HDFC Bank's shares were jumping high on NSE (National Stock Exchange) after private lender announced their quarterly earnings for december quarter which revealed that lender's net profit for the quarter under review spurt 2.2 per cent YoY.

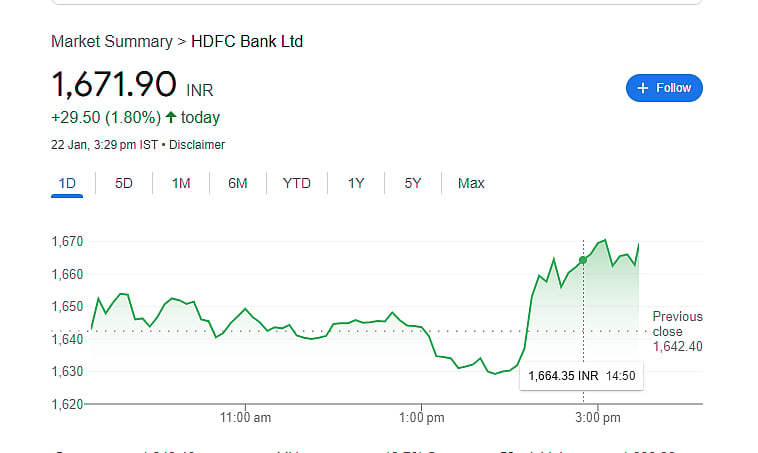

The share of HDFC bank surged up to touch day high level of Rs 1,671.90 per share on the exchanges after hitting the opening bell with surge at Rs 1,642.40 per share.

HDFC Bank shares were trading at Rs 1,671.90 per share with surge of 1.80 per cent amounting to a Rs 29.50 per share on the Indian exchanges, in last trading session.

The biggest private bank in India, HDFC Bank, said in an exchange filing on Wednesday that its standalone net profit for the third quarter of the current fiscal year increased by 2.2 per cent to Rs 16,735.5 crore. The post-tax profit for the previous year was Rs 16,372.54 crore.

Asset quality and Interest income

Compared to the corresponding period of the last fiscal year, when net interest income (NII) was Rs 28,871.3 crore, it increased 7.6 per cent to Rs 30,655 crore in the current quarter.

Gross non-performing assets (GNPAs) for the quarter increased by 1.42 per cent, down from 1.36 per cent in Q2 FY25 and 1.28 per cent in Q3 FY24, indicating a decline in the bank's asset quality.

Adances and loan growth

Compared to Rs 24.8 lakh crore in the same quarter last year, advances growth was modest at 1.3 per cent YoY to Rs 25.18 lakh crore. In comparison to Rs 22.12 lakh crore, deposits increased steadily at a rate of 15.8 per cent YoY to Rs 25.6 lakh crore. At this point, the loan-to-deposit ratio is comfortably below 100.