The narrative that “AI is here to help investors” is old. What matters now is which AI tools are actually built for decision-makers, not buzzwords - and how you can pragmatically use them.

Currently, no-code AI tools have matured. They’re no longer toys, they’re productivity engines. But tools are only useful if they solve a real problem you face consistently - like noisy signal extraction, slow research, or manual pattern hunting.

Below are the top 5 AI platforms that dominate distinct investment workflows. Each section breaks down:

> What it actually does (functionality),

> Why it matters (core benefit),

> How you can start using it (practical insight),

> And the types of users who benefit most.

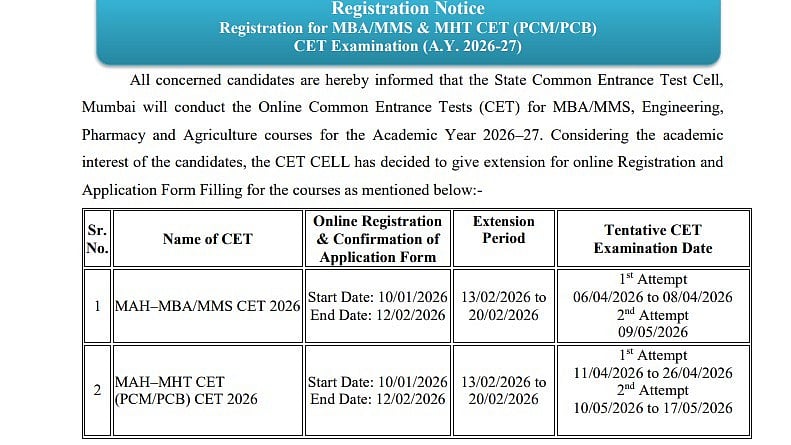

1) Trade Ideas - Best for Active Trading & Signal Clarity

If you’re an active trader, your biggest bottleneck isn’t data - it’s noise. You don’t need more charts, you need validated signals you can trust.

What it does:

Trade Ideas runs an AI engine (“Holly”) that continuously tests hundreds of algorithmic strategies against live market data to produce actionable trade signals - with entry, stop-loss, and profit targets.

Core benefit:

You don’t scan manually, the AI surfaces the highest probability opportunities before most retail traders even notice them. For volatile markets like small caps or crypto, this speed advantage is a real edge.

How this helps you:

Instead of sweeping screens every morning, you start with AI-filtered trade ideas and then apply your own rules. That saves hours and reduces decision fatigue - especially when markets are fast or choppy.

Who it’s for:

> Active day traders

> Experienced swing traders

> Analysts who want signals, not charts

Real insight:

Most trading tools show data. Trade Ideas evaluates it. It’s the difference between “here’s what’s happening” and “here’s what’s likely to happen” - and that directional edge matters.

This is not a set-it-and-forget bot. It’s an analysis accelerator you should pair with your risk filter. But once you lock that in, you get better signal quality with less noise.

2) TrendSpider - Best for Technical Analysis without Manual Fatigue

For many traders and advisors, technical analysis still feels like chart math and eyeballing. TrendSpider changes that by making technical insights systematic and automated.

What it does:

TrendSpider automates key chart patterns, trendlines, support/resistance zones, multi-timeframe analysis, and alerts. Its AI lets you build strategies using natural language and no code.

Core benefit:

The platform turns what used to be manual, slow, subjective charting into reproducible, data-driven analysis. It’s like having a team of technical analysts running scans for you 24/7.

How this helps you:

You can:

> Set dynamic alerts that adjust with market structure.

> Backtest ideas across decades of data.

> Generate watchlists based on patterns you define in plain language.

This means you spend less time drawing lines and more time making decisions.

Who it’s for:

> Technical traders (day & swing)

> Advisors integrating technical insights into client recommendations

> Investors who want contextual signals, not just raw charts

Real insight:

TrendSpider scales your technical workflow. When every resistant break or pattern confirmation could be a trading edge, automation saves time and reduces bias. You don’t guess trend strength - the system quantifies it.

3) Tickeron - Best for Predictive Trends & Confidence-Rated Signals

Trend direction is one thing. Confidence in that direction is another. Tickeron’s strength is not just telling you where an asset might go - it tells you how confident its AI is in that trend.

What it does:

Tickeron combines AI trend prediction, pattern recognition, and pattern-confidence scores. It also offers “AI Robots” - modular strategy components that articulate systematic approaches.

Core benefit:

You rarely see tools that pair trends with confidence levels - this matters because probabilities separate noise from actionable forecasts. Seeing a signal with 85% predicted reliability is far more meaningful than just a generic “bullish” tag.

How this helps you:

> Speed validation of trend setups.

> Improve position sizing by weighting confidence.

> Reduce emotional entry/exit decisions.

Tickeron translates pattern recognition into quantified probability statements, making your decisions less emotional and more statistical.

Who it’s for:

> Swing traders

> Quant-curious investors

> Advisors who want trend forecasts with risk context

Real insight:

Confidence levels are the secret sauce. Two trends can point the same way - but one is statistically stronger. Tickeron tells you which one. That nuance is easy to ignore but hard to trade without.

4) AlphaSense - Best for Deep Fundamental Research & Narrative Insight

If your strategy depends on understanding the story behind the numbers, AlphaSense is the research engine that surfaces signals from information overload.

What it does:

It ingests millions of documents - broker research reports, earnings call transcripts, SEC filings, expert calls - and uses NLP to index, summarize, and contextualize them.

Core benefit:

Instead of sifting through hundreds of pages manually, you get AI-condensed insights with context - not just surface keywords. Its semantic search understands finance language, so you don’t miss relevant content just because the wording differs.

How this helps you:

> Faster due diligence,

> Better narrative context for investment memos,

> Real-time trend tracking across themes and sectors.

This transforms hours of reading into minutes of insight.

Who it’s for:

> Fundamental analysts

> Portfolio managers

> Advisors doing deep sector or company research

Real insight:

AlphaSense turns information chaos into decision clarity. It doesn’t just find text, it synthesizes themes and flags what matters most. That’s strategist-level research at scale.

5) Bloomberg Terminal - Best for Institutional-Grade Data, Execution & Market Intelligence

Despite newer tools capturing headlines, Bloomberg Terminal remains the institutional backbone for integrated market data, news, analytics, and execution.

What it does:

It centralizes real-time pricing across asset classes, historical datasets, advanced analytics, news, alerts, communication tools, and execution capabilities - all under one subscription.

Core benefit:

The Terminal equips you with the same data professionals use to price assets, measure risk, and trade markets - with unmatched depth and timeliness.

How this helps you:

> Monitor global markets live.

> Pull advanced macros, cross-asset correlations, and economic indicators.

> Execute trades and model scenarios in one workflow.

It’s not just data - it’s trusted data with analytics baked in.

Who it’s for:

> Institutional investors

> Hedge funds

> Corporate strategists

> Traders who need every market signal in one place

Real insight:

Bloomberg is expensive - yes - but for teams and individuals who make decisions every day that must be right, the Terminal isn’t a cost. It’s a risk-management necessity.

Emerging Trend: The Agentic Shift - Build, Don’t Just Consume

2026 isn’t just about using AI tools - it’s the year we see a shift toward agentic systems. AI that doesn’t just analyze data but can plan, act, and automate workflows for you. This isn’t theoretical - agents are now part of real financial workflows, and you don’t need an engineering team to build them.

Traditionally, investors relied on static dashboards and alerts. Today, you can create your own AI assistant - a “digital analyst” that runs workflows on your behalf (fetching data, comparing stocks, monitoring news, summarizing risks, running custom models). These agents can be:

> Personal research bots that pull sentiment, earnings transcripts, news flows, forecasts, and present them in one place.

> Slack or Telegram bots that deliver portfolio insights or alert you to trend breakouts.

> Automated workflows that compare investments on demand and surface biases or divergences.

How to Build Your Own Tools (No Code or Low Code)

You have multiple approaches depending on your starting point:

1. ChatGPT Custom GPT Agents (built-in)

OpenAI’s agentic features let you ask the AI to plan and execute multi-step tasks - like deep research, trend comparison, risk summarization, scenario analysis, and more - all in one query. This is ideal for investors who want advice plus action, not just answers.

2. Replit Agent 3

With Replit’s Agent platform, you can describe in plain language what tool you want - for example, “Build a daily stock update scheduler that emails me performance metrics and trend signals for my portfolio.” The agent creates, tests, and deploys the app for you, and can even integrate with Slack or Telegram for alerts.

3. Google AI Studio & Vertex AI Agent Builder

Google’s platforms allow you to build AI agents that hook into your data and workflows - like pulling Google Finance data, running your own scoring model, and emailing summaries every morning. Vertex AI Agent Builder is designed to scale and connect agents across tools you already use.

4. Workflow Integrators (e.g., n8n + AI agent plug-ins)

Tools like n8n let you orchestrate AI agents across hundreds of services - Google Sheets, email, RSS/news APIs, market data sources - and automate multi-step financial workflows like “If volatility spikes + sentiment turns negative, send me a summary with key catalysts.”

A Personal Insight - How I Used AI Agents to Analyze Stocks?

A few months ago, I made an investment in Adani Power. Like many of us, I went in with conviction - the fundamentals looked interesting, and the technical setup felt right. But the very next day, the stock didn’t behave the way I expected. It dipped a bit, not because the story had changed, but because of an event most retail traders don’t see coming, a stock split and volatility shock.

In the past, that scenario would have left me scrambling - opening multiple tabs, manually scanning news feeds, comparing fundamentals, and second-guessing my decision. But this time was different.

I turned to AI - not just one tool, but a workflow I had built in ChatGPT plus, I asked the AI in a conversational way:

My prompts looked like this:

> “Give me trend forecasts and sentiment analysis for Adani Power for the next 30 days.”

> “Compare its technical strength and fundamentals to Tata Power and NTPC.”

> “What key news catalysts could affect these three over the next quarter?”

> “Based on all of this, which stock shows the best risk-adjusted profile for the next 6–12 months?”

The responses were not generic charts. The AI pulled trend forecasts, moving averages, macro news, and even comparative strength indicators. It highlighted where Adani Power had technical support and where it was vulnerable, and then it laid out how Tata Power and NTPC compared across growth trends, volatility, and sector sentiment.

So What Does This Mean for You?

Agentic AI is the next step in the investor journey. It’s not about replacing tools - it’s about customizing automation to your strategy. Whether you’re a beginner or experienced investor, you can:

> Build one-off research bots

> Automate repeats of your favourite workflows

> Standardize how you ask questions across equities, sectors, and macro

> Save hours of manual research every week

I didn’t just observe data - I interacted with it, and I made decisions faster and more confidently.

If you’re serious about staying ahead of markets or freeing up your cognitive load for strategy, this shift from static tools to autonomous workflows is a practical advantage - not a buzzword.

The bottom line? Tools matter. But how you use them - the prompts you craft, the workflows you build - is what turns data into actionable insight. Once you start framing your queries like a strategist, AI goes from reactive answers to proactive decision support.