After a gap-up opening, the benchmark index sustained higher for the day. The Nifty50 index has settled at 17780 levels with a gain of 1.2 percent while Banknifty inched up by 2.1 percent to close at 39,330.50 levels.benchmark Sensex soared 695 points or 1.18 percent on Wednesday to close at 59,558. The NSE Nifty 50 added 203 points or 1.16 percent to settle at 17,780. Bank Nifty was up 825 points

All the sectoral indices settled in positive territory led by PSUBANK, adding 3.5 percent gains in the index followed by the Financials and Media sector. The volatility index (VIX) declined by 6.5 percent in a day.

BSE Midcap and Smallcap index have also contributed more than 1 percent gains. Stocks like, INDUSINDBANK, BAJAJ FINSERV, HCLTECH, BAJFINANCE were the top gainers while TECHM, BRITANNIA, ULTRACEMENT were the prime laggards for the day.

Among top gainers were ITC, Power Grid, Kotak Mahindra Bank, Bajaj Finance, Axis Bank, Bajaj Finserv. Among losers at the closing bell were Tech Mahindra, Tata Steel, Ultratech Cement, Sun Pharma, Larsen & Toubro and India VIX.

Deepak Jasani, Head-Retail, HDFC Securities said, "FPI participation has fallen over the past two sessions which is reflected in the lower volumes. Advance decline ratio however is sharply positive suggesting broad participation in the midst of a halt in large FPI selling. After three consecutive days of gains, Nifty could consolidate/correct a bit over the next few days even as FPIs form their view on Indian markets post the Budget. 17,812-17,879 could be the resistance for the Nifty over the near term while 176,17 is the support."

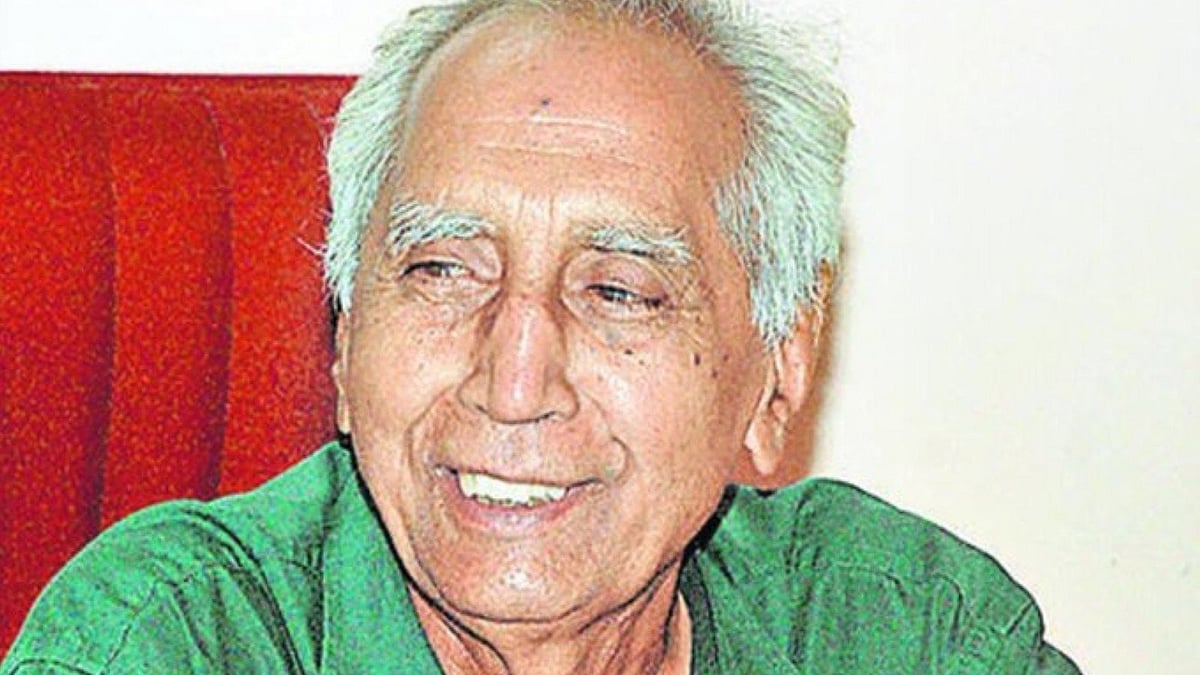

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd, said, "There were no negative factors to spoil the upward journey for the third straight session. Buying continued on the back of strong global cues and the budget also proposed measures that are growth oriented which kept investors in good stead right through the session.

"On intraday charts, the Nifty has been consistently forming higher high and higher low, which supports further uptrend. While the texture of the market is bullish, due to temporary overbought situations the market may consolidate within the range of 17,650 to 17,950. For the day traders, the support has shifted to 17,700 from 17,500, and above the same the Nifty could rally up to 17,950. Any further upside would lift the index till 18,000 and below 17,700 a quick intraday correction up to 17650-17600 is not ruled out."

Osho Krishan, Sr. Analyst - Technical & Derivative Research, Angel One said, "On technical parameters, Nifty50 witnessed a gap-up opening but remained subdued at higher levels throughout the day. However, the index has breached the sturdy resistance of 17,650 in a decisive manner with decent gains of 1.16 percent, suggesting bulls are regaining their strength. Positive sentiment was seen throughout, which assisted the index to hover above all its major exponential moving averages on the daily chart. Even most oscillators have turned bullish, indicating further upside in the coming period. On an immediate basis, 17,300-17,500 is likely to provide some support, while on the higher end, it would be a daunting task to overcome the psychological barrier of 18,000."

Sachin Gupta, AVP-Research, Choice Broking said, "Technically, the Nifty index has been rising consecutively from the last three trading sessions and in the recent candle, it has managed to close above 61.8 percent Retracement Levels of its prior moves, which suggest a bullish presence in the index. A momentum indicator RSI & Stochastic turned up with positive crossover that supports the bullish strength in the index. On a four hourly chart, the index has closed above 200-SMA, which indicates a positive trend for the coming term. At present, the Index has support at 17600 levels while resistance comes at 18000 levels, crossing above the same can show 18,300-18,500 levels. On the other hand, Bank Nifty has support at 38,700 levels while resistance at 40,000 levels."

Mohit Nigam, Head - PMS, Hem Securities, "Benchmark indices made a gap up opening and showed directional bias for the third consecutive day on the back of strong cues received from Wall Street. Investor sentiments got a boost after the statements of Chief Economic Advisor V Anantha Nageswaran that India will become a $5 trillion economy by 2026 on the back of 8-9 percent sustained growth. Later in the day the commerce ministry released the export data which showed a growth of 23.69 percent due to healthy performance shown by petroleum, engineering and gems and jewellery."