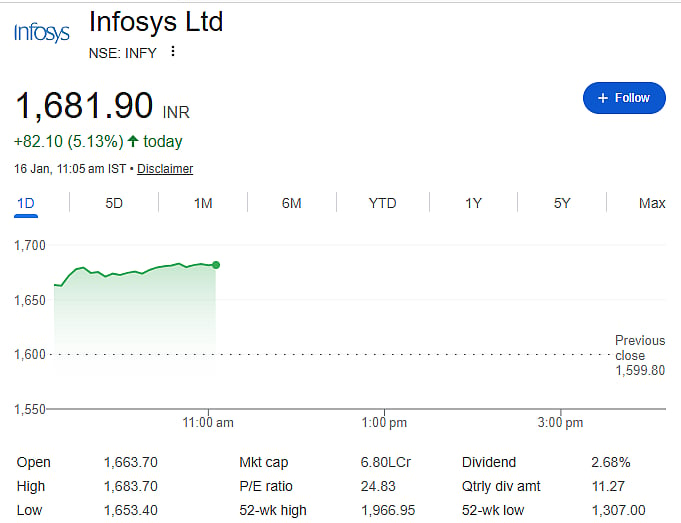

Mumbai: Shares of Infosys surged sharply in early trade on Friday, January 16. The stock jumped as much as 5.1 percent to touch a high of Rs 1,682.10 on the National Stock Exchange.

The rally came after the company announced its Q3 FY26 results on Wednesday evening. Markets were closed on Thursday due to municipal elections in Maharashtra, leading to fresh buying interest when trading resumed.

Profit dips, revenue grows

Infosys reported a 2.2 percent fall in consolidated net profit for the October–December quarter of FY26. Profit stood at Rs 6,654 crore, compared with Rs 6,806 crore in the same quarter last year.

However, revenue performance remained strong. Revenue from operations rose 8.9 percent year-on-year to Rs 45,479 crore, up from Rs 41,764 crore in Q3 FY25. On a quarter-on-quarter basis, profit declined 9.6 percent, while revenue increased 2.2 percent.

AI focus supports business outlook

The company said its strong performance was driven by growing demand for artificial intelligence-led services. Infosys highlighted that clients are increasingly seeing it as a key AI partner, especially through its AI platform Infosys Topaz.

CEO and MD Salil Parekh said the company is focused on training and preparing its employees to succeed in a more AI-driven work environment.

One-time hit from new labour codes

Infosys also reported a one-time exceptional expense of Rs 1,289 crore due to the implementation of new labour codes in India. These new rules bring many older labour laws under one system and increase employee-related costs such as gratuity and leave benefits.

Other IT majors also reported similar impacts. Tata Consultancy Services took a one-time hit of Rs 2,128 crore, while HCLTech made a provision of Rs 719 crore.

Guidance raised and deal wins

Infosys raised its FY26 revenue growth guidance to 3–3.5 percent in constant currency terms, from 2–3 percent earlier. During the quarter, the company signed large deals worth USD 4.8 billion, with more than half being new business.

Infosys also completed its biggest-ever share buyback of Rs 18,000 crore and increased its workforce by 5,043 employees, taking total headcount to 3,37,034.

Disclaimer: This article is for information only and is not investment advice. Stock prices are volatile and past performance may not continue. Readers should consult financial advisors before making investment decisions.