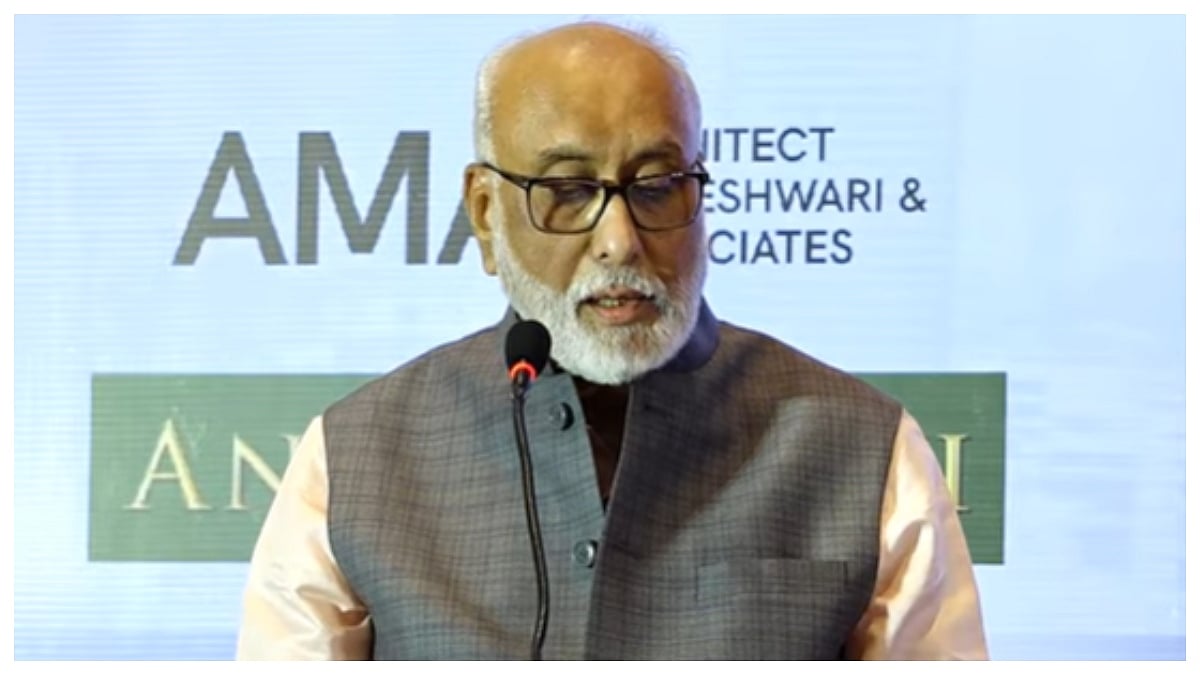

Mumbai: India’s financial system has moved decisively from an era of volatility to one defined by stability, predictability and capital efficiency, former Reserve Bank of India Deputy Governor S.S. Mundra said while delivering the keynote address at the Conclave on the Future of Investing organised by the Maheshwari International Business Foundation (MIBF).

Speaking on 'India’s Financial System and the Road Ahead', Mundra said investors today are no longer betting on uncertainty but on a structurally transformed economy supported by macro discipline, healthier banks and world-class digital public infrastructure.

Macro stability replaces old growth-inflation trade-off

Mundra noted that India was once characterised as a high-growth but high-inflation economy, where macro instability was a constant concern. 'Something fundamental has changed,' he said. India continues to be the fastest-growing large economy, with real GDP growth in the 6.5–7 percent range, while inflation has largely remained within the RBI’s tolerance band, unlike the pre-2013 period when it hovered near 10 percent for nearly a decade.

He highlighted fiscal consolidation, a sharp rise in government capital expenditure over the past decade, and foreign exchange reserves of over $600 billion as key cushions enhancing investor confidence.

Banking and credit system sees structural revival

Mundra said India’s credit system has moved from repair to revival and is now entering a phase of sustained growth. Gross non-performing assets (NPAs) have declined sharply from around 11 percent in 2018 to nearly 3 percent, while capital adequacy remains strong and credit growth has returned to healthy levels.

He pointed to a major structural shift-from asset-backed and relationship-driven lending to cash-flow-based, data-driven underwriting, supported by fintechs, NBFCs and digital credit models that have expanded access to previously unbankable segments.

Digital public infrastructure transforms investing

Calling India’s digital public infrastructure a global benchmark, Mundra said platforms such as UPI, Aadhaar, GST and Account Aggregators have reduced transaction costs, improved transparency and widened the investable universe. UPI alone processes over 10 billion transactions monthly, with values exceeding Rs 15 lakh crore.

'This is not a technology story-it is a capital efficiency story,' he said.

Capital allocation, patience key to returns

Mundra said India has moved from capital scarcity to capital selectivity, with opportunities emerging across manufacturing, supply-chain diversification and the energy transition. Rising domestic flows-monthly SIP inflows of about Rs 20,000 crore-are now stabilising markets amid global volatility.

India, he concluded, rewards patient, aligned and well-structured capital.