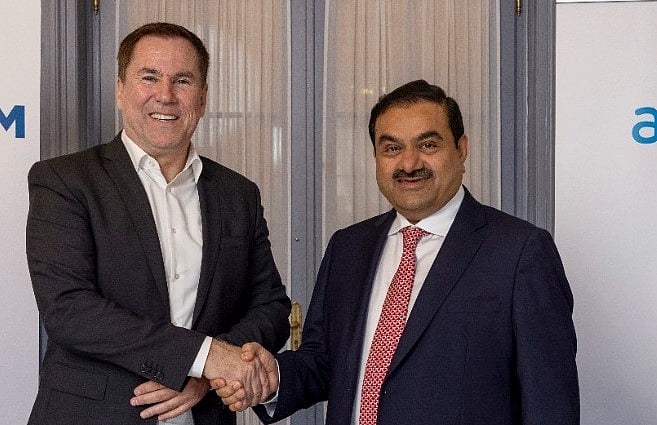

The Adani Family, through an offshore special purpose vehicle, announced that it had entered into definitive agreements for the acquisition of Switzerland-based Holcim Ltd’s entire stake in two of India’s leading cement companies – Ambuja Cements Ltd and ACC Ltd.

Holcim, through its subsidiaries, holds 63.19 percent in Ambuja Cements and 54.53 percent in ACC (of which 50.05 percent is held through Ambuja Cements). The value for the Holcim stake and open offer consideration for Ambuja Cements and ACC is $10.5 billion, which makes this the largest ever acquisition by Adani, and India’s largest ever M&A transaction in the infrastructure and materials space.

"Our move into the cement business is yet another validation of our belief in our nation's growth story," said Gautam Adani, Chairman of the Adani Group. "Not only is India expected to remain one of the world's largest demand-driven economies for several decades, India also continues to be the world's second largest cement market and yet has less than half of the global average per capita cement consumption. In statistical comparison, China’s cement consumption is over 7x that of India’s. When these factors are combined with the several adjacencies of our existing businesses that include the Adani Group's ports and logistics business, energy business, and real estate business, we believe that we will be able to build a uniquely integrated and differentiated business model and set ourselves up for significant capacity expansion.”

Adani said, "Holcim's global leadership in cement production and sustainability best practices brings to us some of the cutting-edge technologies that will allow us to accelerate the path to greener cement production. In addition, Ambuja Cements and ACC are two of the strongest brands recognized across India. When augmented with our renewable power generation footprint, we gain a big headstart in the decarbonization journey that is a must for cement production. This combination of all our capabilities makes me confident that we will be able to establish the cleanest and most sustainable cement manufacturing processes that will meet or exceed global benchmarks.”

“I am delighted that the Adani Group is acquiring our business in India to lead its next era of growth,” said Jan Jenisch, CEO of Holcim Limited. “I am confident that the Adani Group is the perfect home for them as well as our customers to continue to thrive.”

With India’s cement consumption at just 242 kg per capita, as compared to the global average of 525 kg per capita, there is significant potential for the growth of the cement sector in India. The tailwinds of rapid urbanization, the growing middle class and affordable housing together with the post-pandemic recovery in construction and other infrastructure sectors are expected to continue driving the growth of the cement sector over the next several decades.

Ambuja Cements and ACC currently have a combined installed production capacity of ~70 MTPA. The two companies are among the strongest brands in India with immense depth of manufacturing and supply chain infrastructure, represented by their 23 cement plants, 14 grinding stations, 80 ready-mix concrete plants and over 50,000 channel partners across India.

Both Ambuja and ACC will benefit from synergies with the integrated Adani infrastructure platform, especially in the areas of raw material, renewable power and logistics, where Adani Portfolio companies have vast experience and deep expertise. This will enable higher margins and return on capital employed for the two companies. The Companies will also benefit from Adani’s focus on ESG, Circular Economy and Capital Management Philosophy. The businesses will continue to be deeply aligned to UN Sustainability Development Goals with clear focus on SDG 6 (Clean Water and Sanitation), SDG 7 (Affordable and Clean Energy), SDG 11 (Sustainable Cities and Communities) and SDG 13 (Climate Action).

The acquisition is subject to regulatory approvals and conditions.