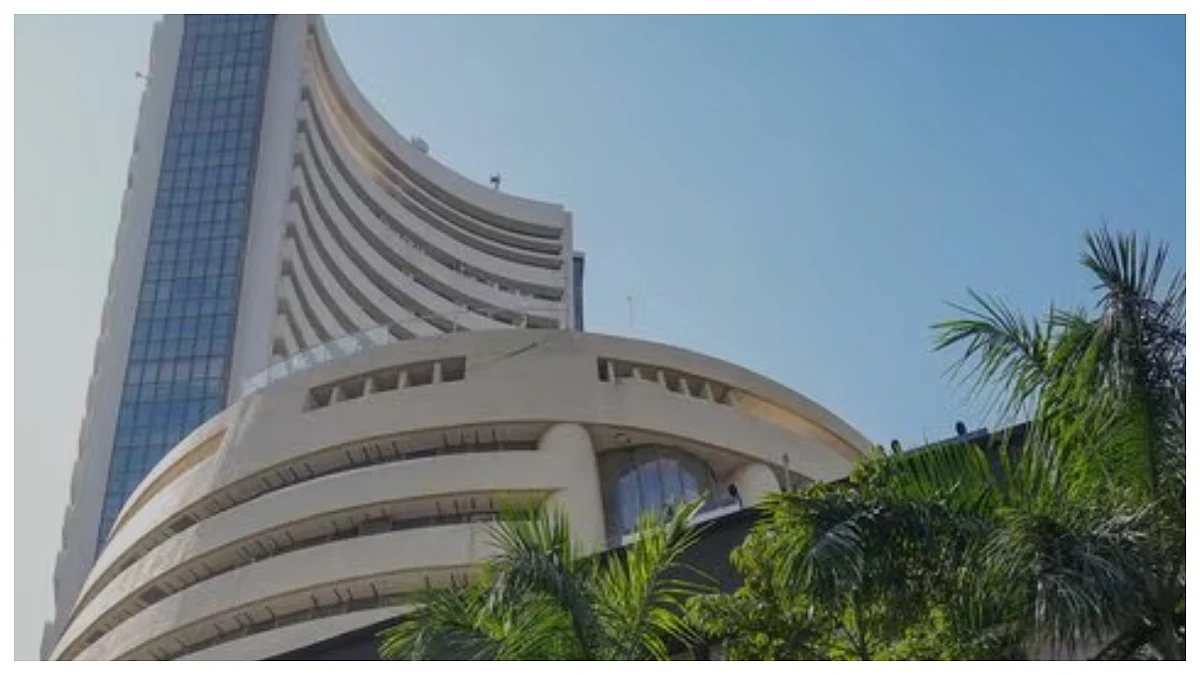

Mumbai : Indian Railway Finance Corp (IRFC) will hit the market on January 6 to raise more than Rs 8,660 crore through tax-free bonds, reports PTI.

The issue of tax-free and secured non-convertible bonds, worth around Rs 8,663 crore, will close on January 20, IRFC said in the prospectus filed with market regulator Sebi.

“Public Issue by Indian Railway Finance Corporation of tax free, secured, redeemable, non-convertible bonds of face value of Rs 1,000 each in the nature of debentures having tax benefits…for an amount of

Rs 1,50,000 lakhs with

an option to retain over-subscription up to Rs 7,16,300 lakh aggregating to Rs 8,66,300 lakhs in the fiscal 2014,” the company said.

The funds raised through this issue will be utilised by IRFC towards financing the acquisition of rolling stock which will be leased to the Ministry of Railways in line with present business activities.

IRFC is a dedicated financing arm of the Ministry of Railways. Its sole objective is to raise money from the market to part finance the plan outlay of Indian Railways.

SBI Capital Markets, A K Capital Services, Axis Capital, ICICI Securities and Kotak Mahindra Capital Company are the lead managers to the issue.

Karvy Computershare is the registrar to the issue. The bonds are proposed to be listed on the National Stock Exchange and BSE.