After the three day Monetary Policy Meeting that transpired between October 7 and October 9, the RBI Governor announced the central bank's policy before the next MPC meeting in the first week of December.

Responsible Lending

The RBI retained its interest rate or Repo rate at 6.50 per cent for the 10th straight time.

Apart from this marquee announcement, the RBI also made crucial announcements to aid the common consumers in the banking system.

One of the announcements was regarding 'responsible lending conduct' by the system. This announcement touched upon the levy of foreclosure charges and pre-payment penalties on loans.

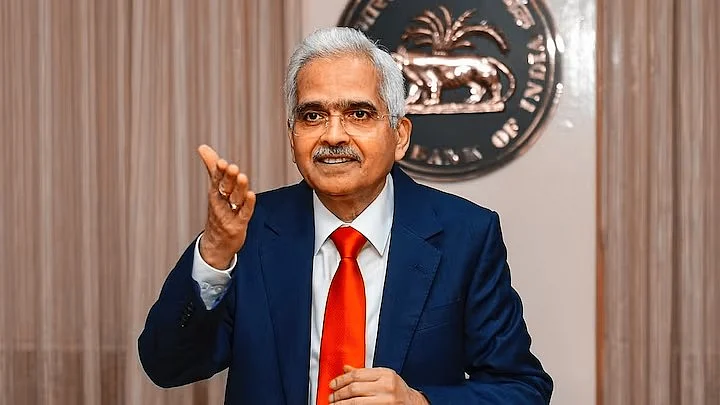

According to the RBI governor, Shaktikanta Das, the RBI has taken various measures to safeguard the interest rates of borrowers.

The RBI governor said that banks and non-banking financial corporations or NBFCs, are not permitted to levy or charge foreclosure charges or pre-payment penalities on any floating rate term loans that have been sanctioned to individual borrowers for non-business purposes.

In addition, the RBI governor also touched upon the aspect of expanding the banking system, its ambit to the larger economy, especially to micro, small and medium enterprises. This comes at a time when a significant number of small and medium enterprises are jumping onto the bandwagon of getting listed in the equity markets.

The governor claimed that FITF, which was implemented in 2016, has helped to stabilise the economy, particularly during the epidemic years. | PTI

RBI Guv's Address

Following the 51st MPC meeting, in the address, the governor marked the eight years of the flexible inflation targeting framework and thereby invoked its salience. The governor claimed that this system, which was implemented in 2016, has helped to stabilise the economy, particularly during the epidemic years.

When it comes to the repo rate, in a new development, the meeting also had three external entities. The MPC came to the decision of retaining the with a 5-1 majority of the committee. The rate has remained at 6.50 per cent since February 2023.