New Delhi : Indian companies raised a record close to Rs 27,000 crore through initial public offerings in the first half of the current fiscal and an impressive pipeline is already in place for coming months. “Besides, over a dozen firms, including New India Assurance Company, Reliance Nippon Life Asset Management and HDFC Standard Life Insurance Company, have lined up their IPOs to raise funds totalling Rs 35,000 crore in coming months,” Dinesh Rohira, founder and CEO at 5nance.com, said. Adding to the depth of the IPO market, companies from diverse sectors like insurance, healthcare, education, bank, cable TV and shipping have made their way to the IPO space during the period under review.

IPOs raise Rs 27K cr in first half this fiscal

RECENT STORIES

'India Can Produce Next World-Leading AI Major, Ecosystem Already Producing Extraordinary...

FedEx Breaks Ground On ₹2,500 Crore Automated Mega Cargo Hub At Navi Mumbai Airport To Redefine...

FedEx Breaks Ground On ₹2,500 Crore Automated Mega Cargo Hub At Navi Mumbai Airport To Redefine...

Locker Owners In PNB’s Delhi Branch Report Missing Jewellery; Police Start Investigation

Locker Owners In PNB’s Delhi Branch Report Missing Jewellery; Police Start Investigation

E2E Networks Hits Upper Circuit After Nvidia Announces Partnership During India AI Impact Summit

E2E Networks Hits Upper Circuit After Nvidia Announces Partnership During India AI Impact Summit

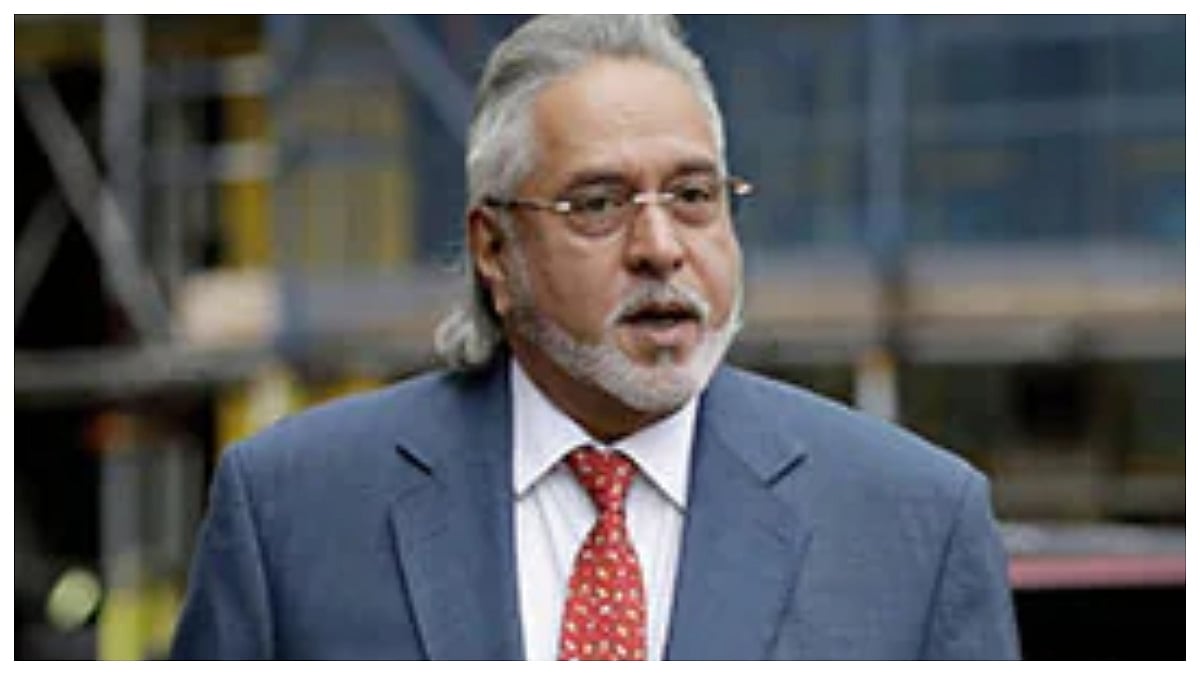

‘Cannot Say When I Will Return’: Vijay Mallya Tells Bombay High Court, Says UK Court Orders Stop...

‘Cannot Say When I Will Return’: Vijay Mallya Tells Bombay High Court, Says UK Court Orders Stop...