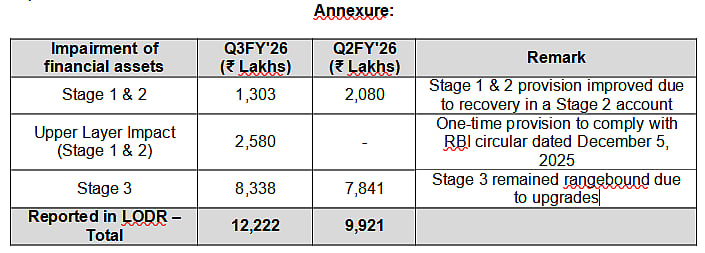

Mumbai: Axis Finance delivered consistent revenue growth from Q1 to Q3 of FY26, reflecting stable business momentum across quarters. As per the Reserve Bank of India (RBI) circular dated December 5, 2025 (Commercial Banks – Undertaking of Financial Services Directions, 2025), Bank-Led NBFCs were required to align with Upper Layer regulatory norms. Consequently, Axis Finance made one-time provisions in Q3 on Stage 1 and Stage 2 assets (refer Annexure), in line with prudential requirements applicable to Upper Layer NBFCs.

This resulted in elevated Expected Credit Loss (ECL) provisions during the quarter. However, asset quality improved, with the Company’s Gross NPA ratio declining sequentially from 1.00 percent to 0.94 percent.

For Q3 FY26 and the first nine months of FY26, Axis Finance reported strong interest income, steady profitability, and an improvement in its net worth-underscoring the Company’s stable and improving business fundamentals.

In Q3 FY26, Axis Finance continued to grow its business and reported total income of Rs 1,29,292 lakh, reflecting sequential growth over the previous quarter. Interest income remained strong at Rs 1,23,273 lakh, underscoring stable loan demand and consistent disbursement momentum across key lending segments, resulting in robust Profit After Tax (PAT) of Rs 19,525 lakh.

Employee costs and other operating expenses stayed largely under control across all three quarters, which also includes an impact of Rs 545 lakhs in employee costs due to notification on New Labour Codes.

The Company’s net worth improved to Rs 5,91,736 lakh as of the end of Q3 FY26, compared to Rs 5,16,365 lakh a year earlier, highlighting steady capital accretion and a stronger balance sheet. Further, asset quality improved, with the Company’s Gross NPA ratio declining sequentially from 1.00 percent to 0.94 percent.

Overall, Axis Finance delivered consistent revenue growth and strong profitability from Q1 to Q3. The company’s core lending business remains strong, and its financial position continues to improve.