Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and mergers and acquisitions (M&A) activity for the Battery Storage, Smart Grid, and Energy Efficiency sectors for the first quarter (Q1) of 2022.

In Q1 2022, $1.6 billion was raised in VC funding by battery storage, smart grid, and energy efficiency companies, a 21 percent increase compared to the $1.3 billion raised in Q1 2021.

Battery storage

Total corporate funding (including VC, Debt, and Public Market Financing) in Battery Energy Storage came to $12.9 billion in 26 deals compared to $4 billion in 27 deals in Q4 2021. Funding was up significantly year-over-year (YoY) compared to $4.7 billion in 18 deals in Q1 2021.

Venture capital (VC) funding (including private equity and corporate venture capital) raised by Battery Storage companies in Q1 2022 came to $1.1 billion in 21 deals a 15% increase compared to $1 billion in 14 deals in Q1 2021. Quarter-over-quarter (QoQ) funding was 28% lower compared to $1.6 billion in 21 deals in Q4 2021.

The top five VC funded Battery Storage companies this quarter were: Hydrostor, which raised $250 million from Goldman Sachs Asset Management; Sunfire raised $215 million from Copenhagen Infrastructure Energy Transition Fund I and Blue Earth Capital; Factorial Energy raised $200 million from Mercedes-Benz (DAI) and Stellantis; Viridi Parente raised $95 million from Thomas Golisano, Ashtead Group/Sunbelt Rentals, and National Grid Partners; and Our Next Energy (ONE) raised $65 million from BMW i Ventures, Coatue Management, Breakthrough Energy Ventures, Assembly Ventures, Flex, and Volta Energy Technologies.

Seventy-six VC investors participated in Battery Storage funding this quarter.

In Q1 2022, announced debt and public market financing for Battery Storage technologies were higher, with $11.7 billion in five deals compared to $2.4 billion in six deals in Q4 2021 and $3.7 billion in four deals in Q1 2021.

There were five M&A transactions involving Battery Storage companies in Q1 2022. In Q4 2021, there were nine M&A transactions. YoY, there were four Battery Storage M&A transactions in Q1 2021.

There were 13 Battery Storage project M&A transactions in Q1 2022.

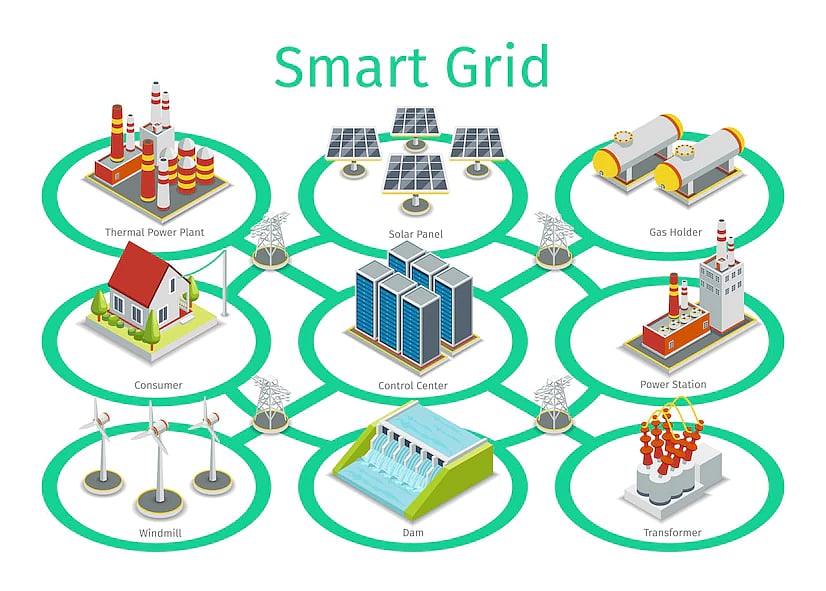

Smart Grid

Total corporate funding in Smart Grid was 7 percent higher, with $316 million in 14 deals compared to $295 million in 11 deals in Q1 2021.

VC funding for Smart Grid companies increased 9% in Q1 2022 with $312 million in 12 deals compared to $287 million in 10 deals in Q1 2021.

The top five VC funded Smart Grid companies included: Tibber, which secured $100 million from Summa Equity; SPAN raised $90 million from Fifth Wall Climate Tech, Wellington Management, Angeleno Group, FootPrintCoalition, Obsidian Investment Partners, A/O PropTech; Utilidata raised $27 million from Moore Strategic Ventures, Microsoft Climate Innovation Fund, NVIDIA, Keyframe Capital, Braemar Energy Ventures, MUUS Asset Management; David Energy raised $21 million from Keyframe Capital, Union Square Ventures, Equal Ventures, Box Group, MCJ Collective, Toba Capital, Turntide, James Dice; and JET Charge raised $18 million from RACV, Clean Energy Innovation Fund, Claremont Capital, Greg Roebuck, Simon Monk.

Thirty-nine investors participated in Smart Grid VC funding rounds this quarter.

Four million dollars was raised in two debt and public market financing deals in Q1 2022. There was one $484 million public market financing deal in Q4 2021. Year-over-year, $8 million was raised in one public market financing deal in Q1 2021.

In Q1 2022, there were three M&A transactions compared to two in Q4 2021 and six transactions in Q1 2021.

Efficiency

Total corporate funding in Energy Efficiency came to $109 million in four deals compared to $118 million in the same number of deals in Q4 2021. In a YoY comparison, $5 million was raised in one deal in Q1 2021.

VC funding raised by Energy Efficiency companies in Q1 2022 came to $109 million in four deals compared to $118 million in four deals in Q4 2021. In a YoY comparison, $5 million was raised in one deal in Q1 2021.

Thirteen investors participated in VC funding this quarter.

There were no Efficiency M&A transactions in Q1 2022. There was one M&A transaction in Q4 2021. In Q1 2021, there was one M&A transaction for $300 million.

India deals in Q1 2022

VC Funding

Husk Power Systems, a distributed utility company that provides minigrids to rural communities and businesses entirely from renewable energy sources, secured Rs 310 million ($4.2 million) in debt financing from the Indian Renewable Energy Development Agency (IREDA). The company will use the loan to finance 140 microgrids in Uttar Pradesh and Bihar.

Exide Industries, a manufacturer of lead-acid batteries, invested Rs 200 million ($2.68 million) in its lithium battery joint venture, Exide Leclanche Energy, with Swiss energy storage solutions company Leclanche.

Taqanal Energy, developer of the cloud-connected smart modular battery energy storage, raised Rs 9.5 crores ($1.3 million) in a pre-series round from JITO Angel Network along with KITVEN, Lets Venture, and Wellingdon Advisors.

Offgrid Energy, a developer of rechargeable zinc-carbon batteries, raised undisclosed funds from energy solutions giant Shell, venture capitalists Ankur Capital, and APVC to take its flagship product, rechargeable zinc-based battery ZincGel, to the market.

M&A

Reliance New Energy, a wholly-owned subsidiary of Reliance Industries, substantially acquired all assets of Lithium Werks, a provider of cobalt-free Lithium Iron Phosphate batteries, for $61 million, including funding for future growth.