The Indian stock market continued its sustained upward journey rising by 2.1percent during the week and scaled new peak with benchmark indices – Sensex and Nifty topping the 61,000 and 18,000-mark respectively, as market momentum continues to be robust with strong participation from retail investors.

Strong economic indicators boost sentiments

Aided by strong economic indicators, sentiments remained upbeat as inflation in September eased to 4.4 percent while industrial activity continued with its recovery momentum.

The RBI’s monetary policy decision of status quo with accommodative stance and dovish commentary also provided boost to market sentiments.

Buying was across the board with major contribution to benchmark indices coming from auto, banking, FMCG and metal sectors, while IT index witnessed profit booking during the week due to weak result by TCS. However, sentiments about IT sector improved close to the week end on the back of strong results from Infosys and Wipro.

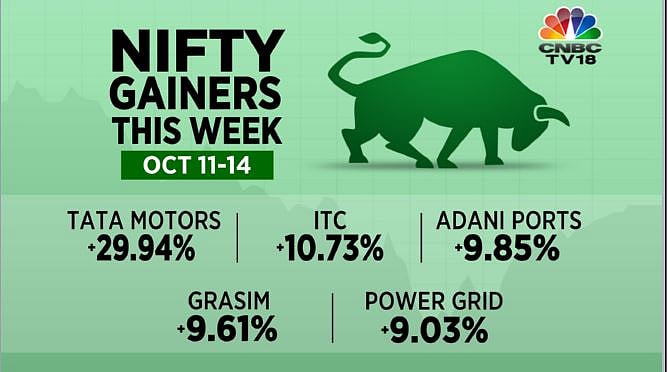

Auto index was up by 6.3 percent during the week led by Tata Motors which witnessed massive rally of 28 percent on news of TPG Capital funding its EV venture. Strong buying was also seen in leading banks amid expectations of good start to the earnings session next week. Broader indices participated in rally with mid cap index up by 3.3 percent during the week.

What to watch out for next week

On global news, the US FOMC minutes indicate that tapering is on course possibly starting mid-November raising concerns for market participants about global liquidity tightening. Next week, investors should keep a close eye on global data such as the US industrial production, China Q3FY21 GDP data and UK/EU inflation rate.

On a weekly basis, the benchmark index gave a nearly 5 percent gain while Banknifty made a record high of 39375.05 and closed at 39,340.90 with a gain of 705.10 or up by 1.82 percent.

On the sectoral front, the Auto sector took the lead by gaining around 7 percent followed by Metal and media index gaining nearly 6 percent and 5 percent while the banking sector rising with 4 percent gains.

All the sectoral indices ended up on a positive note while IT saw the least marginal gain of 0.14 percent. Stocks like Tata Motors secured the highest gains on the dashboard with extraordinary gains of above 32 percent while Vedanta gained 13.8 percent followed by ITC and Wipro was up by 10 percent each.

On the weaker side, Maruti and Asian Paints saw marginal gains of 0.08 percent and 0.25 percent respectively.

On the technical front, the stochastic indicator has given a positive crossover for both the indices which indicates a further strong movement upside. The Parabolic SAR has formed below the candles which indicate a northward movement. Also, both the indices have settled above the Super Trend indicator which suggests bullishness. For the coming week, the Nifty index is looking bullish for the upside potential of 18,500/1,8600 levels while on the downside, the support comes around 18,000 levels.

Top Gainers

Tata Motors up by 30 percent during the week as investors sentiments got a fillip from the news of TPG Capital funding an EV venture of Tata Motors.

Nifty winners | CNBCTV18

ITC Ltd witnessed 11 percent rally during the week amid speculation over tie-up with Amazon. As per media reports, e-commerce giant Amazon is planning to invest in ITC e-Choupal. Farmers use e-Choupal to order seeds, fertilizers and other products such as consumer goods from ITC or its partners at prices lower than those available from village traders.

Grasim Industries stock was remained under investors’ buying radar as the company has executed a supplemental share subscription agreement with Renew Green Energy Solutions and has signed a Power Purchase Agreement with Renew Surya Uday Private Limited.

Power Grid witnessed strong rally during the week as sentiments got a boost after the state-owned company’s board approved an investment of Rs 14 crore for an electric vehicle charging station in Navi Mumbai and for the setting up of an arm for telecom and digital technology businesses.

Top Losers

TCS witnessed a sharp sell-off during week after the company posted weaker than estimated result for Q2FY22.

Nifty Losers | CNBCTV18

HCL Tech recorded fall of 5 percent amid sector specific profit booking post weak result of TCS. Investors were also cautious ahead of Q2FY22 numbers.

Coal India witnessed moderate profit booking during week after the recent run.

(Satish Kumar is Research Analyst at Choice Broking, Mumbai-based full-service stockbroking firm)