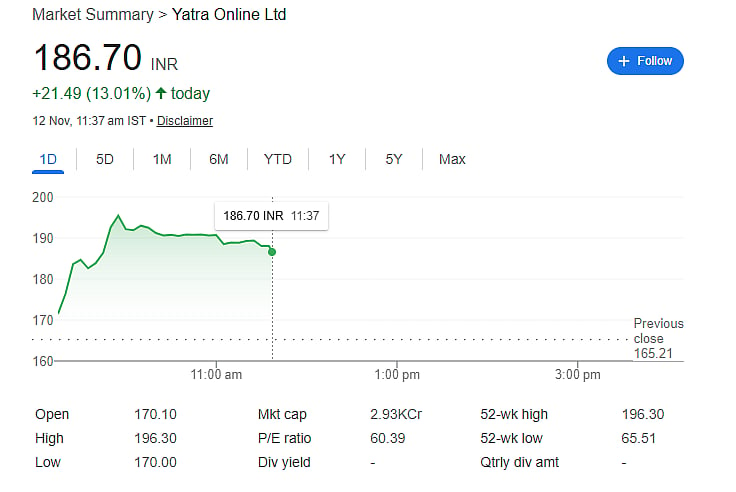

Mumbai: Shares of Yatra Online Ltd soared nearly 19 percent to a 52-week high of Rs 196.30 on Wednesday, November 12, following the company’s impressive second-quarter results. At 11:37 AM, the stock was trading at Rs 186.70 on the NSE, up nearly 13 percent, with a market capitalisation of Rs 3,006.51 crore. Over the past six months, the stock has surged 147 percent, reflecting strong investor confidence.

Revenue and Profit Double

For the July–September quarter (Q2 FY26), Yatra reported a net profit of Rs 14 crore, doubling from Rs 7 crore a year ago. Revenue jumped 49 percent year-on-year to Rs 351 crore, driven by sustained momentum in the Hotels & Packages segment and solid growth in the MICE (Meetings, Incentives, Conferences, and Exhibitions) business.

Operating profit (EBITDA) rose sharply by 158 percent to Rs 24 crore, up from Rs 9 crore in the same period last year, supported by cost optimisation and focus on profitability. The EBITDA margin improved to 6.84 percent, compared with 3.94 percent in Q2 FY25.

Business Expansion and Strong Liquidity

Yatra’s Revenue less Service Costs (RLSC), or gross margin, grew 34 percent to Rs 126 crore, underscoring its diversified business strength. During the quarter, the company signed 34 new corporate clients with an annual billing potential of Rs 260 crore.

The firm’s cash and equivalents stood at Rs 214 crore as of September 30, 2025, while gross debt fell from Rs 55 crore in March 2025 to Rs 21 crore, highlighting sound financial discipline and liquidity.

CEO Outlook and Strategic Focus

CEO Dhruv Shringi credited the growth to strong business travel demand and operational execution despite a slowdown in India’s domestic aviation sector. He highlighted the success of the MICE segment and integration of Globe Travels, which enhanced supplier synergies and technology capabilities.

Looking ahead, Yatra plans to scale high-margin segments and raise adjusted EBITDA growth guidance to 35–40 percent for FY26, up from 30 percent.