Nifty index opened flattish and after attempting to cross 26100 levels in the first tick, it failed to hold momentum and dripped lower throughout the day. It respected the previous day’s lower level and buying interest emerged near 25950 zones in the last hour. It formed a small bodied bullish candle on the daily frame and negated its lower lows formation of the last three sessions. Overall the technical landscapes to a restricted uptrend phase with healthy pullbacks and smart buying at lower levels. Now it has to continue to hold above 26k marks, for an up move towards 26150 then 26250 zones while support can be seen at 25900 then 25800 zones.

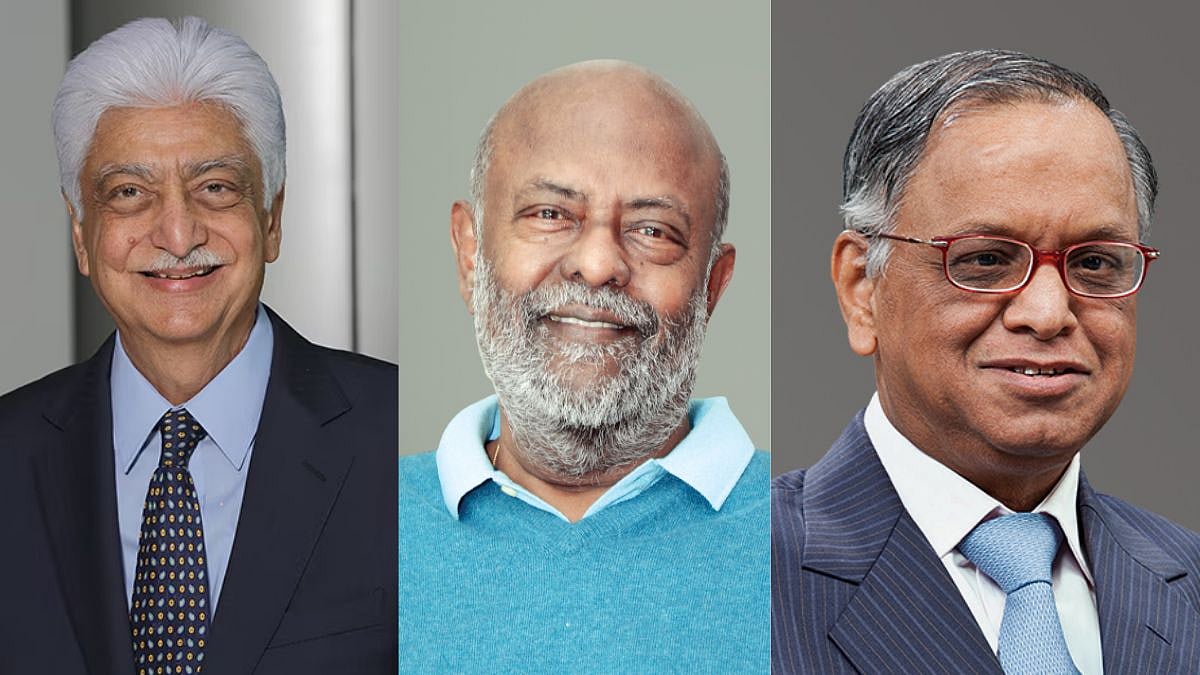

File Image |

On option front, Maximum Call OI is at 26100 then 26000 strike while Maximum Put OI is at 26000 then 25900 strike. Call writing is seen at 26100 then 26050 strike while Put writing is seen at 26000 then 26050 strike. Option data suggests a broader trading range in between 25500 to 26400 zones while an immediate range between 25800 to 26200 levels.

S&P BSE Sensex index opened on a flattish note but buying interest was evident in the first half of the session as the index inched higher towards the 85500 zones. Post the up move, the index witnessed some profit booking along with volatile swings keeping intraday sentiment mixed. However in the last hour it recovered from lower levels, indicating that buying from support zones remains firmly intact. On the daily chart, the index formed a bullish candle with wicks on both sides highlighting intraday indecision yet ending the session with gains of around 160 points. Now it has to hold above 85100 for an upside move towards 85500 then 85800 levels while supports are seen at 85000 then 84700 zones.

Bank Nifty index opened marginally lower near 59300 zones but good momentum was seen towards 59550 levels in the first half of the session. However it failed to hold at higher levels and drifted lower towards 59050 zones in the latter part of the session. It formed a small bodied candle on the daily scale as multiple supports are intact at lower levels but momentum is missing at higher zones. Now it has to hold above 59000 for a bounce towards 59500 then 59750 zones while a hold below the same could see weakness towards 58750 then 58500 zones.

File Image |

Nifty future closed positive with gains of 0.20% at 26189 levels. Positive setup seen in Coforge, Persistent, Hero Motocorp, UPL, Siemens, TCS, APL Apollo, Lupin and Motherson while weakness in Kaynes, Biocon, Indigo, JSW Energy, Jindal Steel, Hudco, BPCL, OIL, Eternal, TMPV and CDSL.

RITCO - TECHNICAL CALL OF THE DAY

RITCO Logistics trades comfortably above its key 40 and 100 EMA levels on daily chart reflecting strength in the short to medium time frame while it is just shy of closing above its 200 EMA levels and we believe once it crosses and closes above 284 levels, the stock will likely bulls its upmove momentum further. The stock is in a clear uptrend as visible via the trend line in the chart and this is supported by a positive super trend indicator and RSI divergence reflecting bullish implications.

File Image |

BUY RITCO CMP 274.20 SL 263.55 TGT 286.00

Top 5 stocks to watch out for 5th Dec 2025

ITC Hotels:

According to media sources, BAT-linked shareholders are set to sell up to 7% of ITC Hotels via a Rs 2,998-crore block deal, with a floor price of Rs 205.65 per share, reflecting a 1% discount to Thursday's close. The sellers include Tobacco Manufacturers (India) Ltd, Myddleton Investment Company Ltd, and Rothmans International Enterprises Ltd, all part of the BAT Group, which holds 15.3% in ITC Hotels. The deal will have a 60-day lock-in for the selling entities and their affiliates. Proceeds will help BAT move toward its target leverage corridor of 2–2.5x adjusted net debt/EBITDA by end-2026.

HCL Technologies:

Strategy, the world's largest independent publicly traded enterprise analytics company and HCL Tech have announced a strategic partnership to accelerate the global adoption and deployment of Strategy Mosaic, Strategy's AI-powered Universal Semantic Layer, for global enterprise clients.

HCL Tech will pair its consulting and AI expertise with Strategy’s engineering capabilities to integrate Strategy Mosaic across complex multicloud environments. The partnership brings together both firms’ service teams to deliver seamless, scalable deployments and support demanding data environments.

Diamond Power:

The company has received a letter of intent from Adani Green Energy Limited for Supply of 33KV HV Cables 2126 kms and 3.3KV Solar MV Cables 3539 Kms for Khavda and Rajasthan Project worth Rs 747 crore. The time period within the order has to be executed is from January to December 2026.

Deepak Nitrite:

Deepak Nitrite’s material wholly owned subsidiary, Deepak Chem Tech Limited, has commenced the manufacturing operations at its Nitric Acid Plant at Nandesari, Dist. Vadodara in Gujarat. The total capital expenditure incurred for the same is approx Rs 515 crore as of the date of commencement of manufacturing operations.

Strategically, this will significantly strengthen Group's backward and forward integration, reinforcing supply security for key intermediates, enabling greater resistance and deeper penetration into high value applications. This marks a major step in Group's evolution toward a more integrated and acute-accretive chemical platform - from Ammonia to Amines, with very few world players enjoying similar strengths.

SEAMEC Ltd:

The company has entered into a Contract with M/s. HAL Offshore Ltd for offering Charter Hire of the Multi Support Vessel “SEAMEC AGASTYA for deploying the same in the ONGC under ongoing Contract of HAL for 5 years, after completion of statutory dry dock of the vessel. The Charter rate is US$ 25,000 per day for a balance period of 4 years and Hal Offshore holds 70.77% of shareholding in SEAMEC Ltd.

.jpg)