Mahindra and Mahindra, one of the country's largest conglomerates, saw their shares tumble on Friday, February 21.

An exchange filing, filed later in the day on February 20 appears to have driven this apparent exodus from the company shares.

Funding Raising

This massive slump in the company's prospects comes to pass after the company announced that it intends to raise a cumulative fund of Rs 4,500 crore through a rights issue plan.

In the filing, the company said, " Approval by the Board of Directors of Mahindra & Mahindra Financial Services Limited, a listed subsidiary of the Company ("MMFSL") for fund raising of an amount not exceeding Rs. 3,000 Crores (Rupees Three Thousand Crores) through a Rights Issue of Equity Shares; and Approval by the Board of Directors of Mahindra Lifespace Developers Limited, a listed subsidiary of the Company ("MLDL") for fund raising of an amount not exceeding Rs. 1,500 Crores (Rupees One Thousand Five Hundred Crores) through a Rights Issue of Equity Shares.

MLDL and MMFSL

Here, both the company subsidiaries, Mahindra & Mahindra Financial Services Ltd (MMFSL) and Mahindra Lifespace Developers Ltd (MLDL) have secured the the necessary board approval to raise funds via rights issues.

The standalone and consolidated net worth of Mahindra Lifespace Developers as of 31st March 2024 was Rs. 1,541.60 crore and Rs. 1,789.84 crore respectively.

In addition, when it comes to Mahindra & Mahindra Financial Services Ltd, the standalone and consolidated net worth as on 31st March 2024 was Rs. 18,157 crore and Rs. 19,933 crore respectively.

M&M Shares On Friday

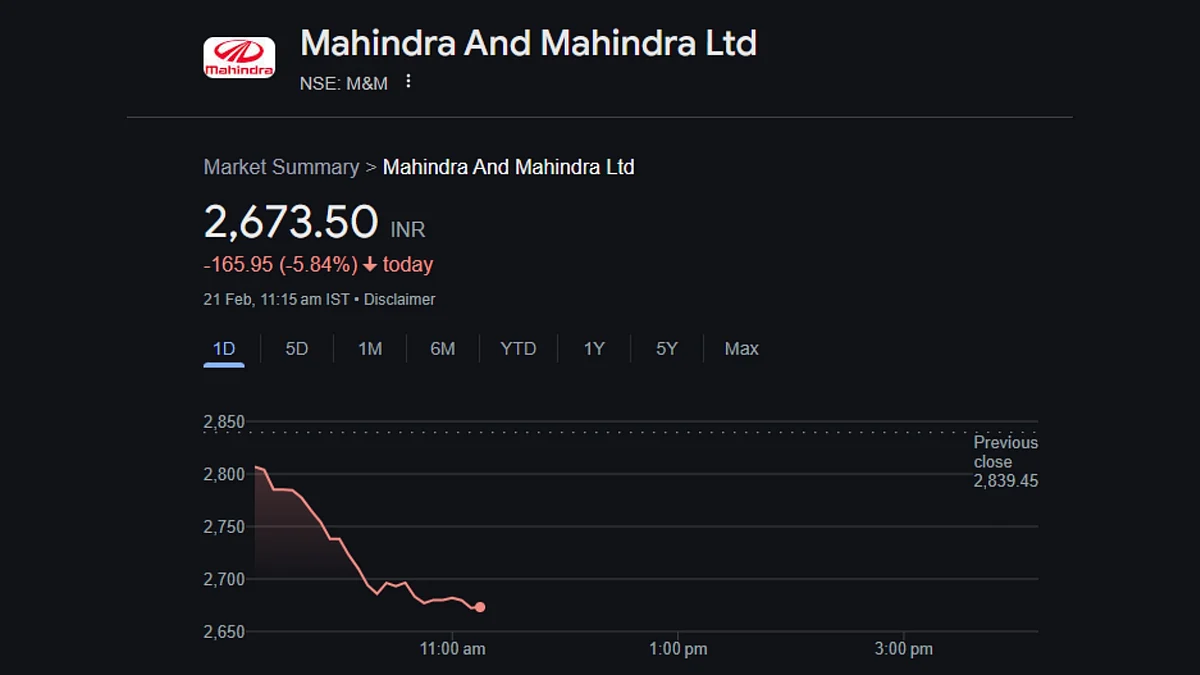

Now, when we look at the impact of this development on the company stock price, it is more than visible.

The company shares started behind it previous closing at Rs 2,815.20. From there, the slope of decline only got steeper, as, at the time of writing the overall decline suffered in the day stood at a major 5.84 per cent or Rs 165.95.

This took the overall value to Rs 2,673.50 per share.