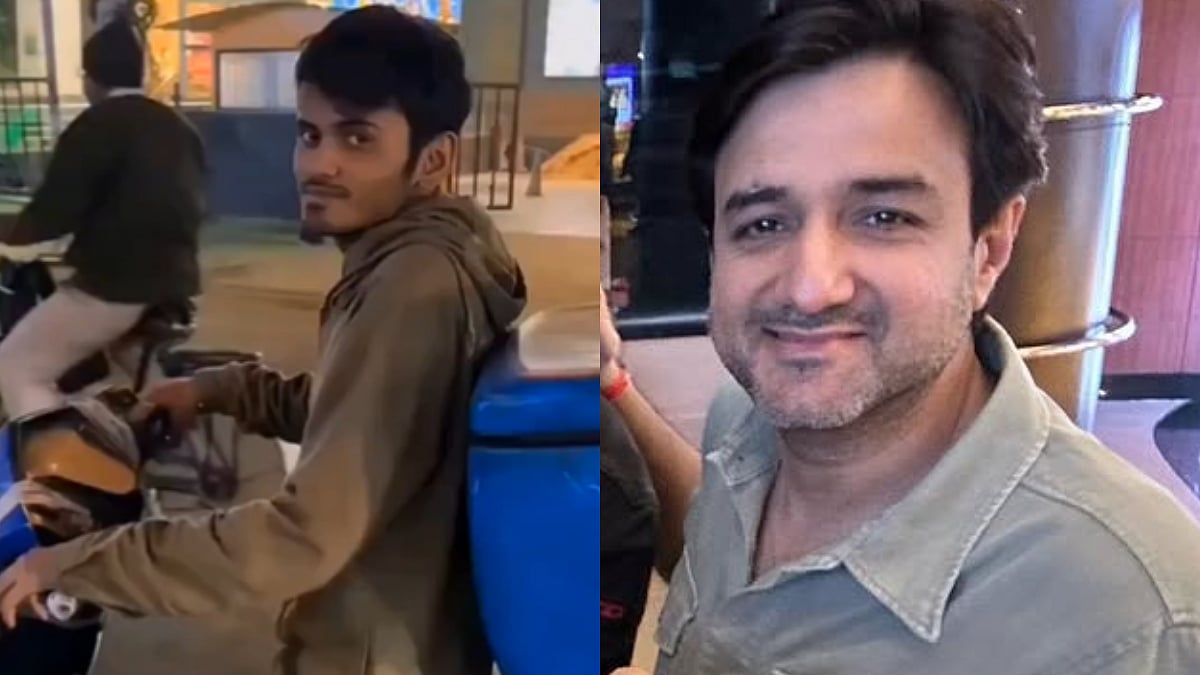

“While one third of the stocks may have fallen by more than 20 percent from their peak, the investors are examining and watching the current vaccination drive very carefully to analyse the impact. With the government‘s initiative to improve the vaccination drive by different measures, the investors are looking at the entry strategy as well at the moment. This has kept the markets fundamentally flat today”, said Abhishek A Rastogi, Partner at Khaitan & Co.

Deepak Jasani, Head-Retail Research, HDFC Securities, said the Nifty once again failed to hold on to higher levels facing selling pressure. The broader market did well on April 20. It took support again from 14207. However repeated testing of 14200 is not a good sign. 14200-14505 is the new band for the Nifty for the near term. A breach of 14200 again could result in accelerated selling, Jasani said.

The broader markets did better with the S&P BSE MidCap and S&P BSE SmallCap indices both ending 0.5 percent higher. Volumes on the NSE were in line with recent averages. Among sectors, Pharma and Auto gained the most, while IT and Materials indices fell the most, Jasani added.

Shrikant Chouhan, Executive Vice President (Fundamental Technical Analyst), Kotak Securities said with the Nifty / Sensex hovering in the range of 14,600 to 14,400/ 47,500-49,000 price range, the texture of the pattern suggests narrow range activity will likely to continue in the near future. "Technically, the index has formed lower top formation which is broadly negative for the market. The intraday chart suggest correction wave likely to continue if the Nifty/ Sensex succeed to trade below 14,400/48,100 below the same the correction wave will continue up to 14,200-14,130/ 47,350-47,000. On the flip side, above 14,400/48,100 we can expect quick pullback rally till 14,475-14,525/ 48,300-48,500."

Pharma stocks gained as the government announced that 18 year-old were eligible for COVID-19 vaccine. Dr Reddy was the top Nifty gainer as it has received approval from the Drug Controller General of India (DCGI) to import the Sputnik vaccine for restricted use. HDGC Life gained 3 percent while ICICI Prudential life was up 5 percent on Q4 earnings. The top Nifty losers were UltraTech, HCL Tech, HDFC, Tech Mahindra, HDFC Bank and HUL emerged as the major laggards -– falling as much as 4.7 percent.

Bajaj Finserv, Dr Reddy’s, Bajaj Finance, Bajaj Auto and Maruti were among the top gainers.

The rupee ended almost flat at 74.88 (provisional) against the US dollar on Tuesday.

The markets will continue to be bearish due to the shortage in vaccine supply, said Ajay Kejriwal, Head-Broking and distribution, Choice Group.

Markets open higher in opening session

Mohit Nigam, head, PMS & advisory, Hem Securities said though the markets opened higher this morning on positive news about mass vaccination drive from May 1 onwards, it failed to sustain the higher levels in the second half due to weak Europe and US markets. "Moreover, the continuous negative developments related to COVID from different parts of the country is acting as the single most dominant factor leading to the decline. Strong positive momentum is seen in the pharma space since the past few days & we can look in this space for short term opportunities.," he said.

A withdrawal of Rs.5,000 crore by FIIs in the month of April might indicate changing sentiments of foreign funds coming into India in the current scenario. The 14,200 levels continue to remain a support and if the market breaches that, then we can see a 500–700 points dip in Nifty quickly, Nigam added.

In the opening session today, the Sensex rebounded over 500 points and the NSE Nifty recaptured the key 14,500-level as investor sentiment improved following the government''s policy response to the resurgence of COVID cases in the country. The Sensex was trading at 48,455.13, showing a rise of 505.13 points or 1.05 per cent in opening deals; while the broader Nifty was trading higher by 150.20 points or 1.05 per cent at 14,509.65.

On the Sensex, barring three IT stocks -- HCL Tech, Tech Mahindra and TCS -- all shares were trading in the green.

Elsewhere in Asia on Tuesday, equity bourses saw mixed trading till afternoon as investors awaited the release of China's latest benchmark lending rate. Japan led losses among the region’s major markets, followed by Hong Kong; while South Korea and China were trading higher.