Bank of Maharashtra has emerged as the top performer among the public sector lenders in terms of the loan growth in percentage terms during the second quarter of the year 2022-23.

The Pune-headquartered lender recorded a 28.62 per cent increase in gross advances to Rs 1,48,216 crore at the end of September 2022, according to published quarterly numbers of the public sector banks (PSBs).It was followed by the Union Bank of India with 21.54 per cent growth to Rs 7,52,469 crore. Country’s largest lender State Bank of India (SBI) stood at third spot with 18.15 per cent rise in advances growth.In terms of Retail-Agriculture-MSME (RAM) loans BoM has the highest growth of 22.31 per cent followed by Bank of Baroda with 19.53 per cent and SBI at 16.51 per cent for the period.

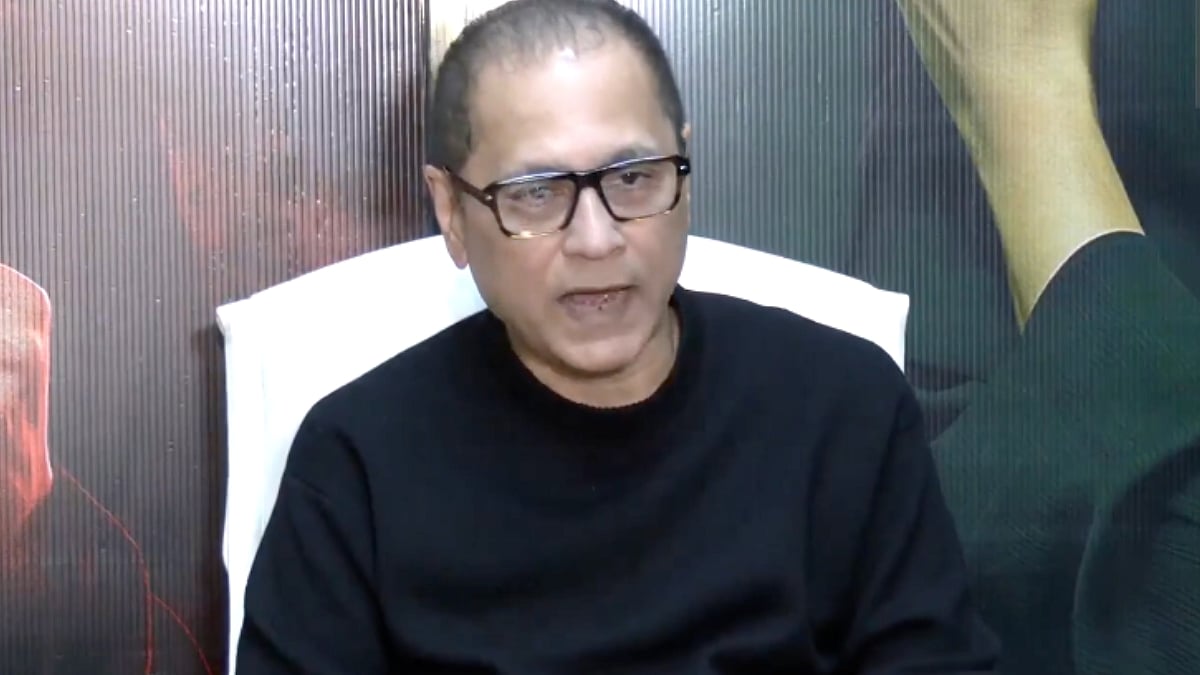

AS Rajeev, Chairman and Managing Director, Bank of Maharashtra. |

In terms of Total Business Growth BoM registered a growth of 15.92 per cent for the Q2-2022-23 Half Yearly period with Total Business of Rs 3,44,065 crore.

Union Bank of India had the highest growth of 17.17% during the period with Total Business of Rs 17,95,464 crore.Bank of Baroda stood at third position in terms of Total Business Growth with 12.62% having total business Rs 16,75,704 crore for the period.

Union Bank of India was at the first spot with 14.21 per cent growth in deposits (Rs 10,42,995 crore), followed by Bank of Baroda with 10.90 per cent rise at Rs 9,58,967 crore, according to the data.

With regard to deposit growth, BoM witnessed a 7.86 per cent growth and mobilised Rs 1,95,849 crore at the end of September 2022. BoM stood 5th in terms of Total Deposit growth among the PSBs for the period. However, in terms of Low-cost CASA deposit BoM topped the chart with 56.27 per cent followed by Central Bank of India with 50.99 per cent.

During the September quarter, public sector banks raked in more profits on the back of a persistent decline in bad loans, and the trend may have a positive bearing on their balance sheets in the coming quarters.

Cumulatively, all the 12 public sector banks reported a net profit of about Rs 25,684 crore in the Second quarter of 2022-23. UCO bank had the highest net profit growth with 145.64 per cent (Rs 505 crore) followed by BoM with 102.93 per cent growth (Rs 535 crore) and Canara Bank with 89.42 per cent (Rs 2525 crore).

Country’s largest lender SBI registered a growth of 73.93% in profit for the second quarter with Rs. 13,265 crore, was at the fourth position.BoM and SBI with 3.55 per cent Net Interest Margin (NIM), a key profitability parameter, stood at top among PSBs. It was followed by Bank of India at 3.49% and Central Bank of India at 3.44 per cent.In terms of Return on Assets (RoA) State Bank of India is at the Top among PSBs with 1.04 per cent followed by Bank of Baroda at 1.01 per cent and BoM at 0.92 per cent.

For Cost to Income ratio BoM is lowest with 38.82 per cent followed by Union Bank of India with 43.21 per cent and Canara Bank with 43.68 per cent. BoM has also lowest Cost of Deposit Ratio among PSBs with 3.54 per cent. State Bank of India is at second having Cost of Deposit Ratio with 3.84 per cent followed by Central Bank of India with 3.89 per cent.

BoM and SBI were in the lowest quartile as far as gross non-performing assets (NPAs) and net NPAs were concerned, according to an analysis of the quarterly financial numbers published by the public sector lenders. As per the analysis, the gross NPAs reported by BoM and SBI were 3.40 per cent and 3.52 per cent of their total advances, respectively, in the Second quarter of the current fiscal. The net NPAs for these banks came down to 0.68 per cent and 0.80 per cent, respectively, at the end of September 2022.

With regard to Capital Adequacy Ratio, BoM has 16.71 per cent highest among PSBs followed by Canara Bank at 16.51 per cent and Indian Bank at 16.15 per cent at the end ofsecond quarter of 2022-23.