Ever since the social distancing norms were put in place in the light of the Novel Coronavirus pandemic outbreak, people have been heavily reliant on online banking procedures and card payments, which have resulted in a spurt of debit card/e-wallet frauds. According to police, there has been at least a 75 percent increase such frauds and scamsters are getting creative by the minute, using innovative methods to dupe people using a large array of fraudulent schemes.

According to a recent data by the Maharashtra State Cyber Cell, the debit card and e-wallet frauds have seen a massive spurt due to its sudden rise in usage and citizens from all walks of life now learning the process of making digital payments. The Unified Payments Interface (UPI) platform has also made an alarming effect on the cyber crime, said a senior police official.

While there were over 237 cases of UPI frauds registered in Mumbai between January and September last year, the corresponding figures for this year were more than double at 562 cases, said an official. "A similar rising trend was observed for debit/credit card fraud. The banks and police have been constantly reminding citizens to not share their bank details or OTPs with anyone in person/over the phone," said the official requesting confidentiality.

The expert said, once the user clicks on the phishing links, they are taken to a fake website which is identical to the original one and seeks the user's bank account details. Once the user enters their bank details like account number, consumer ID for net banking and password, the fraudsters immediately note those numbers and use it to siphon off money.

The pandemic induced lockdown had compelled people to make digital payments and use their debit/credit card more than often for any purchases considering the threat of virus transmission. This situation sadly paved way for a number of cyber frauds which preyed on every scheme, offer that was put in place for citizen relief and turned it into a scam.

Elaborating on the same, a cyber expert claimed that the fraudsters did not leave a single scheme-- right from loan deferment to PM's economic relief packages; everything was used as a click-bait to lure victims into sharing their privy banking information. Experts also worry about the low detection rate of such frauds, which lies between 3 and 7 percent for Mumbai.

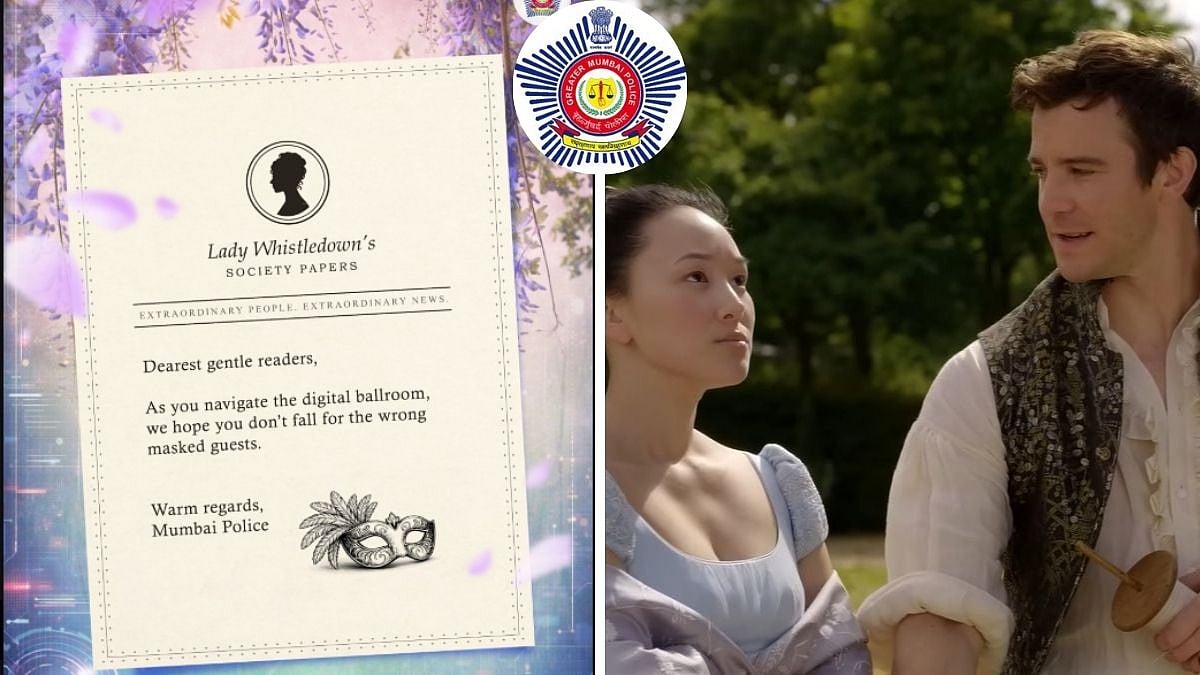

Time and again, the cyber officials have appealed to the citizens to not fall prey to such tricks and no government body or official would ever ask for any privy bank details like ATM PIN, CVV or password for net banking. If one comes across any such frauds, they should immediately report to police, who will initiate a strict probe in the matter.