India has decided to withdraw the transshipment facility that allowed Bangladesh to use Indian customs stations for shipping goods to third countries. This decision, announced in a circular by the Central Board of Indirect Taxes and Customs (CBIC) on April 8, 2025, marks a significant change in trade relations between the two nations.

The transshipment facility, which was initially granted in June 2020, permitted Bangladesh to transport goods through Indian Land Customs Stations (LCSs) to ports and airports for onward shipping to Bhutan, Nepal, and Myanmar. This move aimed to streamline trade for Bangladesh, which is landlocked with some neighboring countries.

The Role of Bangladesh’s Chinese Interests

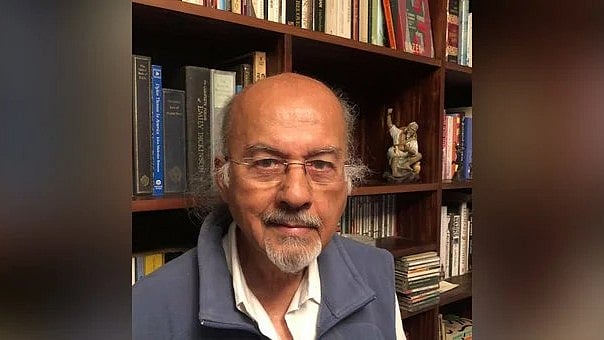

The decision follows recent remarks made by Bangladesh's Chief Adviser, Professor Muhammad Yunus, during his visit to China in March 2025. Yunus referred to Bangladesh’s strategic role in providing ocean access to the landlocked Northeast region of India. His comments were seen as an attempt to boost China's economic involvement in the region, specifically near India’s crucial "Chicken Neck" corridor.

In his statement, Yunus suggested that Northeast India could benefit from Chinese investment, which could lead to greater economic integration between the region and China. This idea raised concerns in New Delhi, especially considering India’s longstanding strategic interests in the area.

Disruptions to Trade

With the withdrawal of the transshipment facility, Bangladesh’s trade with countries like Bhutan, Nepal, and Myanmar could face disruptions. These countries rely on Indian infrastructure for their trade routes, and without the transshipment system, exports may face delays, higher costs, and logistical challenges.

Impact on Landlocked Countries

The move could also affect Nepal and Bhutan, both of which are landlocked and rely on smooth transit for trade. The WTO’s provisions on the freedom of transit could be a point of contention, as the decision may limit Nepal and Bhutan’s access to Bangladeshi goods, violating trade agreements.

India-Bangladesh Relations

The tensions between India and Bangladesh are growing, with the transshipment decision reflecting deeper concerns over the region’s geopolitics. Assam’s Chief Minister, Himanta Biswa Sarma, criticized Yunus’ statement, calling it offensive and pointing out the vulnerability of India’s strategic Chicken Neck corridor. Sarma has called for alternative transportation routes to secure better connectivity for Northeast India.

India’s WTO Commitments

The cancellation of the transshipment facility also raises questions about India’s commitments under the World Trade Organization’s (WTO) rules. These provisions mandate that landlocked countries should have unrestricted access to trade routes through neighboring countries. India’s move might be seen as violating these obligations, particularly in relation to Bhutan and Nepal.