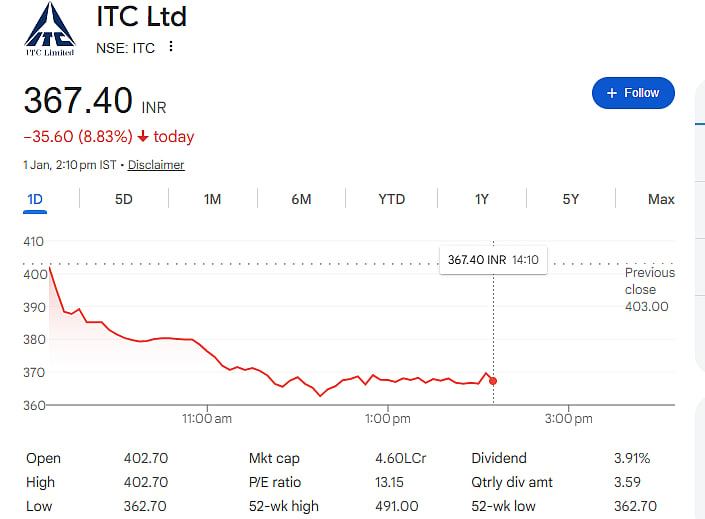

New Delhi: Shares of ITC Limited tumbled nearly 10 percent on the first trading day of 2026, reaching the lowest levels in almost two years. The dramatic fall was driven by the government’s announcement of higher excise duties on cigarettes, tobacco products, and bidis, effective February 1, 2026.

The sharp decline triggered a lower circuit, with ITC shares trading at Rs 365 per share at the time, limiting further losses for the day.

Government Increases Excise and GST

The Ministry of Finance issued an official notification stating that starting February 1, 2026, all tobacco, cigarette, and bidi products will attract a 40 percent GST. This includes the existing 28 percent GST along with excise duty and National Calamity Contingent Duty (NCCD).

While the total tax burden under the new framework is still to be clarified, the change is expected to raise the cost of tobacco products significantly, potentially affecting consumer demand and company sales.

Heavy Block Deal Adds Pressure

Alongside the tax news, ITC also saw a large block deal in the market. Over 4 crore shares of ITC, approximately 0.3 percent of the company’s total shares, were sold in a single transaction.

The shares were traded at an average price of Rs 400 each, translating to a total transaction value of around Rs 1,614.5 crore. The block deal further added to the selling pressure and contributed to the sharp decline in share price.

Market Reaction and Outlook

Investors reacted cautiously to the new tax announcement and large market transactions. The combination of higher taxes on tobacco products and the block deal created strong negative sentiment, pushing the stock to its lower circuit limit.

Analysts suggest that the impact of the new excise and GST structure on ITC’s revenues will be closely watched in upcoming quarters, and investor sentiment may remain volatile until the exact tax implications are clear.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a professional before making any investment decisions.