Doms Industries shares slid down almost 6 per cent on NSE (National Stock Exchange), after doms industries' italian parent company 'FILA' announced a sale of up to 4.57 per cent stake in the Indian stationary maker unit.

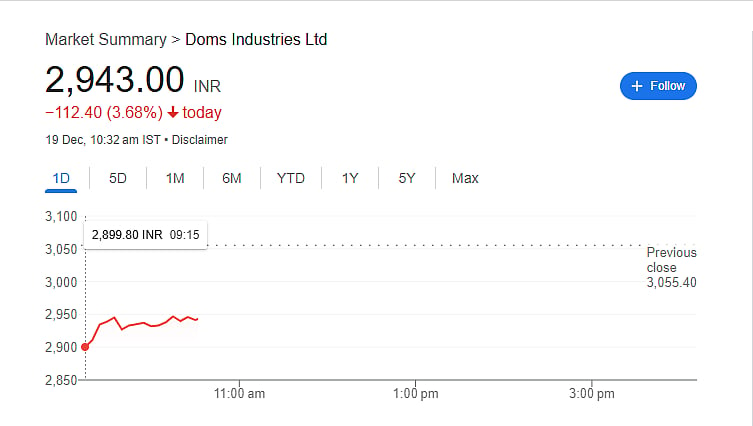

The shares of Doms Industries went on to touch the day low level of Rs 2,879.00 per share on the Indian bourses, after hitting the opening bell at Rs 2,900.00 per share on the exchanges.

Doms industries shares were trading around Rs 2,943.00 per share on the NSE (National Stock Exchange), with a decline of 3.68 per cent amounting to a Rs 112.40 per share on the bourses.

Stake sale through accelerated book building

The stake sale is being conducted through an accelerated book building (ABB) process starting on Wednesday, offering up to 2,773,407 ordinary shares in the Indian firm, FILA said.

'The placement is aimed at increasing the free float of the company, improving the liquidity of its shares, and attracting new investors to the share capital,' FILA said in a statement.

Debut on dalal street

In December of last year, shares of pencil manufacturer DOMS Industries Ltd. made their spectacular stock market debut, listing at a massive premium of more than 77 per cent over the issue price of Rs 790.

Both the BSE and NSE listed the stock at Rs 1,400, which represents a 77.21 per cent increase from the issue price.

The overwhelming participation of institutional buyers, DOMS Industries' first share sale received 93.40 times subscription on the last day of bidding.

Following the completion of the placement, which includes a 90-day lock-up period for the buyer, the Italian company, whose Indian unit, DOMS Industries, was listed on bourses last December, is expected to reduce its stake to at least 26.01 per cent of DOMS' share capital, according to Reuters.