With the new financial year approaching, now is an excellent time to review your investments and make fresh yearly financial goals. Every investment portfolio should incorporate a risk-mitigating secure investment alternative in addition to high-earning market-linked tools. With the plethora of investment options available in the market, choosing one can be a daunting task. You must consider your risk appetite, financial goals, liquidity requirements, the safety of the investment instrument, etc.

A fixed deposit is a wise investment option that isn't affected by market volatilities, helping you grow your savings with minimum risk. Bajaj Finance Fixed Deposit is a sound investment instrument that offers safe and generous returns on deposits.

With Bajaj Finance Fixed Deposit, you can benefit from the dual advantage of high FD rates and deposit safety.

Here are five reasons why you must consider investing in a Bajaj Finance online FD:

1. Lucrative FD interest rates

Choosing an FD with high-interest rates is a primary criterion for investing. In India, the RBI regulations affect the FD interest rates. However, the same is not applicable for Bajaj Finance Limited, as it is an NBFC. Thus, Bajaj Finance Limited provides a profitable interest rate of up to 7.05% p.a. with flexible tenor and payout options.

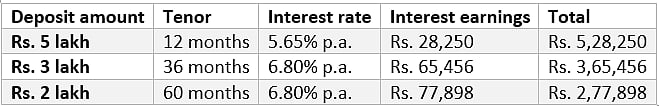

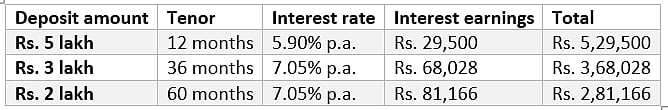

For an estimate of the potential earnings, here’s a look at these examples.

1. Citizens aged below 60 investing in a Bajaj Finance online FD

2. Senior citizen investing in a Bajaj Finance online FD

2. Loan against FD facility

Unfortunate emergencies that warrant a free flow of cash can arise suddenly. To fund these, you must have a contingency amount set aside. However, even if you have invested in the surplus, you should be able to use your money when you need it the most. Bajaj Finance FD offers a loan against FD facility where you can easily avail of a loan up to 75% of your FD value.

2. Flexible tenor and payout options

With Bajaj Finance Fixed Deposit, you have the freedom to choose the tenor of investment and the frequency of payouts, making it a flexible investment option. By selecting the non-cumulative fixed deposit, you can get payouts on a monthly, quarterly, half-yearly or annual basis, as per your choice.

3. The easy online application process

Thanks to an easy online application process, you can book an FD with Bajaj Finance Fixed Deposit from the comfort of your home. Simply provide your KYC details and book an FD without worrying about long queues, tedious documentation and physical visits to branches.

4. Safety of deposit

Bajaj Finance FD has been accredited with the highest safety ratings of (FAAA) and (MAAA) by CRISIL and ICRA, respectively, India’s leading credit rating agencies. Therefore, one can easily invest in a Bajaj Finance online Fixed Deposit without worrying about returns, defaults or untimely interest payouts.

About Bajaj Finance Limited

Bajaj Finance Limited, the lending company of the Bajaj Finserv group, is one of the most diversified NBFCs in the Indian market, catering to more than 44 million customers across the country. Headquartered in Pune, the company’s product offering includes Consumer Durable Loans, Lifestyle Finance, Digital Product Finance, Personal Loans, Loan against Property, Small Business Loans, Home loans, Credit Cards, Two-wheeler and Three-wheeler Loans, Commercial lending/SME Loans, Loan against Securities and Rural Finance which includes Gold Loans and Vehicle Refinancing Loans along with Fixed Deposits. Bajaj Finance Limited prides itself on holding the highest credit rating of FAAA/Stable for any NBFC in the country today.

To know more, please visit: www.bajajfinserv.in.