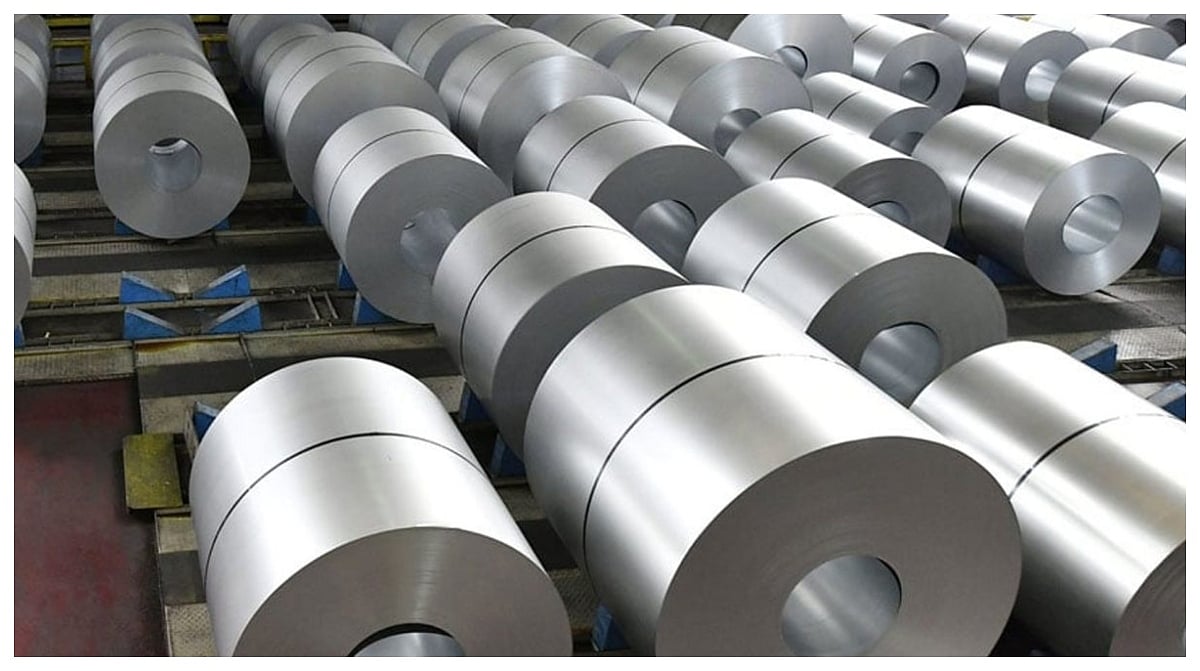

New Delhi: Steel demand growth in India is projected to remain steady at around 8 per cent for FY26, generating an incremental demand of 11-12 million tonnes per annum (mtpa), a report said on Wednesday. However, softer steel prices and incremental supply are expected to pose challenges for domestic steel producers, the report from ratings agency ICRA said. The ratings agency forecasted the "operating environment for domestic steel producers to remain challenging over the coming quarters" also due to stable yet sticky input costs, and a weak external environment.

"Fresh upcoming capacity addition plans of 80-85 million tonne (mt), entailing investments of $45-50 billion over FY2026-2031, could be at a risk of a slowdown," the report noted. ICRA highlighted that domestic steel industry operating margins for FY 2026 are expected to remain flat at 12.5 per cent. The industry leverage (TD/OPBDITA) was projected at 3.4 times in FY26 against its August 2025 estimate of 3.1 times and 3.5 times reported in FY25.

The domestic steel industry has seen a record capacity addition 15 million tonnes (mt) over the past three to four quarters, 5 mt more expected by the end of the fiscal year, said Girishkumar Kadam, Senior Vice-President & Group Head, Corporate Sector Ratings, ICRA. "Domestic Hot Rolled Coil (HRC) prices are currently trading below import parity, reflecting persistent supply-side pressures,” he said. For FY26, domestic HRC prices are expected to average Rs. 50,500 per tonne, ICRA noted.

Due to incremental supply, Domestic HRC prices spiked to Rs. 52,850 per tonne in April 2025, but dipped to Rs. 46,000 per tonne by November 2025 after implementation of the 12 per cent Safeguard Duty (SGD). Further, record-high steel exports from China and weak global consumption are limiting the ability of domestic producers to increase steel prices. Rising trade barriers in the US and EU could divert surplus global steel volumes towards high-growth markets like India, the report warned, urging for the continuation of Safeguard Duty.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.