Mumbai: Indian stock markets made a strong comeback on Monday, snapping a five-day losing streak as positive signals from the United States boosted investor confidence. Benchmark indices recovered sharply from their intra-day lows, supported by fresh buying across major sectors.

US-India Trade Talks Lift Sentiment

Market sentiment improved significantly after the US Ambassador to India, Sergio Gor, said that trade talks between the US and India could begin as early as Tuesday. This announcement raised hopes of improved economic cooperation, encouraging investors to return to equities after recent losses.

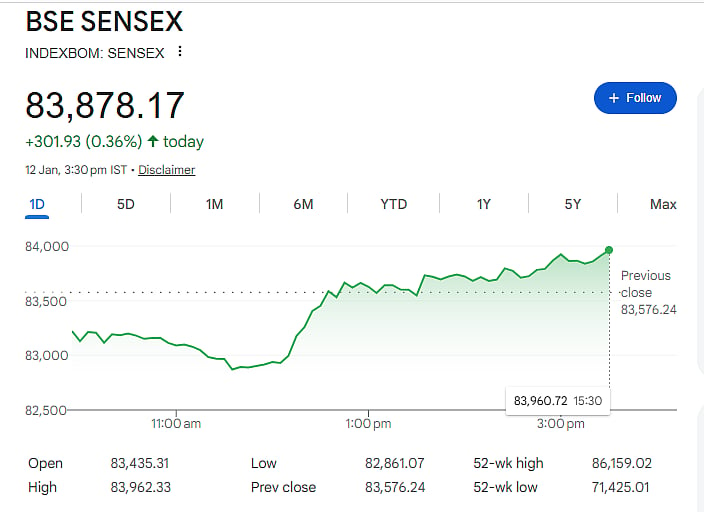

Sensex Recovers Over 1,100 Points

During the trading session, the BSE Sensex recovered nearly 1,100 points from its lowest level of the day. By the closing bell, the 30-share index ended at 83,878, up 302 points or 0.36 per cent.

The National Stock Exchange’s Nifty also staged a strong recovery. After slipping to an intra-day low of 25,473.40, the index climbed to a high of 25,813.15 before closing at 25,790, gaining 107 points or 0.42 per cent.

Technical Support Aids Recovery

Market experts said the recovery was supported by strong technical levels. According to analysts, the 100-day exponential moving average (EMA), placed between 25,540 and 25,600 on the Nifty, acted as a key support zone and helped trigger the rebound.

However, analysts cautioned that immediate resistance lies in the range of 25,800 to 25,870, which could limit further upside in the near term.

Broader Markets Still Weak

Despite the recovery in benchmark indices, broader markets remained under pressure. The Nifty MidCap index slipped marginally by 0.05 per cent, while the Nifty SmallCap index fell by 0.52 per cent, reflecting cautious sentiment among investors.

Focus on Inflation Data and Union Budget

Investors are now awaiting key economic events. Retail inflation data for December, based on the Consumer Price Index (CPI), is expected later in the day and could influence market direction.

Attention is also turning to the Union Budget, scheduled to be presented on Sunday, February 1, 2026.

Metals and Value Buying Support Markets

The commodities sector outperformed, led by gains in metal stocks due to supply constraints. Value buying was also seen in consumer and banking stocks, supported by expectations of better third-quarter earnings and improving demand.