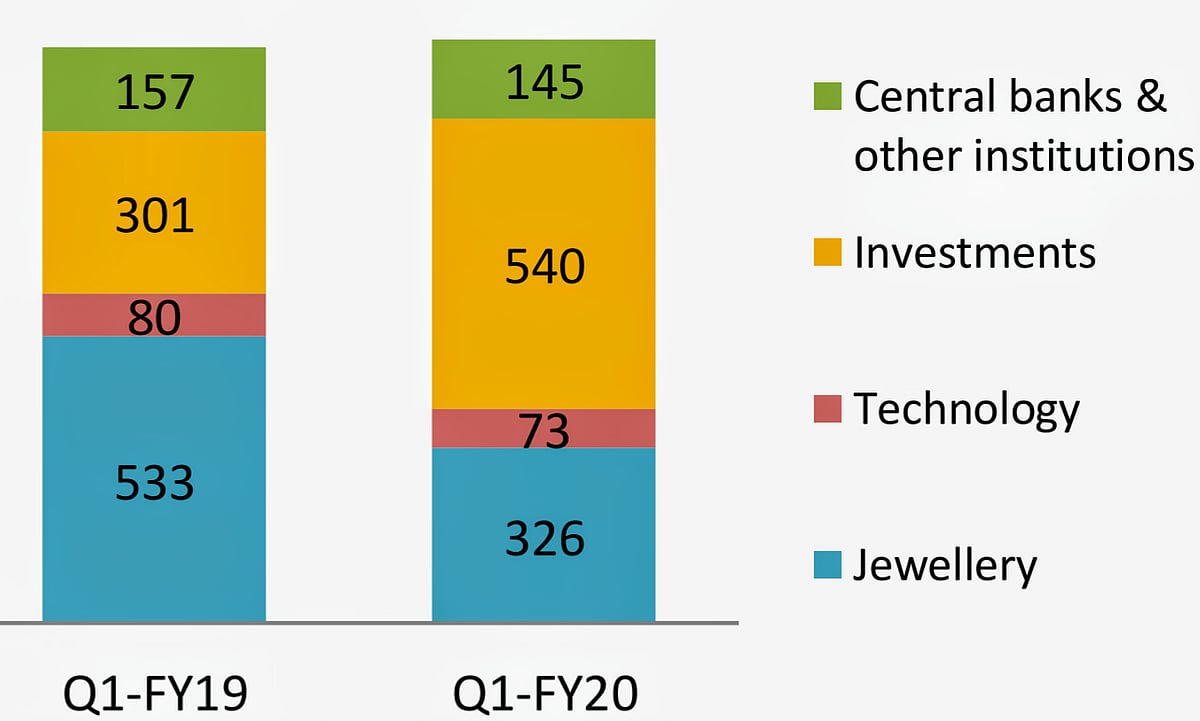

When countries face economic downturn, gold becomes quite attractive. Central banks of various countries and investors run to stock up gold. According to the Care Ratings report, the demand for gold around the world rose to 1,083 tonnes in the first three months of 2020, half of which came in from investments in gold- backed ETFs.

The investments in gold-backed ETFs saw a rise of 594 per cent in the January-March period of 2020, compared to the same period last year. While gold investment picked up, the demand for jewellery witnessed a slump. China and India — large jewellery consuming nations — saw an overall fall of 41 per cent and 65 per cent year-on-year respectively, revealed Care Ratings.

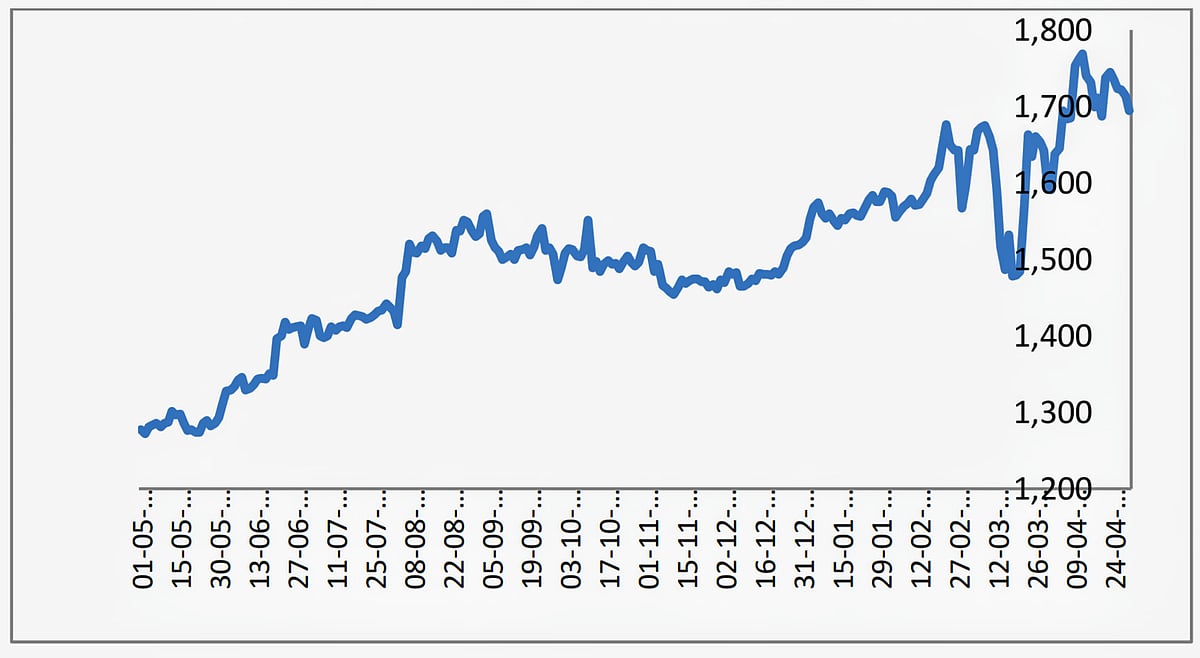

International gold prices (May 2019 to Apr 2020) | Care Ratings

In the last 12 months (May 2019- April 2020), the price of precious metal witnessed a jump of 33 per cent (on a monthly average). Factors such un-ending trade wars, fall in consumer demand and rising fear of recession, political tensions in the Middle East impacting energy prices, falling interest rates climate and the worldwide spread of Covid-19, made investors turn to gold for returns.

World gold demand | Source: World gold council

In the pre COVID 19 phase (May 2019 to December 2019), gold prices rose by 16 per cent. “In the following month of January 2020, when the pandemic was announced a public health emergency, the prices jumped 5 per cent (December 2019 to January 2020),” the rating agency stated. In April 2020, gold price crossed USD 1,700 for the first time and nearly inched USD 1,800 by mid-April.

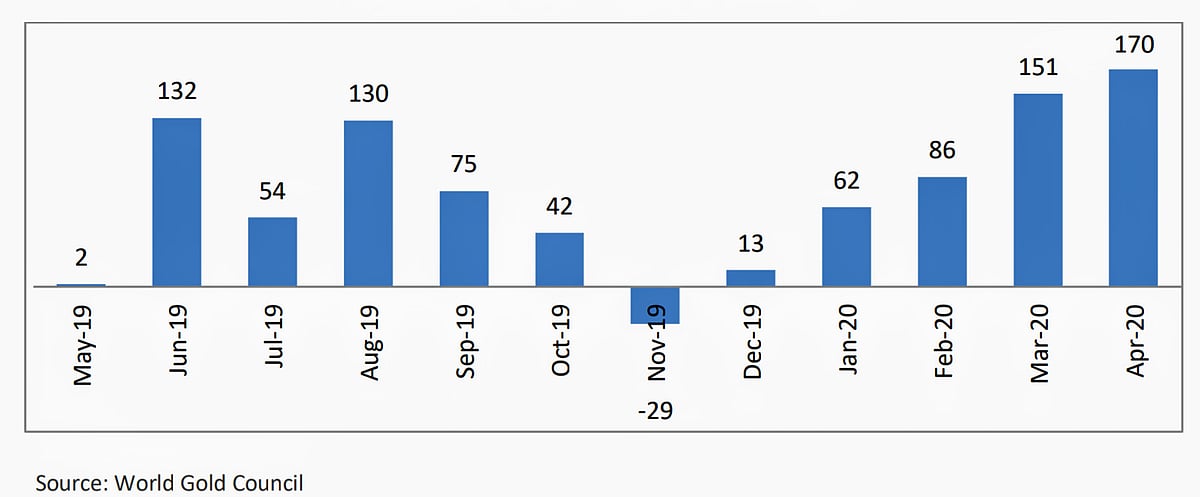

Meanwhile, the net inflows in gold-backed ETFs witnessed a consistent rise since December 2019. “This accounts for cumulative net inflows of 482 tonnes in the spread of COVID-19 era (December 2019 to April 2020). Large proportion of these, were directed into US and UK-listed funds.”

Net inflows in gold-backed ETFs (tonnes) |