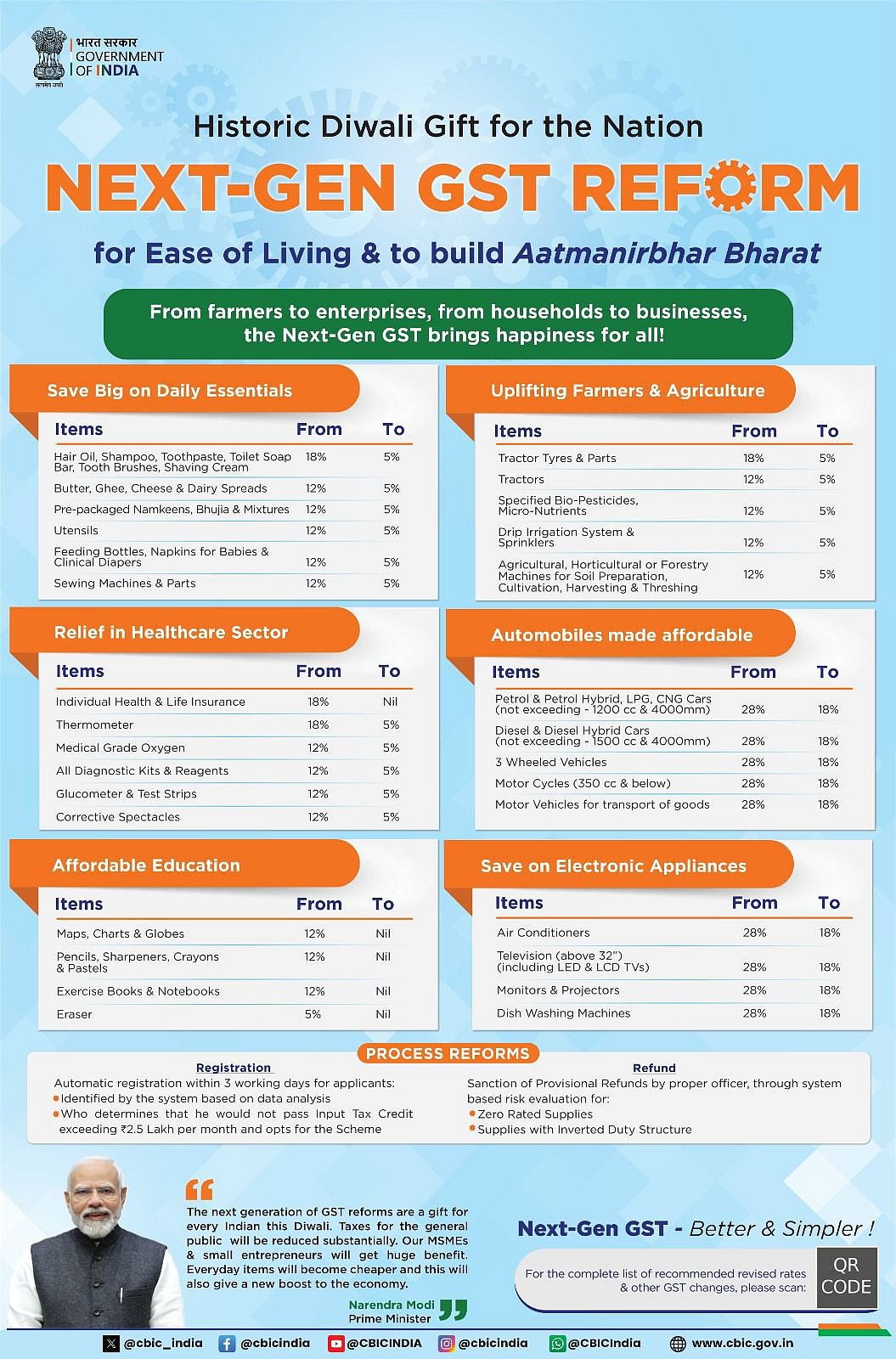

New Delhi: The central government has announced major GST reforms to provide relief to the public. Prime Minister Narendra Modi has called it a Diwali gift that will make everyday items cheaper and life easier. However, some luxury and harmful products will become costlier.

Prime Minister Narendra Modi said, 'These reforms are a Diwali gift for every Indian. It will reduce the tax burden, make daily items cheaper, and help small businesses. It will also strengthen the economy.'

What Will Become Cheaper?

Under the new GST reforms, tax has been reduced on many items, making them more affordable:

Daily Use Items

- Hair oil, shampoo, toothpaste, soap, toilet soap, toothbrushes, shaving cream

- Butter, ghee, cheese

- Packaged namkeen, bhujia, mixed snacks

- Baby feeding bottles, napkins, and clinical diapers

(GST reduced from 18 percent/12 percent to 5 percent)

Agriculture-Related Goods

- Tractors, tractor tyres and parts

- Biopesticides, micronutrients

- Drip irrigation systems, sprinklers

- Soil preparation and harvesting machines

(GST reduced from 18 percent/12 percent to 5 percent)

Healthcare

- GST removed from personal health and life insurance

- Thermometers, medical-grade oxygen, glucometers, test strips

- Diagnostic kits, reagents, and corrective glasses

(Now at 5 percent or zero GST)

Vehicles

- Petrol, hybrid petrol, LPG, and CNG cars (within limits)

- Diesel and diesel hybrid cars (within limits)

- Three-wheelers, motorcycles up to 350 cc, goods transport vehicles

(GST reduced from 28 percent to 18 percent)

Education Materials

- Maps, charts, globes

- Pencils, sharpeners, crayons, pastels

- Exercise books, notebooks, erasers (GST removed)

Electronics

- Air conditioners, TVs (including LED and LCD over 32 inches)

- Monitors, projectors, dishwashers (GST reduced from 28 percent to 18 percent)

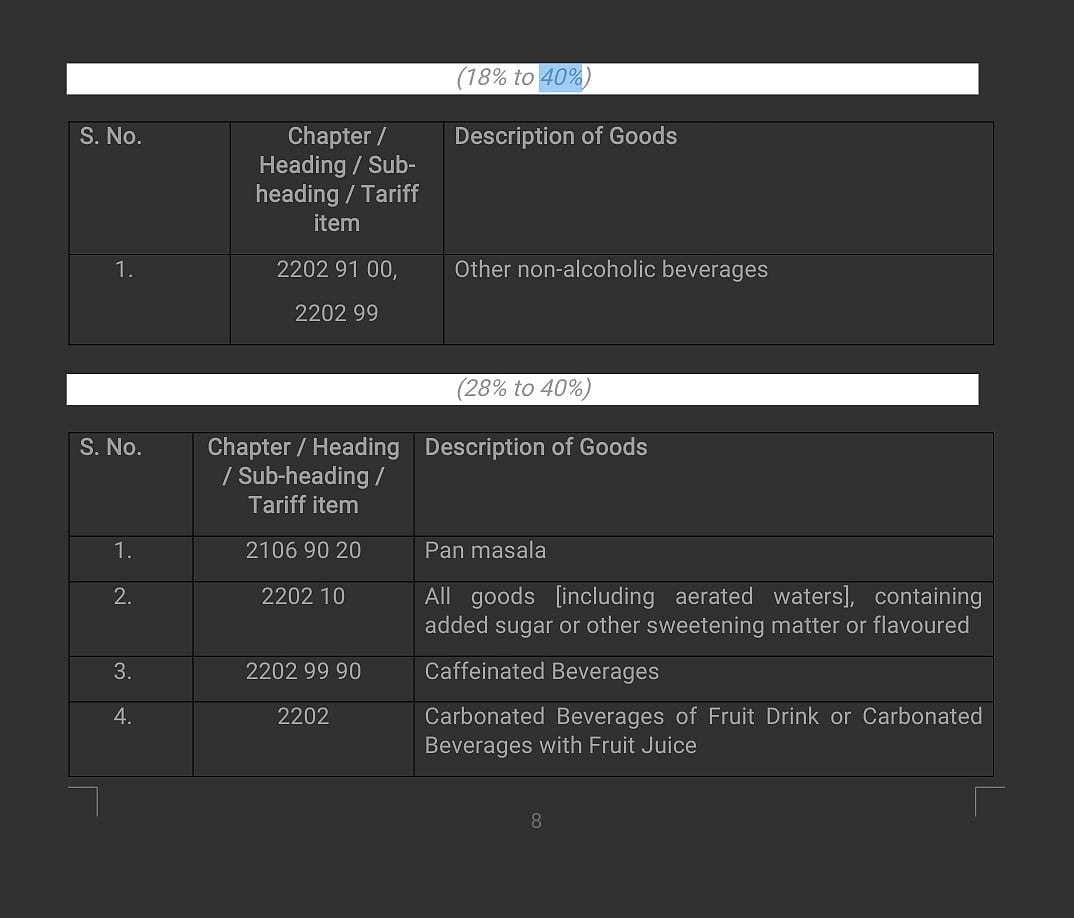

What Will Become Costlier?

- Luxury and Harmful Products

- Pan masala, tobacco products (zarda, gutkha, cigarettes, unprocessed tobacco)

These items will continue to attract 28 percent GST plus compensation cess until states repay their loans. Later, they will attract 40 percent GST without extra duties.

Big Cars

Petrol cars above 1200 cc and diesel cars above 1500 cc (New GST rate 40 percent)

Extra Relief for Businesses

The government has made GST registration easier for businesses. Now, registration will be completed within 3 days, which will help small businesses and MSMEs (Micro, Small, and Medium Enterprises).