ESAF Small Finance Bank is looking to refile its initial public offering (IPO) with a lower issue size, which will hit the market in FY24, a top official said on Thursday.

The lender had in October filed for a nearly Rs 1,000 crore IPO which was to include Rs 800 crore of primary issuance and also a Rs 200 crore offer-for-sale from existing investors. However, the same has lapsed as it was to be done within a year.

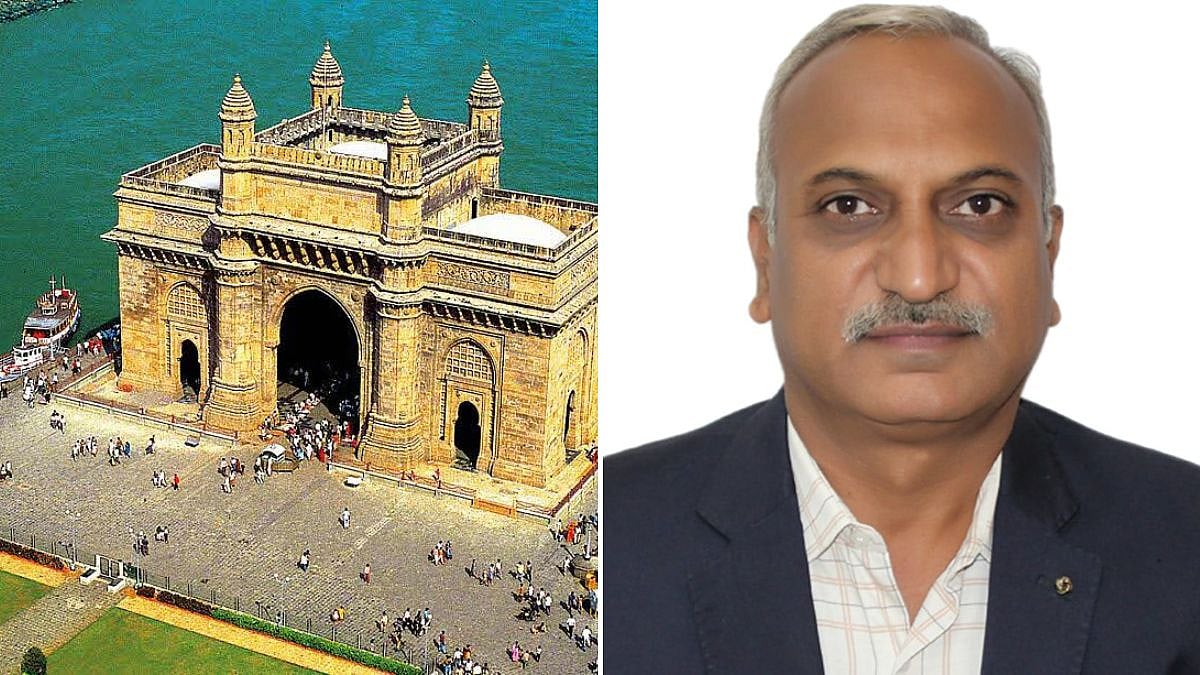

Its managing director and chief executive K Paul Thomas told reporters that the company is in the process of refiling the draft prospectus with the capital markets regulator Sebi and will be doing the same by December.

It expects Sebi nod in 2-3 months time and will be in a position to launch the issue in FY24, he said.

Thomas, however, said that the revised issue size will be smaller than what was originally planned but declined to share the size.

The overall capital adequacy of the lender is at over 20 per cent, but the business requires capital, he said, adding that market volatilities was the prime reason why the issue could not happen.