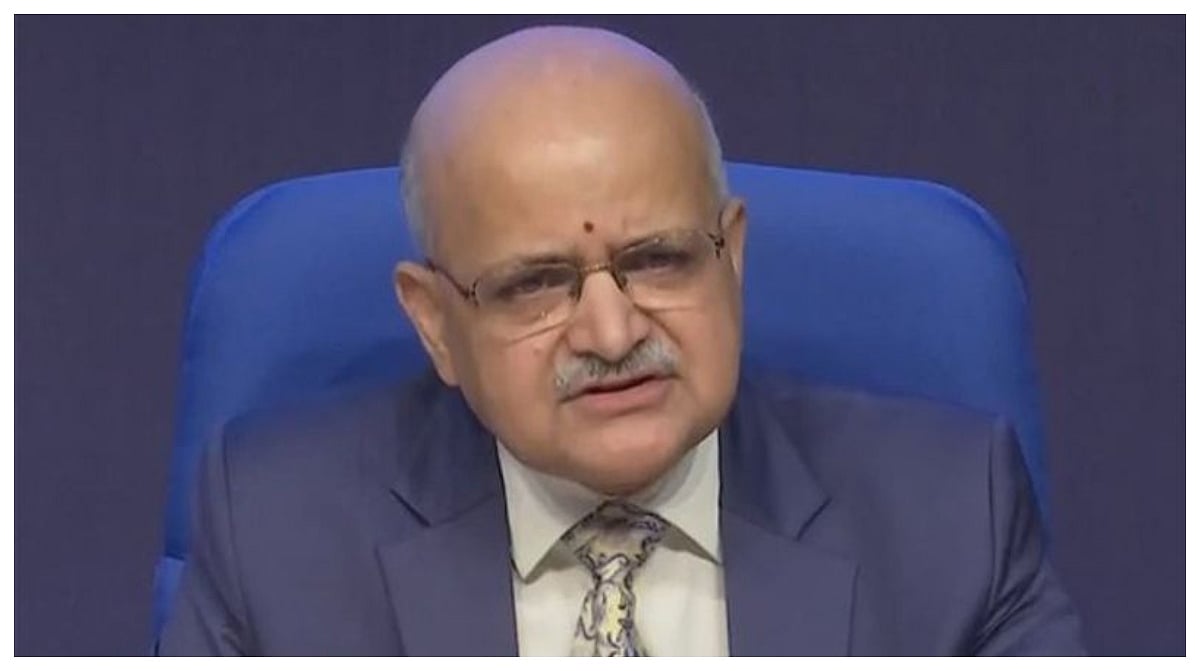

Fintech major BharatPe Group on Monday announced to appoint industry veteran Aparna Kuppuswamy as its Chief Risk Officer, who will help the compay get prepared towards its IPO goal.

Prior to joining BharatPe, she was the Chief Risk Officer at SBI Cards for more than 14 years, where she led a number of key projects.

About Aparna Kuppuswamy

Kuppuswamy will lead the risk portfolio across the BharatPe Group of companies, including the merchant and consumer businesses.

She will work closely with Nalin Negi, CFO and interim CEO, to further build a robust lending vertical at BharatPe, the company said in a statement.

"We are committed to address the $380 billion credit gap for MSMEs and small merchants. Kuppuswamy will play a vital role in the next phase of our growth story as well as helping us in becoming IPO ready," said Negi.

"Her expertise in managing the technology risk will ensure we build highly secure products for our merchant partners and consumers," he added.

Amit Jain, current CRO

Amit Jain, who is currently the Chief Risk Officer of BharatPe, will work closely with Kuppuswamy, investing more of his time on collections and underwriting from a merchant standpoint.

She was a member of the SBI Cards leadership group that oversaw the company's IPO.

Together with frontline business and operational units, she also worked closely with the Risk Management Committee of the Board to create the company's risk appetite framework.

Kuppuswamy also had positions at Bank of America, Ameriprise Financial, and ABN AMRO Bank.

"I look forward to working with the team to build new products, that will make a huge impact on millions of unbanked and underserved businesses and play a key role in making India a truly digital economy," she said.

With inputs from Agencies.