With the Central government proposing to allow composite insurers, one of the views voiced by industry experts is that the four public sector general insurance companies can be merged with the Life Insurance Corporation of India (LIC).

The Centre has proposed to amend various provisions of the Insurance Act, 1938 and the Insurance Regulatory and Development Authority Act. 1999.

The amendments proposed are: allowing composite insurers—one insurer selling life and non-life insurance policies; enabling the insurance regulator to fix the minimum capital required and scrapping the statutory limits; changes in the investment norms; and allowing different kinds of insurers, including captives and others.

"Finance Minister Nirmala Sitharaman had earlier announced that in the case of strategic sectors, there can be four public sector units, and in the case of non-strategic sectors, there will be only one government owned unit," a senior insurance industry official told.

"In line with that announcement, the government can merge its four non-life insurance companies with LIC," the official added.

The employee unions in the four government-owned general insurance companies -- The Oriental Insurance Company Limited, National Insurance Company Limited, The New India Assurance Company Limited and United India Insurance Company Limited -- have been demanding the merger of the companies into one strong entity.

The Central government also owns other insurance companies -- General Insurance Corporation of India (GIC Re), ECGC Ltd and Agriculture Insurance Company of India Ltd.

According to an industry official, GIC Re is the national reinsurer, and ECGC and Agriculture Insurance are specialised business units.

"Perhaps the Agriculture Insurance can be merged with LIC at a later date," the official added.

Employees at the four government non-life companies are also enthusiastic about the idea.

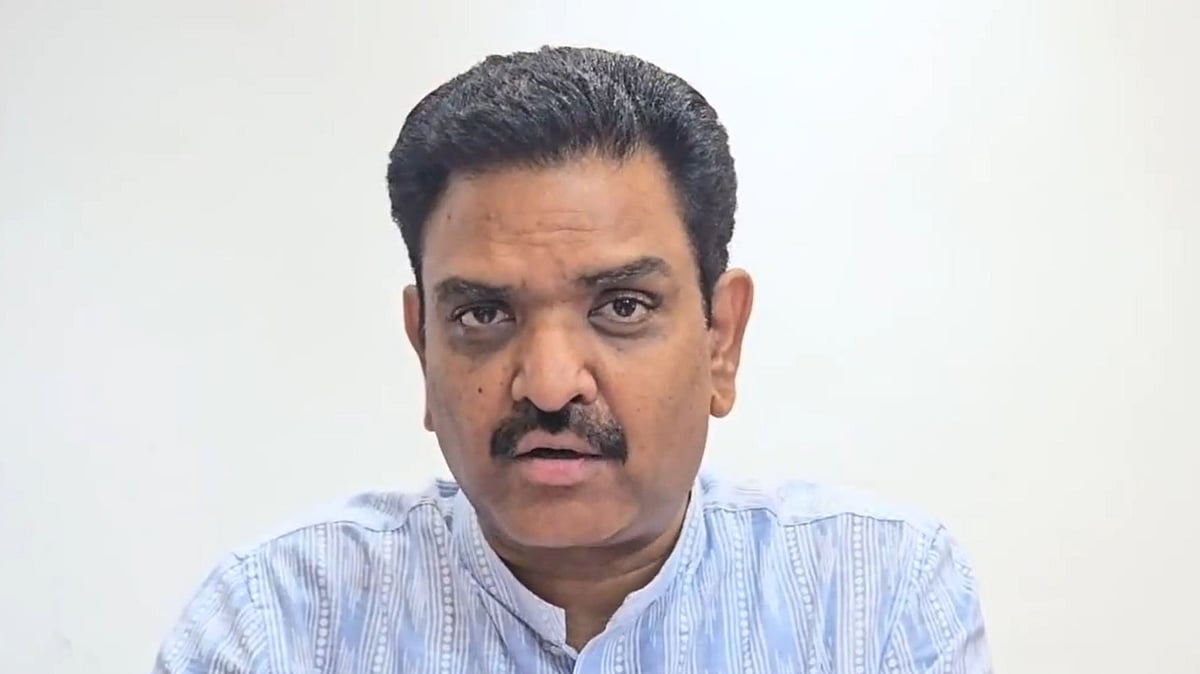

"We welcome any move that would strengthen the public sector insurance companies," Trilok Singh, General Secretary, General Insurance Employees' All India Association (GIEAIA) told.

He said the GIEAIA is studying the legal amendments proposed by the government.

Few years ago, the government had announced that it would merge The Oriental Insurance, National Insurance and United India into one company.

However, it did not proceed further on that idea.