New Delhi: The Adani Group reported its highest-ever trailing twelve-month EBITDA of Rs 90,572 crore, driven by strong performance in its core infrastructure and clean energy businesses, along with contributions from its emerging airports segment, the conglomerate said on Thursday.

The group reported an earnings before interest, taxes, depreciation and amortization (EBITDA) of Rs 90,572 crore for the period from July 2024 to June 2025, up from Rs 85,502 crore pre-tax profit in the trailing twelve months ending June 2024, it said in a statement.

The ports-to-energy group posted highest ever quarterly EBITDA of Rs 23,793 crore in April-June, with core infrastructure businesses of utility, transport, and incubating infra businesses under Adani Enterprises accounting for about 87 per cent of this.

Incubating infra assets such as airports, solar and wind manufacturing, and roads crossed Rs 10,000 crore EBITDA for the first time.

Strong performance across infrastructure and adjacencies offset a dip in the coal trading business of flagship Adani Enterprises Ltd (AEL).

"The Adani Portfolio EBITDA has crossed the Rs 90,000-crore milestone on a trailing twelve-month basis for the first time, with Q1 EBITDA also reaching a record high," the statement said.

This strong performance was led by sustained growth in incubating businesses (notably airports under AEL), along with renewable energy firm Adani Green Energy, electricity transmission arm Adani Energy Solutions, Adani Ports and SEZ, and Ambuja Cements.

"Robust contributions from these businesses more than offset the dip in AEL's existing business. Negative growth in AEL existing business is primarily due to a decrease in trade volume and volatility of index prices in IRM (commodity trading)," it said.

Adani Group said sustained EBITDA expansion provides strong support for the planned annual capital expenditure of Rs 1.5 lakh crore to Rs 1.6 lakh crore.

"On the credit side, the portfolio-level leverage continues to remain one of the lowest globally at 2.6 times net debt to EBITDA, while high liquidity of Rs 53,843 crore is maintained in cash," it said.

As on March 31, 2025, fund flow from operations or cash after tax was at a record Rs 66,527 crore while asset base stood at Rs 6.1 lakh crore with the addition of Rs 1.26 lakh crore in FY25.

Net debt to EBITDA was at 2.6x -- one of the lowest amongst large global infra players.

The conglomerate had "ample liquidity to cover debt servicing for at least the next 21 months," it said, adding that cash balance at Rs 53,843 crore was about 19 per cent of gross debt.

Adani Green Energy, Adani Energy Solutions, Adani Ports & SEZ, and Adani Cements (Ambuja) continue to deliver double-digit EBITDA growth.

Giving operational highlights, the group said AEL's incubated businesses are on a high-growth path -- Adani New Industries Ltd (ANIL) commissioned India's first off-grid 5 MW green hydrogen pilot plant, 7 out of 8 under-construction projects are more than 70 per cent completed (including Ganga Expressway), airport passenger movements up 3 per cent year-on-year to 23.4 million in Q1 and cargo movements up 4 per cent to 0.28 million tonnes.

Adani Green Energy's (AGEL) operational capacity increased 45 per cent year-on-year to 15,816 MW with the addition of 3,763 MW solar, 585 MW wind power plants and 534 MW hybrid power plants.

Adani Energy Solutions (AESL) secured one new transmission project -- WRNES Talegaon line -- taking the under-construction order book to Rs 59,304 crore.

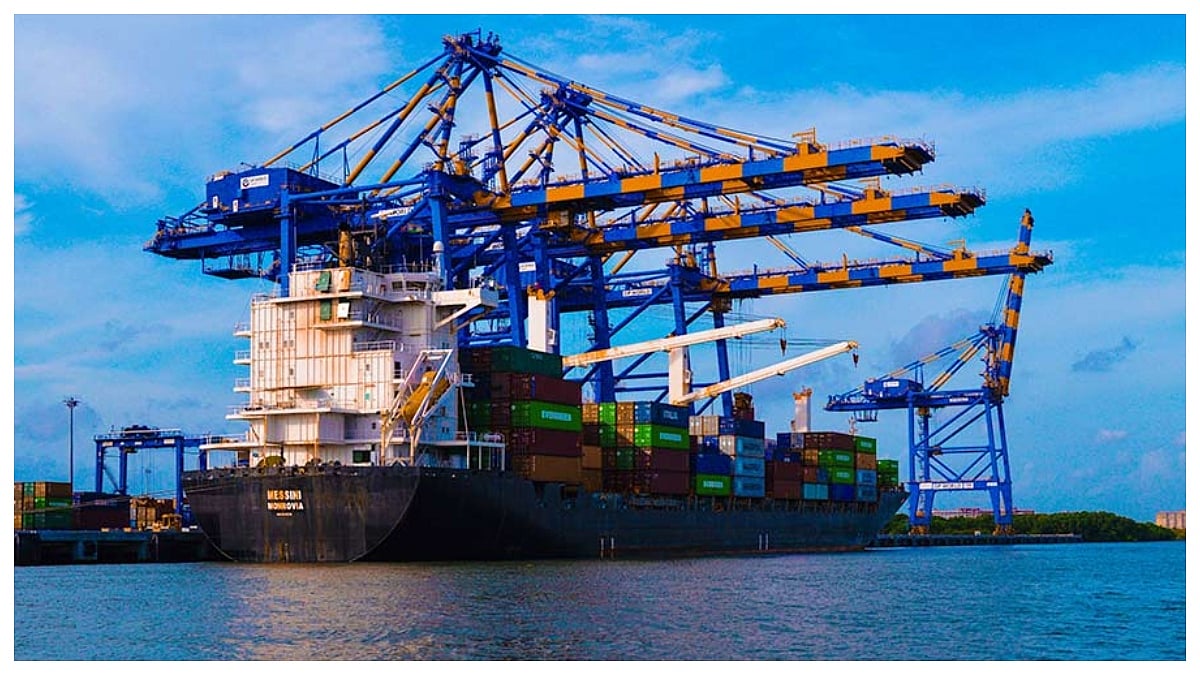

Adani Ports & SEZ's (APSEZ) volume grew 11 per cent to 121 million tonnes in the first quarter.

Adani Cements' (Ambuja) present cement capacity of 105 million tonnes per annum is on track to be raised to 118 million tonnes by March 2026.

(Except for the headline, this article has not been edited by FPJ's editorial team and is auto-generated from an agency feed.)